Wow! See How Much Screen Real Estate Google Is Giving Rivals In Its EU Antitrust Settlement

Google’s finally reached a proposed agreement with the European Union over antitrust charges. Judging from screenshots the EU has released, it will give Google rivals unprecedented positioning in Google’s results, sometimes for free, sometimes for a fee. Consider how the EU is saying that shopping results will appear, as part of the agreement. The before: […]

Google’s finally reached a proposed agreement with the European Union over antitrust charges. Judging from screenshots the EU has released, it will give Google rivals unprecedented positioning in Google’s results, sometimes for free, sometimes for a fee.

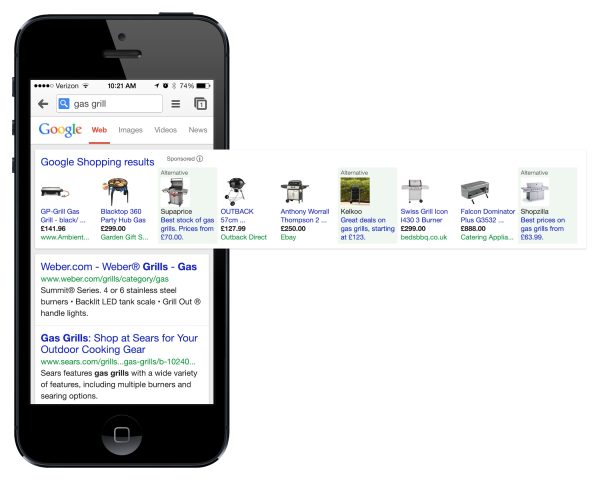

Consider how the EU is saying that shopping results will appear, as part of the agreement. The before:

And the after, based on screenshots that the EU has released:

In the after, you can see an “Alternatives” section that gives shopping search engines co-equal space alongside Google’s own advertisers who buy product listing ads (which is what “Google Shopping results” are — just ads). This treatment will also happen with mobile search:

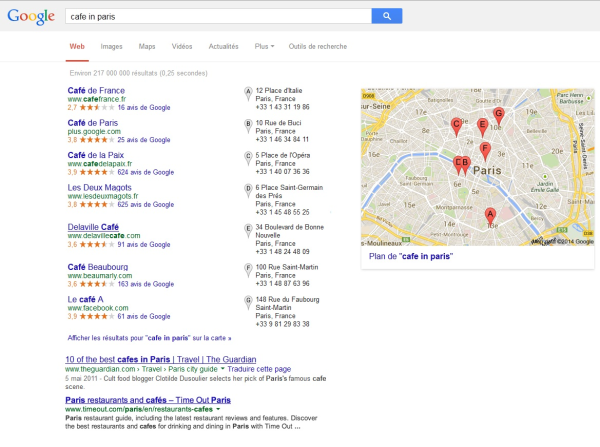

Here’s a before on how it would work with local results:

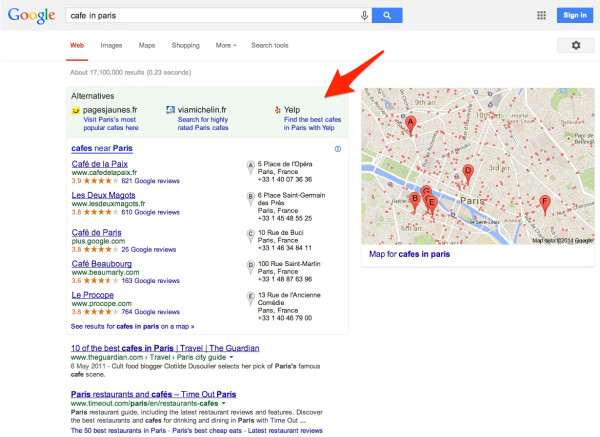

And the after for desktop and tablet:

When They Pay & When They Don’t

Google competitors get another round of raising objections to the proposed settlement. Microsoft’s statement from its general counsel is cautious:

For decades transparency has been a hallmark of the Commission’s competition proceedings, and it should not be sacrificed today. As Vice President Almunia has acknowledged, market testing of Google’s last two proposals identified serious and wide spread concerns about the damage they would have done. If these new proposals are materially better than those that have already been rejected then they should be broadly market tested. If this is really a good deal for consumers then the data will confirm it.

But the FairSearch group, which Microsoft backs, is out saying the proposal is “worse than doing nothing.” That’s not surprising given that FairSearch often seems like it will be unsatisfied with anything short of Google completely closing.

However, “worse than nothing” is crazy, given what the competitors are getting here. In cases where Google doesn’t charge for listings, as with local, the proposals put competitors actually above Google’s own listings, in a guaranteed space, and for free.

Currently, competitors — like any publisher — have no guarantee of showing up in Google’s listings at all (listings that, in the US, have case law backing them as protected First Amendment free speech, IE, Google can largely list what it wants).

In cases where Google charges for listings, as with Google Shopping, then competitors will have to pay. The EU found this reasonable, in its press release about the proposed settlement:

Some complainants or competitors have expressed the view that Google should not require them to pay to feature prominently on Google’s page. Google’s proposals do not require payment for all forms of rival links. It is only required for the commercial categories such as shopping comparators, where Google charges for inclusion in its own specialised search service. For these commercial categories I consider the auction mechanism an efficient way to select rival links.

FairSearch objects:

The Google proposal requires rivals to pay Google for placement similar to that of Google’s own material, undercutting the ability of other to compete and provide consumer choice. This will be done through an auction mechanism that requires participating companies to hand the vast majority of their profits to Google.

FairSearch omits the fact that unlike virtually all other advertisers out there, this tiny group of Google competitors will apparently compete against themselves for a dedicated spot that actual merchants aren’t allowed in. The pool of competition for these spots will be much less — indeed, perhaps even making it possible for Google competitors to collude among themselves to keep the prices they pay for ads low, maybe lower than merchants themselves have to pay.

In some ways, it may even help institutionalize these players with having a guaranteed source of arbitrage, where they can buy Google traffic for cheaper than merchants can, then reselling it to merchants on their own sites and making a profit. They have no such guarantee of that now.

How it all will play out in practice still remains to be seen, as if the agreement proposed today is finalized. We’ll also have more reporting on this to come.

Postscript: See our follow-up story, Google Publishes Full Text Of EU Antitrust Agreement.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories