Google Has Over 75% Of US Search Ad Market

New figures out on search advertising spend from Efficient Frontier show Google continues to dominate the market, stats that will no doubt complicate the company’s goal to gain approval of its deal with Yahoo on search ads. However, it is interesting how in Japan, it’s a much more 50/50 market split with Yahoo, showing that […]

New figures out on search advertising spend from

Efficient Frontier show Google continues

to dominate the market, stats that will no doubt complicate the company’s

goal to gain approval of

its deal with Yahoo

on search ads. However, it is interesting how in Japan, it’s a much more

50/50 market split with Yahoo, showing that Google does have weaknesses.

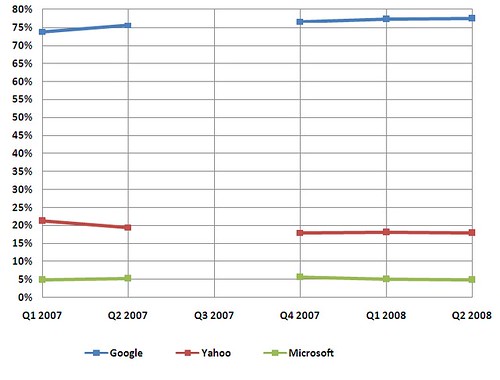

For the second quarter of 2008, Google had 77.4% of the search

advertising spend according to data tracked by Efficient Frontier, which

manages ad campaigns for a wide variety of large advertisers. The data

covers 23 billion ad impressions and 390 million clicks. Google’s share

includes a small percentage of contextual ad spend (which is not search), as

does Yahoo’s. You can see these broken out in the share chart below for Q2

2008:

Over the past year, Google has continued to gain share of ad spend

pulling away primarily from Yahoo (Note: I don’t have figures for Q3 2007 at

the moment, so I’ll update later when they come in):

That drop is bad for Yahoo, since its

Panama ad system,

launched last year, was supposed to

help increase the amount advertisers were spending with the company. Of

course, the company has also had

declining search share overall, so

fewer

impressions can also mean potentially less spending with Yahoo.

Keep in mind that Yahoo could have a declining share of the search spending pie

yet still earning more money as long as the overall spend on search advertising

is growing. And it is, says Efficient Frontier — but not to Yahoo or

Microsoft’s benefit.

Instead, Google is getting more of the new money coming

in than the others. Officially, Efficient says Google gets $1.10 of every

new dollar spent on search. That’s complicated to understand, even after I

talked with them about it. So stick with the bigger point — the others are

seeing both declining share of overall search spend and a declining amount

of actual earnings.

This is great for Google with the exception that the

company is currently

trying to win US government support for a plan to have Yahoo carry some of

its search ads. The latest numbers hold no particular surprise about how

dominant Google is, but they’re fresh evidence that you’ll no doubt hear

Microsoft parroting in terms of why a Google-Yahoo deal would be bad for

competition.

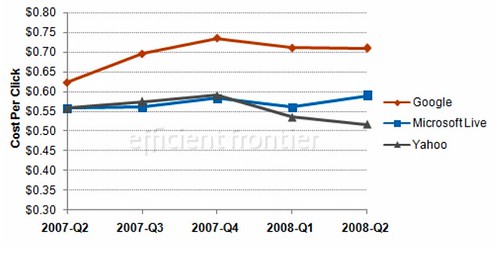

Another stat that might get trotted out is the cost-per-click figure.

Google’s cost per click is well above the others, about $0.70 on average,

with Microsoft around $0.60 and Yahoo around $0.50. Google’s CPC rate has

actually dropped the past two quarters (as has Yahoo’s), but no doubt it

will be argued (as it already has been) that a Google-Yahoo deal

will just allow Google to "set" the market and make CPC rates go higher

(officially,

Google says the market sets prices).

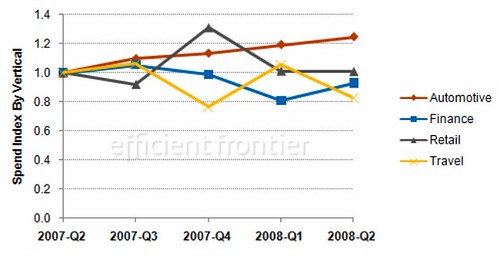

Here’s the chart (note that spend by financial services advertisers is not

included in it):

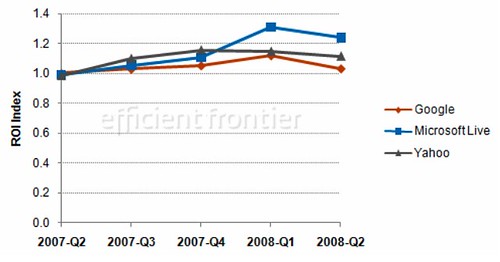

Good news from Microsoft — for two quarters in a row, it has claimed the

title of best ROI. The problem, of course, is that while advertisers might

get better ROI, there’s a lot less search traffic for them at Microsoft to

get it from:

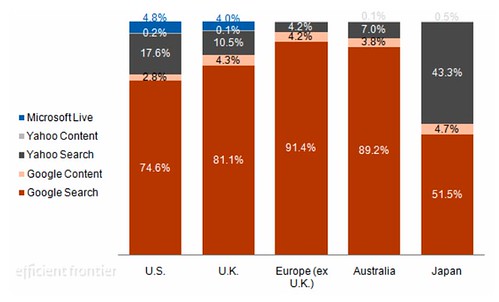

Back to the competition aspect: just because Google’s dominant in the US

doesn’t mean it plays that way out in all countries. In particular, Google

is behind in China, South Korea, Russia and Japan. Efficient has spend

figures for the latter, which show Google has just barely 50% of the Japanese market.

The other half belongs to Yahoo:

Note that in Europe (excluding the UK), Google has over a 90 percent

share. Fortunately for Google, the Yahoo ad deal is US-only, so it won’t

have to face European regulators who likely would take a hard look.

Finally, many who worry that search spend will decline because

of current economic woes should feel reassured that, on the whole, Efficient

says spend is increasing. But some sectors are feeling the impact:

Overall:

- Auto spend rose despite the hike in gas prices.

- Financial spend after several drops is about the same as a year ago.

Efficient said that a drop in mortgage-related spending is being made up

for by spend by advertisers with credit products.

- Retail spend is about the same as a year ago. The Q4 2007 spike is

likely due to the holiday shopping season.

- Travel is lower, even when looking back on a season basis to the same

quarter last year.

For related discussion,

see Techmeme.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land