ComScore Releases January Search Numbers (Bing Gains) & Year In Review

The financial analysts and investment banks publish the comScore monthly search data ahead of its public release, generally by about 24 hours. We’ll probably see comScore’s January numbers, accordingly, later today. However the numbers hit the web almost immediately because many writers/analysts/bloggers are on the investment bank mailing lists. So here, with all the usual […]

The financial analysts and investment banks publish the comScore monthly search data ahead of its public release, generally by about 24 hours. We’ll probably see comScore’s January numbers, accordingly, later today. However the numbers hit the web almost immediately because many writers/analysts/bloggers are on the investment bank mailing lists. So here, with all the usual caveats, are the comScore search numbers for January:

- Google: 65.4 percent

- Yahoo: 17 percent

- Bing: 11.3 percent

- Ask: 3.8 percent

- AOL: 2.5 percent

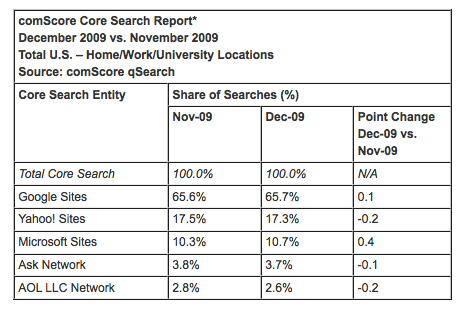

Google appears to have lost three tenths of one percent. Yahoo and AOL are slightly down. Ask is up a fraction of a percent. The combination of Yahoo and Bing now stands at 28.3 percent according to comScore (the deal is still pending approval). Compare the December figures from comScore:

What can’t be denied is the growth of Bing and the slow erosion of Yahoo. It’s not clear whether Bing is responsible for Yahoo’s decline over time — but it would appear to be (at least in conjunction with Google’s continued gains).

When Bing launched in May last year, I said: “I predict that it will gain share. Those potential gains may come not at Google’s expense but rather from Ask, AOL or even Yahoo.” That seems to now be confirmed by many months of data.

Separately yesterday comScore released “The 2009 U.S. Digital Year in Review.” The report offers a broad array of data from social networking usage to video, display advertising trends and mobile. And of course search is in there too:

The U.S. core search market grew 16 percent overall in 2009, driven by a 6-percent gain in unique searchers and a 10-percent gain in searchers per searcher. Google Sites’ search query volume grew 21 percent, driven both by gains in searches per searcher (up 10 percent) and unique searchers (9 percent). Microsoft Sites had the largest growth in search volume at 49 percent, propelled by sizeable gains in both unique searchers (15 percent) and searches per searcher (30 percent). Ask Network increased its search query volume by 12 percent, driven mainly by attracting more searchers (up 19 percent).

Here’s comScore’s full-year US search market share chart:

What this chart and the comScore data appear to argue is that Google’s share may have hit the ceiling in the US. So future paid search growth will need to come from:

- Less mature markets (outside US)

- Other Google properties

- More efficient monetization in core search and/or new ad types in search

- Growth in terms of the participation of new advertiser segments or greater penetration of existing ones

- Mobile

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories