Google’s New European “Antitrust” Search Results: Here’s What They’ll Look Like

I’ve found documents associated with the Google-EU settlement proposal that offer mock-ups of how the new, regulated SERPs will look. It’s very interesting and greatly clarifies the settlement terms and how they will be implemented practically. These mockups look quite different (and less “disruptive”) than what I imagined. There are three basic scenarios: where Google […]

I’ve found documents associated with the Google-EU settlement proposal that offer mock-ups of how the new, regulated SERPs will look. It’s very interesting and greatly clarifies the settlement terms and how they will be implemented practically. These mockups look quite different (and less “disruptive”) than what I imagined.

There are three basic scenarios: where Google sees direct monetization from the SERP, indirect monetization in the vertical or no monetization (e.g., News in Europe). In each case the presentation and the rules will be slightly different. The screens below are all mock-ups that have been supplied to the EU by Google as part of the formal settlement proposal.

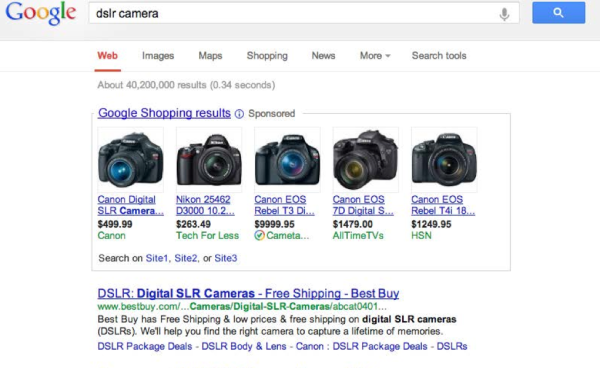

The image immediately below reflects what the new page will look like in a situation where sponsored results appear in the SERP (e.g., product listing ads). The current label “sponsored” is expanded to include “Google Shopping results.” This is intended to clearly indicate these results are from Google.

At the bottom of the box are “site 1, site 2 or site 3.” These are going to be paid links (based on an auction). Companies eligible to bid on these links will be any vertical aggregator or supplier of multiple products in the category — in this case cameras. For example, Amazon or an OEM (e.g., Nikon) could equally bid on these positions.

In each scenario there will be informational pulldowns (from the “i” icon) to explain what the results are.

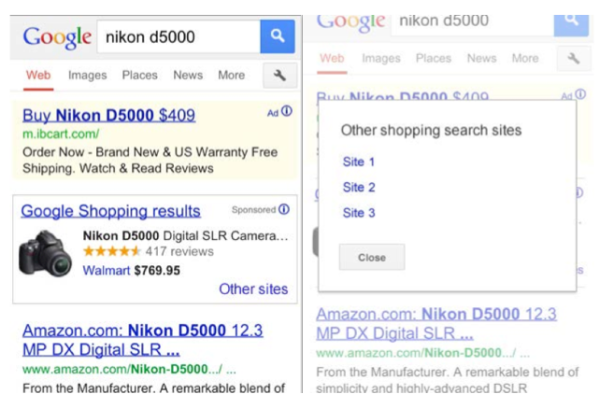

Below is a version of this same camera/product result in a mobile context. The three links will appear after a click under “other sites.”

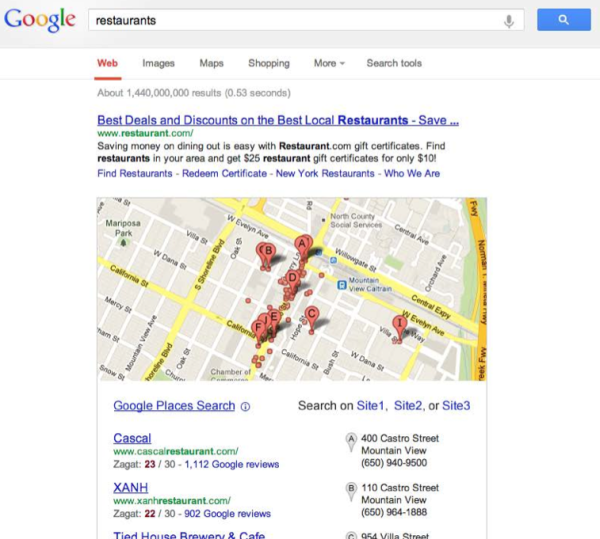

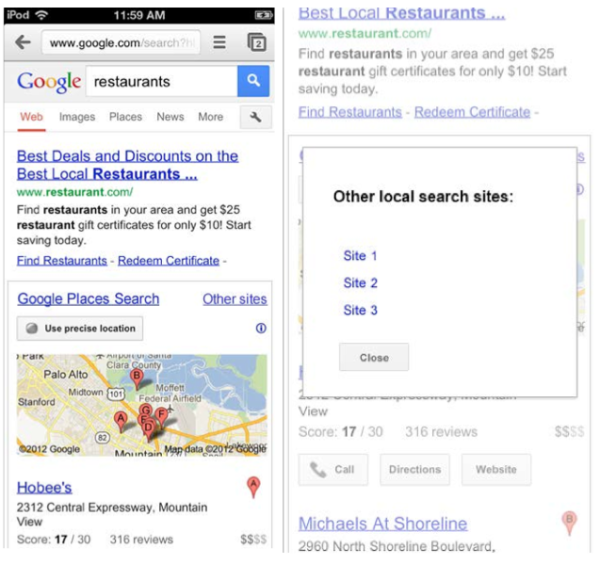

In a situation where Google monetizes the search result indirectly (e.g., local/Maps) the three links will essentially be the top three organic vertical/directory links that would appear on the SERP. In a restaurant search scenarios those could be Yelp, OpenTable and Restaurants.com (hypothetically), although the specific links will be different across Europe. The links will not be auctioned.

The text above the local listings reads “Google Places Search,” again with an informational link to further clarify that these results are from Google. Beside that heading are the three links to competitors’ sites. Below, once again, is the mobile version of this result:

In the third scenario, where there is no monetization whatsoever, there’s also no requirement to present the three links.

The following example shows a news search result. Here “news for X” is replaced by “Google News Search.” And the cluster of top news results is slightly separated from the rest of organic results. Again, in this “no monetization” scenario, there are no competitor links.

While the three competitive links are likely to drive some traffic to Google alternatives, from a user experience standpoint this is not the radical change I was imagining. In addition there’s apparently no requirement or constraint around where Google can put universal search results on the page. In other words, it can still show products, maps, flight search and so on, where it likes.

Many Google critics will undoubtedly complain that the settlement and these pages don’t go far enough. Indeed, FairSearch has already expressed disapproval of this approach in a statement just issued:

“FairSearch applauds the Commission for laying out a clear and compelling case that Google is abusing its dominant position by giving its own products preferential treatment in search results. This is an important conclusion that must lead to meaningful remedies.

We have always said that the best remedy for consumers and innovation would be to require Google to apply the same policy to search results for its own products as it does to all others.

However, Google’s proposed commitments appear to fall short of ending the preferential treatment at the heart of the Commission’s case based on formal complaints from 17 companies. Google’s own screen shots in its proposal (see p. 30) shows it seeks approval to continue preferential treatment for its own products.

We will study the proposal in detail and offer an empirical analysis based on actual tests.”

It is now also my understanding that while the market test is intended to solicit comments from rivals, critics and the general public, the terms of the settlement — including the mock-ups above — have been carefully negotiated between Google and The European Commission.

The Commission is not required to listen to Google’s most vocal critics if it choses not to (or modify the proposal if they’re not satisfied). And given that these terms were developed jointly during many months of discussions between the parties, it is unlikely that there will be material changes to the settlement — regardless of how upset or vocal the opposition is.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land