Mobile 411: A Leading Indicator For Mobile Search

There are roughly 250 million cell phone users in the United States and more than ten times that figure around the globe. Approximately 42 million (or so) people use the “mobile Internet” in the US, with varying degrees of frequency. The number of people texting constitutes at least 100 million more on top of that. […]

There are roughly 250 million cell phone users in the United States and more than ten times that figure around the globe. Approximately 42 million (or so) people use the “mobile Internet” in the US, with varying degrees of frequency. The number of people texting constitutes at least 100 million more on top of that. And even though the “mobile Internet” is in its infancy, there’s a high degree of confidence that it will become a lucrative ad medium.

The major search engines are thus aggressively maneuvering to build the applications and the relationships that will allow them to take advantage of a mobile ad market that may be worth many billions of dollars by 2012. Yet many people still bring skepticism to the bullish projections of mobile internet usage and revenues. However, we can look to mobile directory assistance (DA) as something of a directional proxy or “leading indicator” for mobile search and future mobile internet usage. It might now be more appropriate to call mobile DA “voice search,” as Google does.

The DA industry is almost as old as telecom itself and is something of a “cash cow,” worth more than $7 billion in the US annually in the form of per-call fees callers. Today, there are roughly 5.4 billion DA calls made annually in the US. More than half are from mobile phones and that trend is accelerating, as mobile-only US households continue to grow.

As part of my “day job” I run a program at Opus Research called “Local Mobile Search” about the mobile market. Not long ago, we conducted an online survey on behalf of mobile and voice search provider V-Enable, which sought to obtain a snapshot of current mobile 411 usage and consumer behavior. It was fielded and completed in November 2007 with 671 total respondents (U.S. adults 18 years and older).

The survey explored call frequency, user intent, caller location, and use of free DA alternatives (e.g., 800-Free-411), among several other areas. The picture that emerged of the average mobile DA user was someone ready to conduct a transaction – often on her way to a business location. It points to how “qualified” many mobile users are and why there’s reason to be excited about mobile and mobile search as an ad medium.

Usage Frequency and Location

The survey found the most common usage frequency for mobile DA was “once every three months” (61 percent). A smaller group (14 percent) used mobile DA about once a month. Roughly 11 percent used it more than twice a month and a significant number (13 percent) never used mobile DA.

Interestingly, the overwhelming number of respondents (66 percent) used mobile DA while “in the car” (vs. at home, in the office, etc.). Though perhaps a surprise, this finding makes lots of sense when considered against the backdrop of other information sources (e.g., the internet) available at home or at work.

Caller Intent and Content

The survey asked why people used mobile DA and provided multiple choice answers based on historical DA calling patterns. The top three responses were:

- To reach a business for driving directions

- To reach a business for hours of operation

- To reach a business regarding a product or service

Yet the open-ended option yielded responses consistent with those behaviors. The survey also explored whether users sought content beyond a limited range of conventional DA lookups. Enhanced directory assistance from mobile carriers has existed for some time and offers a range of content and services beyond the traditional “what city, what listing” prompt. However, these services are not widely known or used by most mobile callers. And, accordingly, the survey discovered limited demand for these services through mobile 411, because of a lack of awareness and/or fear of potential cost.

Price Sensitivity and Free DA

Price is the single greatest factor inhibiting more frequent mobile DA usage, even though most users do not know precisely how much they pay for mobile DA. Asked “what is the primary reason you do not call 411 from your mobile phone?,” just under 80 percent said that it was because it was “too expensive.”

As more mobile DA users become aware of the various free and ad-supported DA options, one would expect them to defect to those providers, which include:

- 1-800-Free-411 (Jingle Networks)

- 1-800-Goog-411 (Google)

- 1-800-YellowPages (AT&T)

- 1-800-Call-411 (Microsoft)

- 1-800-555-Tell (Tellme/Microsoft)

It remains to be seen, however, whether any of these companies do any consumer marketing to build awareness and usage. Jingle Networks has done the most and is the market leader, while Google has experimented with outdoor advertising in isolated markets.

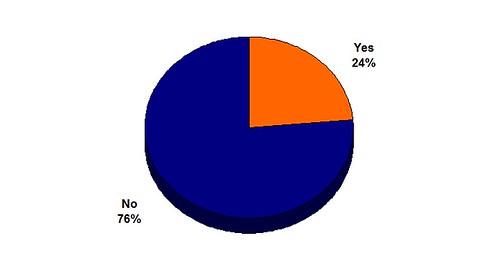

Have you ever used one of the free alternatives to carrier-provided 411 directory assistance?

Source: Opus Research (12/07)

Two earlier, more-informal surveys by Local Mobile Search with smaller samples found that 71% and 77% of mobile consumers had not used any of the services. Separately, three waves of surveys, all conducted in 2007 by comScore, showed that roughly 66 percent of the survey respondents were not aware of these free 411 alternatives.

Nonetheless, the 24 percent of mobile callers in the Local Mobile Search survey who had used free 411 represents a potentially substantial number: 60 million people (if one extrapolates). Beyond this, usage frequency of free 411 can be expected to be greater than the typical “once every three months” response; comScore data from June 2006 found that 88 percent of consumers said they “probably” or “definitely” would use free 411 services more than paid 411.

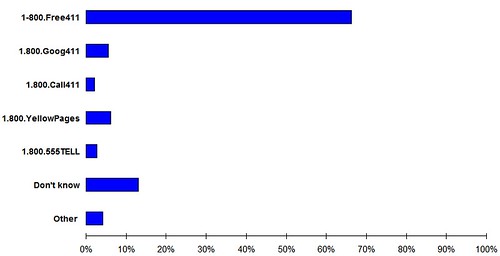

Which of the following free alternatives to 411 have you used?

Source: Opus Research (12/07)

Other than Jingle Networks’ 1-800-Free-411, which is more established than its competitors, no single service has any meaningful share of the market. As mentioned, Google has done some limited outdoor advertising for Goog-411, but the other services are largely unknown to consumers at this point. The share assigned to 1-800-YellowPages is likely a product of familiarity with the term “yellow pages” rather than an actual reflection of usage or market share.

Interestingly, the free DA providers are starting to push the envelope somewhat and expand the range of content and services available via voice search. Jingle Networks, for example, recently added directions (via text) through a partnership with Dial Directions. Microsoft’s 1-800-Call-411 offers some social features and a number of the services are flirting with adding reviews and user-generated content. And we can expect the free DA market to continue to evolve in interesting ways because of competition and the fact that it’s immediately accessible to 250 million mobile users.

The appeal of mobile DA/voice search is its simplicity, familiarity, and convenience for callers. It doesn’t require any behavior change, a smartphone, or any particular mobile application. Today, it’s the mass-market entry point for mobile search.

Greg Sterling is the founding principal of Sterling Market Intelligence and a senior analyst at Opus Research’s Local Mobile Search program. He publishes Screenwerk, a blog focusing on the relationship between the Internet and traditional media, with an emphasis on the local search marketplace. The Locals Only column appears on Mondays at Search Engine Land.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories