Relax, The Search Industry Is Doing Just Fine

For enterprise SEM practitioners looking to set budgets or otherwise anticipate their needs in the space for the months and years ahead, it’s been a particularly difficult time to get a read on how the industry is really trending. Conflicting data and opinions abound; new threats to the hegemony of search, real or just perceived, […]

For enterprise SEM practitioners looking to set budgets or otherwise anticipate their needs in the space for the months and years ahead, it’s been a particularly difficult time to get a read on how the industry is really trending.

Conflicting data and opinions abound; new threats to the hegemony of search, real or just perceived, continue to spring up; and, there are times when all of us may wonder just how much the numbers are actually changing and whether we should be concerned.

Case in point: comScore recently showed U.S. core searches increasing 11% year-over-year to hit an all-time monthly high in March; however, as recently as December, it was showing declines in the same metric.

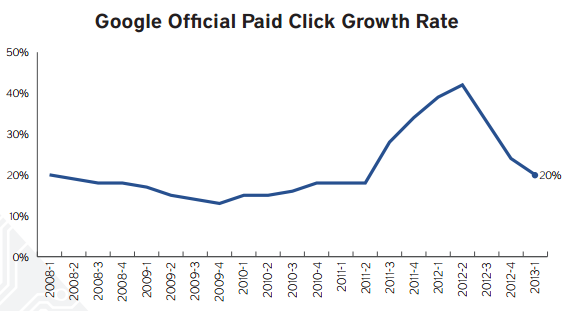

Even as its count of Google searches has trended up in Q1, comScore shows total visits to Google sites declining 0.3% Y/Y. Meanwhile, Google released its own numbers for Q1 a couple of weeks ago showing paid clicks were up 20% Y/Y, or about double comScore’s growth rate for search. What gives?

While the cannibalization of organic search by paid is a real possibility, if not likelihood, the biggest factor in these discrepancies appears to be the growth of tablet and smartphone search. As the share of mobile increases, reports that only cover desktop and laptop searches, like comScore’s core search figures, will provide a less and less representative view of the full picture.

How Big is the Impact of Mobile on Total Search Growth?

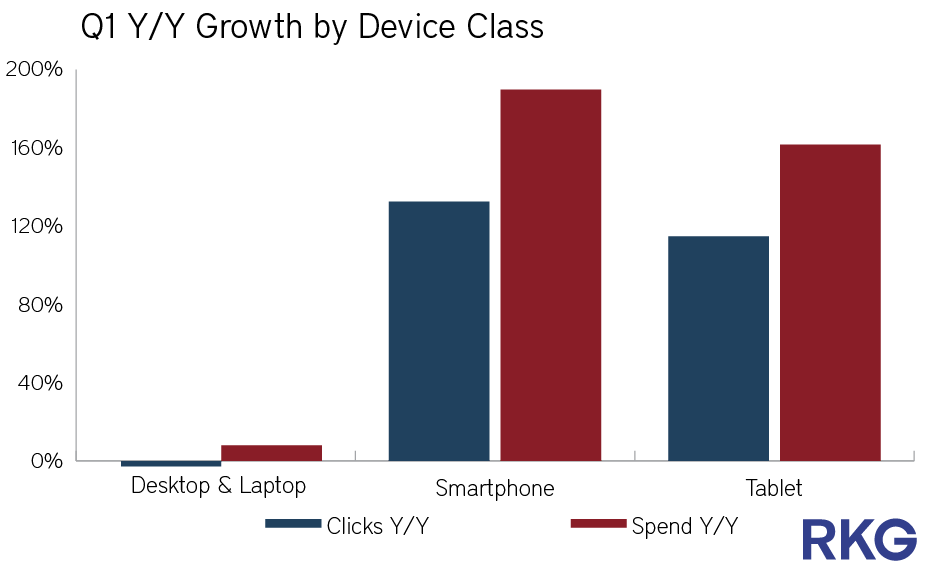

In March 2012, RKG found that tablets and smartphones generated approximately 13% of paid search clicks. With higher click-through rates, mobile accounted for close to 8% of search ad impressions. Fast forward to March of 2013, and we saw mobile click share double while mobile impression share reached 20%.

If we take comScore’s March figures for desktop and laptop searches and add in those mobile impressions, we get a total Y/Y growth rate for searches of close to 28%.

That figure sounds a bit high, but it provides a sense of just how much mobile growth is driving total search growth. At RKG, we are seeing desktop and laptop paid clicks running roughly flat against last year, but mobile click growth drove total clicks to a 15% gain in Q1:

While advertisers face additional challenges with generating revenues on smartphones and assessing their full impact in a potentially cross-device, online-to-off buying cycle, the shift to mobile overall is not necessarily as fundamental as it appears. Tablets, which generate roughly half of mobile clicks or more, are largely supplementing or replacing laptops, and user behavior on tablets looks a lot more like that for PCs than it does for smartphones.

But Paid Is Just Stealing From Organic, Right?

So, we are finding our paid click growth rates trending closer to Google’s numbers than comScore’s over the past few quarters, but if paid is largely stealing from organic, that growth is somewhat illusory and likely unsustainable. Google can’t fill the entire SERP with ads, can they? (Maybe don’t answer that one….)

