Analyzing The Impact Of Amazon’s Departure From Google’s Search Network

If, as rumored, Amazon will replace Google's ads on its site with those from its own network, what would that mean for advertisers?

Last month, The Wall Street Journal first reported that Amazon has plans to depart the Google Search Network and replace the Google ads it currently runs on the Amazon domain with its own in-house ads.

Amazon hasn’t confirmed this, but those keeping a close eye on their Google search partner traffic may have seen a signal of this change months ago.

I’ll get back to that in a bit, but to better understand how this change may impact the fortunes of retailers advertising through paid search, as well as Google itself, I think it is helpful to first consider the importance of the Google Search Network to advertisers overall, and how that has trended in recent years.

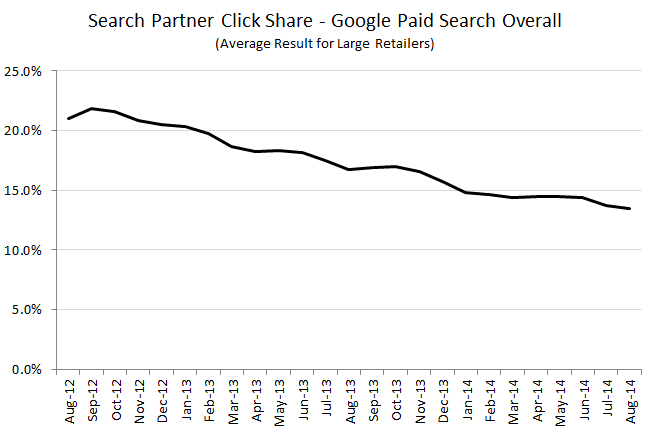

Google Search Network Traffic Share Has Been On The Decline For Years

Looking across a couple of dozen large retail paid search programs, we see a consistent decline at RKG in the share of paid search traffic generated by Google search partners over time. In the last two years, partner traffic share has dropped by eight percentage points for the average site.

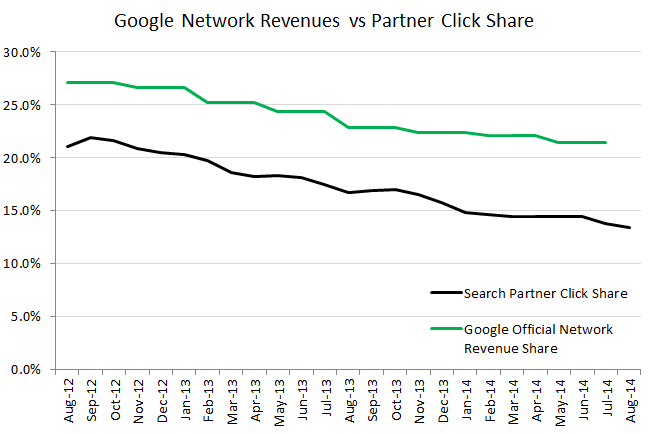

These findings mirror official Google financial results that show the contribution of their “network revenues” has fallen about six percentage points over the same period. To be clear, Google’s network revenues figure is not exclusive to paid search, so its share is likely bolstered by display.

Still, the trend of Google’s network being a smaller, though still meaningful, factor over time is clear. Why the decline? Product Listing Ads and the growth of mobile seem like likely suspects.

Product Listing Ads On The Search Network

Just last week, Google announced that advertisers would be able to extend the reach of their Product Listing Ads by opting them into AdSense for Shopping, which will bring PLAs to retail and commerce search partners such as Walmart.com.

PLAs have been showing up on other search partners for some time prior to this, though; but, the partner traffic volume has been pretty tiny. This August, search partners generated just 3% of PLA clicks for the average large retailer.

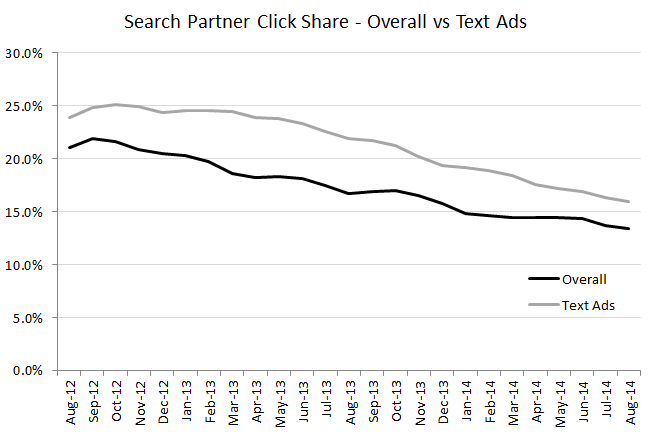

With PLAs having grown rapidly and now contributing about a quarter of all Google paid search clicks for a typical retailer, it would seem like they must be driving total search partner share down.

