3 AdWords Reports That Every Search Marketer Needs To Stay Competitive

Looking for additional insights to improve your paid and organic search efforts? Columnist Thomas Stern details some underutilized AdWords reports that can do just that.

When our search team sat down to brainstorm topics for this article, our primary objective was to identify strategies, tools and reports that are largely underutilized. These resources come from our experience bringing on new clients that have either been managing search marketing in-house or through another agency, and seeing what they’ve done in the past.

Our secondary objective was to identify recommendations that can help both paid and organic search marketers. While we’ll cover reports in AdWords, many important learnings can be applied to organic search as well.

This article breaks out key takeaways from each report, defined as Quick Wins and Breaking Assumptions. Each report could have easily been outlined in its own article, but we wanted to provide ways to quickly benefit from them and help marketers best identify obstacles and opportunities in search.

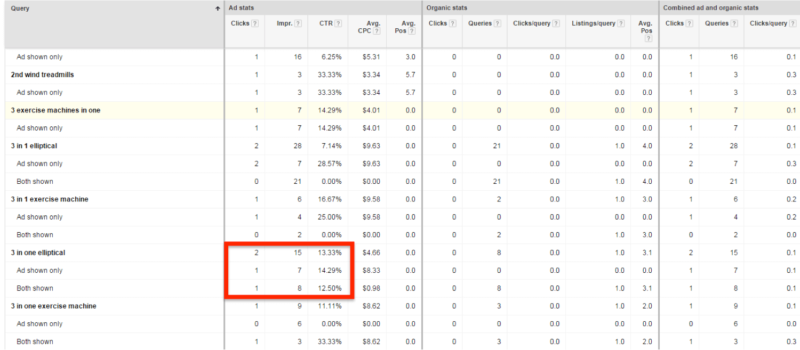

1. Paid & Organic Report

Many marketers find themselves asking the same question: Should I be bidding on keywords I already rank for organically? Often the answer is yes, but it varies based on competition and keyword data. Google’s paid & organic report can help identify the keyword opportunities your brand should capitalize on to increase visibility and search authority.We’re consistently surprised at how underutilized the paid & organic report is in AdWords. Perhaps it’s the integration required by Google to sync Google Webmaster Tools with AdWords for organic search data to be populated alongside paid. For companies or individuals managing paid and organic search separately, this integration isn’t always a natural one. Rarely do SEO teams spend time in the actual AdWords interface — and it’s not often that paid search teams spend time in Google Webmaster Tools.

Despite these challenges, we highly recommend search marketers establish this integration quickly to benefit from all of its comprehensive data.

The paid & organic report lists all of the keywords that are receiving impressions and clicks in Google. The key here is being able to assess client interaction (Impressions + CTR) with your listings when search ads are present, when organic listings are present, and when the two channels are combined.

Quick Wins

One of the most immediate insights you can take from this report are the keywords that achieve the best performance (CTR in this report) from both paid and organic search. As a paid search marketer, you’ll be able to identify all the long-tail queries for which organic is earning great performance and enhance your bid strategies accordingly.

For organic search marketers, you’ll gain insight to the terms that contain the highest relevance to searchers, not just those with the most search volume. This will allow you to segment your keyword usage in a more refined manner.

How It Breaks Assumptions

One question we still hear regularly from clients is whether or not we should be paying for clicks (branded and non-branded) when their website is already ranking in the top position.

Previously, we would have needed to rely on isolated studies that prove how paid and organic actually work together to deliver an incremental lift in performance. But with the paid and organic report from Google, you can use your own or your client’s data to show them why bidding on top ranking organic keywords makes sense.

To date, we haven’t found an account that doesn’t at least contain some top ranking keywords that we’ve proven should also be bid on with PPC.

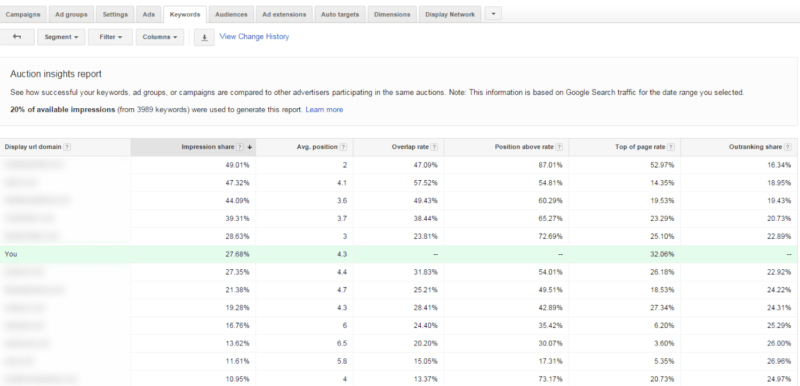

2. Auction Insights Report

At its core, the auction insights report tells Google AdWords advertisers what the competitive landscape looks like through impression share, average position, overlap and outranking share. This data is available for both search and shopping campaigns with some slight differences between the two.Auction insight reports can also aid analysts in recommending SOV (share of voice) budget increases. Let’s say that we’ve shared a monthly auction insight report with a client and have found the following to be true:

During the holiday season, the client’s ad coverage starts to slip due to increased competition from direct competitors. Specifically, their position historically drops to 3.4 from 2.9 during the months of November and December.

We would then use that information to explain to the client what additional budget we would need during those months in order to stay competitive. If our drop represents a ~17% reduction in position, and our Max. CPC during that time was set to $3.10, we would use the 17% loss in position to recommend a correlating increase in ad spend.

By using the formula below we would recommend a new Max CPC of $3.63, from $3.10, and a new monthly budget of $910, from $750.

Old Max. CPC $3.10 * .17 = $.53

New Max. CPC = $3.10 + .$53 = $3.63

New Ad Spend Budget Proposal = Projected Impressions (10,000) * Avg. CTR (2.5%) * New Max. CPC ($3.63) = $907.5

Now that you have monthly auction insights to back up your recommendations, the increase in required funds and overall objective should hopefully be crystal clear to the client.

Feel free to get even more granular with your reports by diving into ad group level competitive comparisons, as some competitors may not reveal themselves until the specific keyword grouping is examined on its own.

Quick Wins

Since AdWords operates as an auction with competition driving up cost, it’s logical that this report includes competitive insight that can benefit search marketers.

We recommend pulling this report to identify the competitors that are beating you for rank and search share. Dig into the competition by reviewing data at a campaign level — here, impression share shows you for which campaigns you perform the strongest.

One of the best ways to gain some immediate traction with this report is by reviewing your branded impression share. Is it at the level it should be? This report is a great way to see if you do, in fact, have your brand bidding thoroughly covered, and whether or not action is needed.

How It Breaks Assumptions

Building off the aforementioned quick wins, competitive data drives many of the assumptions that can hold search marketers back in performance. While you may know who you’re competing with in a broad sense, rarely are you able to identify nearly all competitors across all your ad groups, campaigns and keywords.

By giving insight into the competitive landscape at a much greater scale, search marketers can use the auction insights report to dig into many more competitors and uncover how they’re acquiring customers through paid and organic search tactics.

Many brands have trouble competing with the largest spenders in paid search; likewise, even brands with big budgets have trouble competing across of the all keywords they want to go after. Combine this with seasonal trends that have dictated marketing budgets for years, and you’re left with limited time periods and keywords that can be bid on to acquire customers.

The auction insights report helps search marketers break this mindset — through it, you’re able to make strategic decisions with keywords that should quantifiably capture more of your budget.

Additionally, you can monitor competitor’s behavior around seasonal periods. What you’ll likely find is that competitors manage their budget in a similar fashion, with a larger share being reserved for specific seasonal periods.

While perhaps fewer prospects are looking for your products and services outside of defined “seasons,” you may also find that fewer competitors are bidding for this smaller prospect pool, meaning you can achieve a much better cost per acquisition.

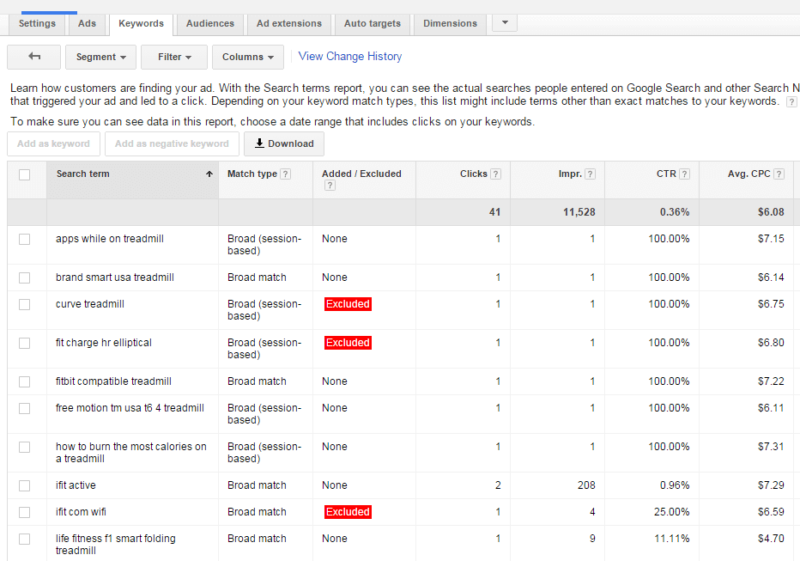

3. Search Query Report: Broad Match

While the search query report is normally used for generating negative keyword lists, it can also be used for generating new ad groups and broad match modifiers. This report can help your brand stay competitive by identifying keywords with similar and competitor-focused content that may require a unique campaign with personalized content to convert leads.

When not managed well, broad match has the ability to create exorbitant costs with paid search campaigns. However, we’ve found that when closely monitored and controlled (negative keywords are critical), broad match can be one of the most useful ways to continuously identify relevant keywords and expand an account.

Quick Wins

There are more keyword quick wins available through broad match reports than we can list, so we’ve isolated one of our favorites; keyword modifiers.

Modifiers are the supporting keywords that provide specificity to a product or service and generally reveal some degree of intent. Broad match reports can indicate all of the different ways that modifiers can be connected with your target keywords and which in particular yield conversions.

Keyword modifiers can be colors, sizes, or materials of different products. They can also be qualifiers like best, top rated or inexpensive. One of the things we love about search modifiers is that they give us continual insight into how prospects search for our clients’ products and services and the criteria that is most important to them.

How It Breaks Assumptions

Keyword research tools can provide search marketers with all the search intent data that they need, but assumptions still largely drive the data that’s input to generate recommendations.

Whether we realize it or not, these assumptions limit our capacity to think beyond our own understanding of how people may search for what they want or need.

Fortunately, broad match can act as a perpetual keyword exercise, with conversion data attached, aiding paid and organic search marketers in their all-important strategic decision making.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories