Search Retargeting: The Must-Have Media Tactic For Q4

As we rapidly enter the busiest period for the year for retailers, many are turning to Search Retargeting as the keystone for their digital marketing programs. Whereas in Q4 2011 many dipped a toe into the pixeled waters to test out its effectiveness, this year they have embraced it at scale. In its simplest form, […]

As we rapidly enter the busiest period for the year for retailers, many are turning to Search Retargeting as the keystone for their digital marketing programs. Whereas in Q4 2011 many dipped a toe into the pixeled waters to test out its effectiveness, this year they have embraced it at scale.

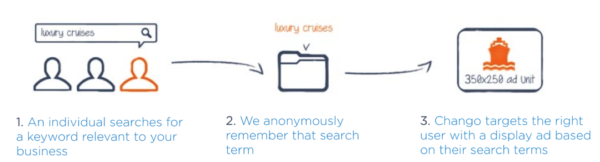

In its simplest form, Search Retargeting allows a retailer to find those individuals who have searched for a relevant term on Google, Yahoo! and Bing, but have not yet visited their site. This latter point is critical – Search Retargeting is unlike a typical retargeting or remarketing program in that it focuses on net new customers, not those who have abandoned your pages.

Retailer Case Study

In a recent campaign for a major traditional grocery retailer (with a growing online business), Chango was used to deliver against a set of diverse, and sometimes surprising, set of challenges.

A. Challenges

Our grocery client is in a competitive market, one that is fundamentally evolving because of changing buying habits, especially the use of online grocery ordering. They must compete with behemoths that can outspend them 100 to 1 and are household names, not just brand names. They have dollars to invest, but like many challenger brands, they must be smarter than their competitors, and squeeze out every last drop of benefit.

They struggle to rank for important home delivery terms in SEO because the market is too crowded, and their budget doesn’t stretch to head terms in PPC like [supermarket] because in some markets it is simply cost-prohibitive.

Like many such retailers, their product portfolio has diversified, and they want their audience to know they are a one-stop shop for flowers, electronics and wine. And as a high-end retailer brand, they are extremely cautious about the quality of their ads, as well as the placement

Most importantly, they want net new customers, as these will bring the maximum value over their lifetime.

B. Methodology

Search Retargeting is about defining audiences based on their intent, and that intent is defined by the keywords that the individual is searching on. The audiences defined included:

Curious about online grocery: [online grocery], [online supermarket], [supermarket home delivery], etc.

Competitor conquesting: brand terms of competing supermarkets and retailers, and the brand names of their major in-house product lines

Flower buyers: [order flowers], [mother’s day flowers], [flower gifts], etc.

Wine buyers: [order wine], [wine cases], [wine delivery] and brand names of wine information sites and guides

Each individual was shown an ad that was relevant to the category they were searching for. All ad placements were screened with a three-layer brand safety methodology to ensure suitable placement.

C. Results

- Against an ROI target of 6:1, Chango delivered results peaking at 11:1

- 42% of all orders came from net new customers

- One third of all sales were from individuals who had searched for a competitor’s brand term

- 20% of sales came from new customers buying wine

- 26% of sales came from new customers buying flowers

- The gap created by the SEO and PPC environment was filled, providing a presence for consumers on strategic terms

D. Driving more efficiency

Smart buyers know that a good campaign should be optimized positively, and negatively, against simple ROI or ROAS (return on ad spend); yet, this often was the hardest point to teach media planners when I was on the agency-side.

What we mean by this is that a campaign should be measured against all its goals, not just the single goal of ROI. You sacrifice some ROI in exchange for achieving a secondary goal that has strategic value.

With this particular campaign, the client was very happy with the ROI we were achieving, a peak of 11:1 return instead of the 6:1 goal. The campaign was analyzed, and it was seen that we could invest more in wine and flower terms, even though they were low performers for ROI – this lowered the ROI initially, but generated thousands of new customers to strategic product ranges.

In addition, the retailer deployed the Exclusion Pixel site-wide, which tells the system not to target any individual who has already visited the site, therefore driving up net new customer percentage, and removing the overlap with an existing site retargeting buy.

Each week, we would supply a list of order IDs associated with the Search Retargeting program, and the client would match them against their CRM system, giving us access to data that helped the optimization further for net new customers.

The Q4 Gold Rush

In a recent eMarketer / Chango study, eMarketer reports that this retailer is typical of others who are turning to Search Retargeting. Nearly all respondents (93.9%) reported that they were using it to acquire new customers, and two thirds (63.6%) were using it to conquest from their direct competitors.

A reason for the latter is that unlike PPC, the targeting of competitor terms is hidden from view; you may see an ad being served for your competitor, but you don’t know which keyword was the trigger. This prevents the bidding war that often breaks out in search.

When coupled with high returns and consistent performance, retailers are realizing that they may have found an early Christmas gift. In the white paper, Retargeting for Retailers Exposed, seven real marketers from brands including Resolution Media and iCrossing speak out on the roles retargeting can play, and also the pitfalls to be wary of.

Happy Q4 conquesting!

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land