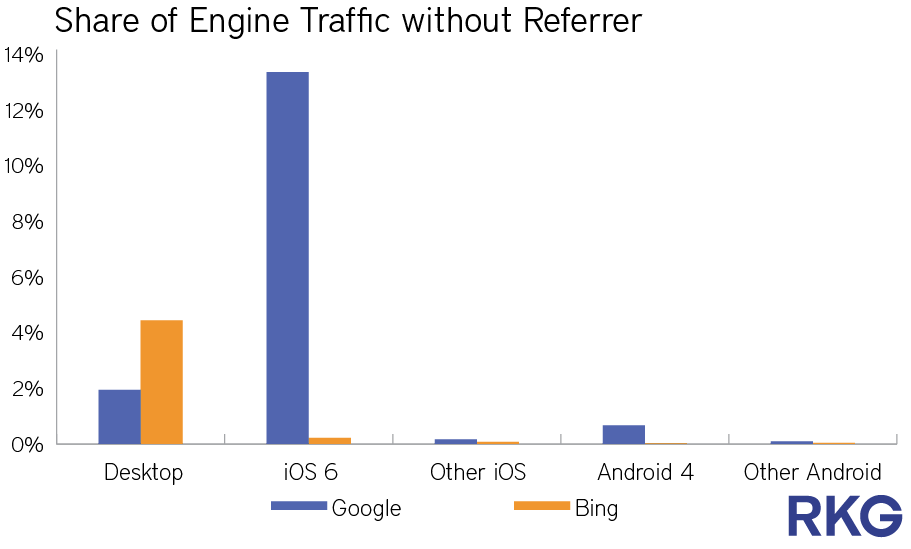

A quick glance at the data in our analytics package might seem to confirm our suspicions of cannibalism, but we need to dig a little deeper. With the release of iOS 6 in September of last year, a growing amount of Google organic search traffic is being classified as direct due to Safari toolbar searches defaulting to secure search.

Without taking that factor into account, organic visits for many sites do appear to have declined or at least not grown nearly as much as paid clicks. In Q1, RKG estimated that 13% of total Google organic searches appeared to be direct site visits because Safari did not pass a referrer on an iOS 6 device.

In March of this year, this issue had the effect of reducing an estimated 17% lift in Google organic searches for RKG clients to just a 4% lift, as recorded by analytics packages.

Admittedly, these are rough calculations that only superficially address the question of cannibalization, but they suggest there is significantly more growth in the organic sphere than it may appear at first blush.

Other Threats On The Horizon

Even if we are convinced that search growth remains strong on both the paid and organic sides, there are certainly threats out there that hold the potential to disrupt the search industry. But, the threats that seem to get the most attention aren’t all that new: shoppers will go directly to Amazon, eBay, etc; consumers will eschew search engines in favor of social recommendations or searches on Facebook; everyone will use apps instead of search.

Each of these notions easily warrants a separate in-depth analysis, but I will just note a few quick data points, in case they are causing you to lose sleep at night. With respect to Amazon, there seems to be the impression that they are devouring the entire retail industry at an incredible rate — but their net sales growth in Q4 2012 was 22%, which was the same growth rate Google reported for its gross revenue, excluding Motorola.

Much of Amazon’s growth is driven by third-party sales, which were up 40% Y/Y in Q4, and Amazon has long run search ads for third-parties on its site. Should consumers make a sudden shift to Amazon, search advertisers will likely still be able to reach them one way or another.

On the social side, RKG data suggests Facebook and others are not generating site visits at rates not anywhere near search, even for those that have a strong presence in the space. We also found that commercial Web search volume on Facebook appeared to be very small, given the number of clicks on the Bing search ads running alongside those searches. Again, should user behavior change on that front, search advertisers will be well-positioned to generate traffic — it just might be from Facebook itself rather than Bing or Google.

“If apps were going to destroy the search industry as we know it, it would have happened by now” isn’t the most compelling argument, but the huge growth of mobile searches in the face of an ever-expanding app ecosystem suggests the overall threat isn’t dire. Certain industries could see a greater impact than others; however, travel, in particular, comes to mind. For other verticals, apps are more likely to supplant direct site visits than competitive searches.

The Near Future Of Search

In a few months, AdWords advertisers which have yet to do so will be forced to make the transition to Enhanced Campaigns. The new model received a mixed response at best, but Google has already shown a willingness to tweak the details and make improvements as the transition date approaches.

Advertisers are still set to lose control over the segmentation of computer and tablet traffic, and there are concerns that the changes will drive up mobile CPCs considerably; but, sophisticated advertisers will handle this well, and the early impact will likely be smaller than most think.

That said, not all tablets convert alike; and, if poorer performing models continue to devalue the entire tablet segment (and, by association in AdWords, the PC segment), we may have some issues down the road. On the positive side, the new options around modifying bids by geography in Enhanced Campaigns should be a boon for advertisers and, ultimately, Google.

Finally, it doesn’t get as much attention as its much larger rival, but Bing’s performance in paid search has been trending very strongly, and that seems likely to continue in the near future. A number of search agencies, including RKG, have seen Bing’s paid-click growth outshine Google’s by a healthy margin over the last two quarters or so. Official numbers are hard to come by, but given the behind-the-scenes changes being made there, this phenomenon looks to be very real.

Bing stands to get another shot in the arm later this year with its version of product ads, a format that has been a major traffic driver for retailers on Google.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories