Microsoft Earnings: The Morning After

Yesterday Microsoft announced earnings. Though the company had $13.65 billion in revenue, it saw its first YoY revenue decline since becoming a public company. The bruising headline is: Microsoft Profit Falls for First Time in 23 Years. Below are two charts of interest, the first showing division revenues and the second focused on online business […]

Yesterday Microsoft announced earnings. Though the company had $13.65 billion in revenue, it saw its first YoY revenue decline since becoming a public company. The bruising headline is: Microsoft Profit Falls for First Time in 23 Years.

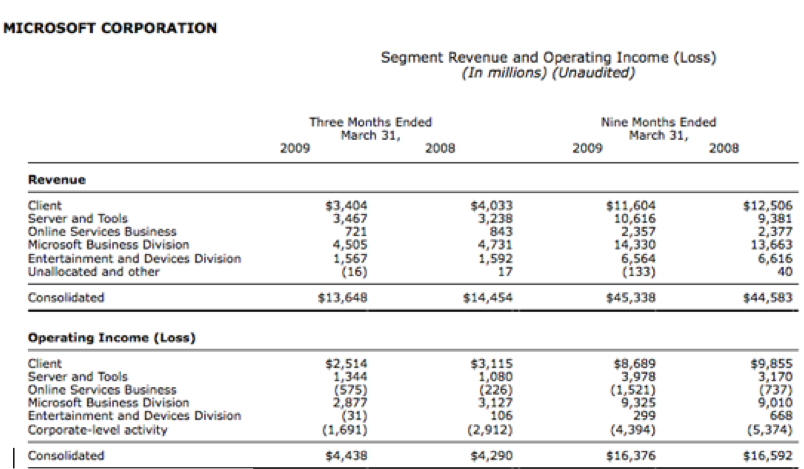

Below are two charts of interest, the first showing division revenues and the second focused on online business services in particular. Regarding the latter, there was an overall 14 percent decline in online business services revenue, while online ad revenues dropped 16 percent — hit by weakness in online display advertising.

There are a million posts on the earnings release. Among them, Kara Swisher live blogged the earnings call yesterday and Mary-Jo Foley asks “five unanswered questions” after the announcement and call. TechFlash points out that the “Lauren” (PCs are cheaper) campaign has had some traction with consumers.

Notwithstanding all those billions, it’s safe to say, that things aren’t great for Redmond right now. CFO Chris Liddell didn’t think there would be any meaningful improvement in the near term.

Microsoft is about to re-brand search and introduce a new user experience. So far I like what I’ve seen but until it hits, we won’t know whether a new engine and/or a massive consumer ad campaign will have any material impact on Microsoft search’s market share. Gaining in search is a long term proposition for anyone whose name isn’t Google.

These days an ad deal with Yahoo is looking more hopeful. If a deal is ultimately announced it would likely provide Microsoft with greater reach for its search advertisers. Even so, it won’t be the same thing as owning Yahoo or controlling Yahoo search.

A bad economy and low-cost netbooks have hurt Microsoft, though the company now claims Windows is the leading OS on netbooks. But the market is clearly changing and diversifying. In order to retain its OS leadership Microsoft will have to be more flexible and faster to market. It will also need to skillfully manage the transition that we’re now in. Computing and the internet are moving to more devices, most of which are mobile.

On that front, Microsoft’s venerable Windows Mobile OS is falling behind rivals such as Apple, Google and Palm. BlackBerry for its part is displacing Windows Mobile as the OS of choice for business and enterprise users. Microsoft has announced Windows 6.5 and the upgrade is supposed to launch in the next quarter according to current speculation. But it’s mostly a stop-gap measure while the company readies Windows Mobile 7. Right now it’s safe to say that Microsoft is playing catch up in mobile, somewhat blindsided by the iPhone’s success, and despite its huge installed base of devices.

On several fronts Microsoft doesn’t seem the invincible “juggernaut” it once did or the inevitable victor in any segment it chooses to enter. That’s not to say “game over.” Microsoft with its resources and balance sheet can never be counted out. But the company does seem more “vulnerable” than at any time in the recent past.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land