While it’s true that total search partner click share would be around three points higher without PLAs, the growth of PLAs does not appear to have accelerated the decline of partner traffic, at least in the past two years.

In other words, the downward slope in partner share is about the same whether we include PLAs or not. This is because as PLAs themselves have grown their share, more of that volume has been from partners, and the effects are essentially equaling out. The new AdSense for Shopping program could change that soon as it rolls out to more partners.

The Impact Of Mobile On Search Network Share

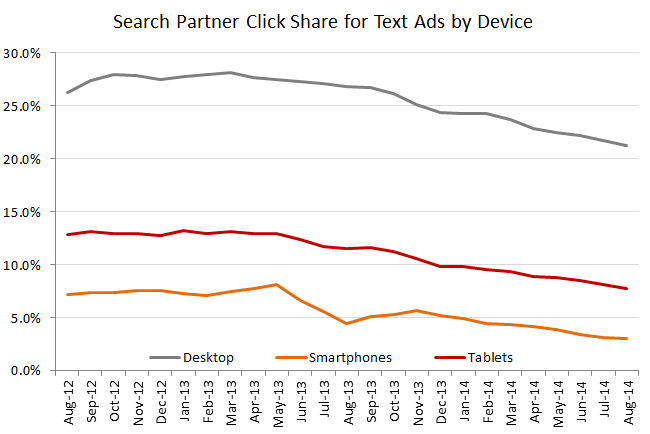

Google partners have never been big paid search traffic producers for mobile devices, and even what little share they have generated has been falling pretty rapidly. In the past two years, partner share of smartphone text ad clicks has dropped from around 7% to 2%. For tablets, partner share has fallen from 12% to 7%.

But even excluding PLAs and mobile devices, and just looking at text ads on desktop, we still see a fairly steep decline in partner traffic share. Two years ago, partners contributed around 27% of text ad clicks on desktop, but that has fallen to about 21%.

No matter how you slice the results, the share of traffic produced by the search network has been on the decline; but, this isn’t necessarily bad news for Google or its advertisers.

Google’s network revenues have still been growing, just not as fast as those from Google.com. Also, network traffic is not as valuable to Google because of the revenue share they have to pay to partners. This was 51% for search partners as of 2010.

For advertisers, given that Google.com traffic tends to perform a good deal better than partner traffic, the mix shift has helped improved conversion performance. I’d be remiss, though, if I didn’t note that a decent portion of Google.com paid search gains have come at the expense of organic search.

How Amazon And Its Potential Departure Come Into Play

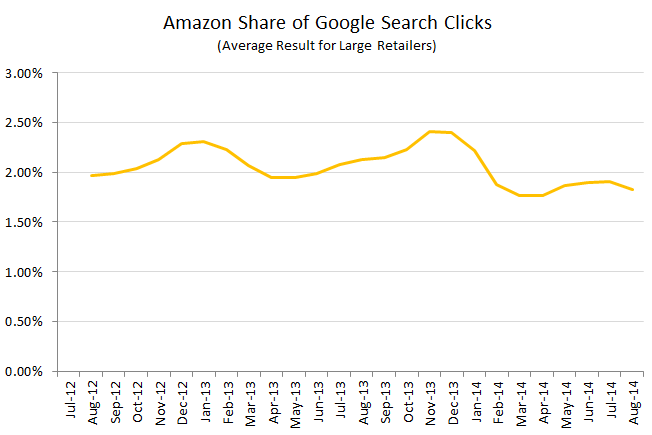

Whether search network traffic is on an inexorable decline or not, Google would certainly rather not lose a big partner like Amazon anytime soon, or ever. For the large retail programs I looked at, Amazon accounted for an average of 1.8% of total Google paid search clicks last month.

That is just a little below the 2.0% share we saw a couple of years earlier. The intra-year trends are really interesting here, though, as Amazon’s share has peaked at around 2.4% of Google paid search clicks during the last two holiday shopping seasons.

For any nervous Google stockholders out there, note again that this is click share among retailers only, and CPCs for partner traffic tend to run 15% lower than CPCs for Google.com traffic. Google is also probably giving Amazon roughly a 50% cut of ad revenues.

All told, if Amazon drops Google search ads entirely, we’re probably talking about this impacting somewhere in the neighborhood of 0.2-0.4% of Google’s revenues overall.

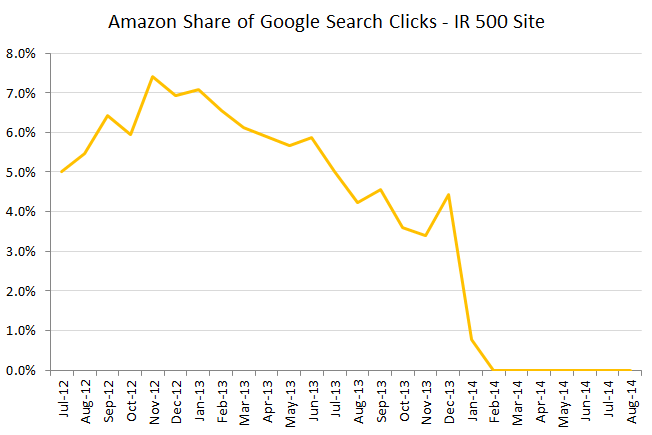

For advertisers, the picture is a little more fuzzy. For starters, like many aspects of paid search, the share of clicks Amazon contributes exhibits a pretty wide range across individual retail sites. It is not uncommon to see Amazon’s share reach 5-10%. That is a pretty big chunk of traffic to be up in the air.

Now, Amazon traffic doesn’t perform as well as Google.com traffic, but it does perform better than average search partner traffic. Last month, revenue per click for non-branded search partner traffic from Amazon was about 26% lower than the revenue per click for Google non-brand overall. Revenue per click for other search partners was about 33% lower.

So we know that Amazon search ad traffic can be substantial and it actually does convert pretty well. Should Amazon drop out of the Google Search Network, the two most important questions will be whether Amazon’s model can deliver better performing traffic and how the volume of traffic will change.

As Search Engine Land reporter Ginny Marvin noted in her analysis of the WSJ report, “Amazon’s unique trove of shopping and product data would be a strong draw for advertisers.” Depending on what capabilities Amazon made available, and that’s a big uncertainty, it’s not hard to imagine retail advertisers producing a higher revenue per click through more sophisticated targeting.

The question of volume is an interesting one. By running its own ads, the economics for Amazon change significantly. Amazon will have the added expense of maintaining its own platform, but it will no longer have to share its ad revenues. This may lead them to open up more and better inventory than they are currently willing to offer to Google Search Network ads.

But a big concern for advertisers is whether Amazon will choose to be more selective in who will be able to run search ads on its site at all.

Will Amazon Shut Out Its Biggest Competition?

With its own ad platform, Amazon will have full control over whom among its potential competitors may show up on its site, and RKG data from Google Search Network ads suggests that Amazon may be experimenting with the idea of shutting out some sites entirely.

In the graph above showing the share of Google paid search traffic originating from Amazon, you may have noticed a more severe dip after the most recent holiday season compared to the year before. This is because a handful of sites saw their Amazon search partner traffic effectively shut off in January 2014.

Here’s an example of how that looked for an IR top 500 site:

My understanding is that Google search partners can block ads from up to 500 specific websites. Due to its size, Amazon may also have a special arrangement with Google that already gives it greater control. Either way this is concerning.

Many advertisers won’t be terribly bothered by whether it’s Google or Amazon running the show as long as they can maintain or grow search ad volume. Losing 5 to 10%, or even just 2% of Google search volume would hurt, though.

If such a scenario plays out, there will be winners as well, but it’s impossible to say at this point where that line would fall.

I Don’t Want The World, I Just Want Your Half

The competition between Google and Amazon for internet dominance makes for a compelling, albeit often overblown narrative. Google losing Amazon as a search partner will sting, but it won’t have a large impact on Google’s revenues directly.

Should Amazon find success in replacing Google ads on third-party sites, the impact will be more material, but Amazon will be chipping away at a shrinking portion of Google’s business. While retail advertisers will be caught in the middle of this wrangling, most will choose to work with both parties, assuming they will be able to do so.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories