Size Does Matter: How, Where & Why People Buy

In my last post, I had discussed how big retailers with thousands of SKUs are faced with difficult performance management questions relating to their SEM campaigns. I had also analyzed transaction data and shown how small and big ticket items convert differently. Finally, I had also suggested management approaches for effective campaign management of these […]

In my last post, I had discussed how big retailers with thousands of SKUs are faced with difficult performance management questions relating to their SEM campaigns. I had also analyzed transaction data and shown how small and big ticket items convert differently. Finally, I had also suggested management approaches for effective campaign management of these items.

In this post, I shall glean insights about purchasing behavior from transaction data. For the analysis, I classified purchases between $1-$300 as small ticket and $300-$1000 as mid ticket items and over $1000 as big ticket items. I then looked at one month worth of data spanning over 50,000 transactions. Several significant trends emerged including:

People Are Price Sensitive… Somewhat

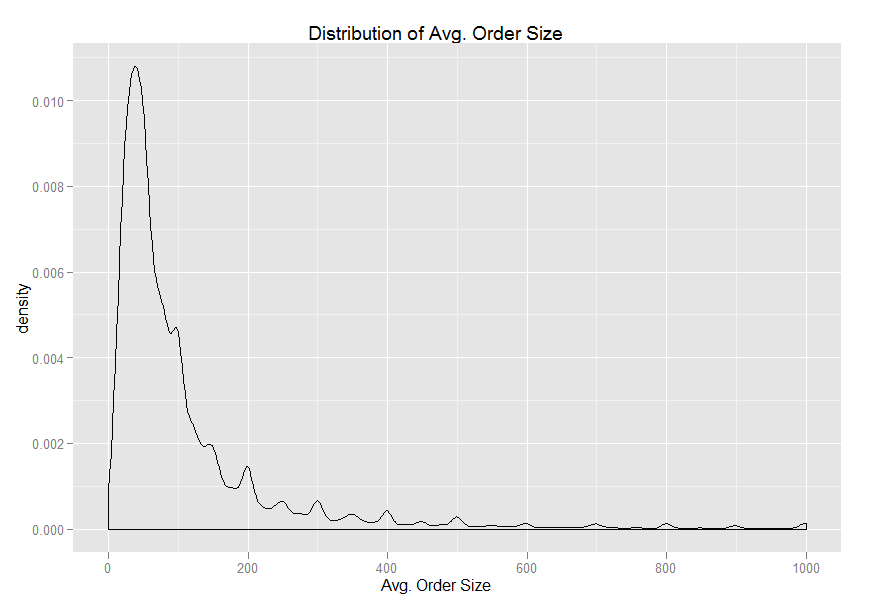

When we calculate the distribution of items by average order size, an interesting pattern emerges. While the biggest peak is around $65, the distribution shows spikes at regular intervals. For small order sizes, the blips occur every $20 or so while for the larger ones they occur every $50.

This interesting effect is due to two possible reasons (1) Items being priced close to certain “threshold” points ($99.99) and (2) Customers having different pricing thresholds in their mind. They might not be inclined to make a $210 purchase but a $195 purchase might be fine with them.

While the true cause is debatable, the decreased price sensitivity with higher order values is clear i.e. the more expensive the item the less sensitive the person is to the price.

What about purchasing time? One surmises that consumers would take a longer time to purchase bigger ticket items. Which brings me to my next insight…

The More Expensive An Item = A Longer Purchase Cycle

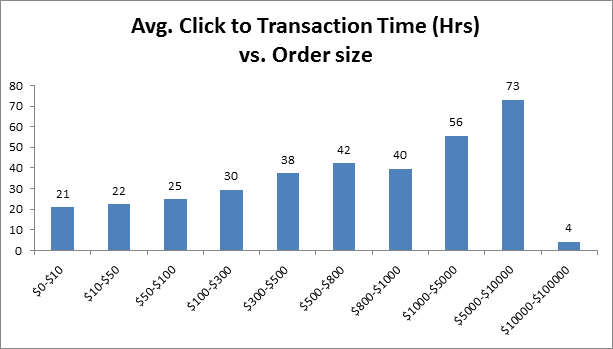

The graph shows that this is indeed true. If you regress the median order value vs average transaction time, you would get a nice relationship between transaction time and order value.

But what about the last bar? It shows that the median transaction time for very big ticket items is only 4 hours; 5 times lower than the very low ticket item transaction times. What is going on there?

The Offline-Online Effect

A deeper investigation revealed that many purchases in this category took less than 10 minutes. Further, while they were few and far between infrequency they contributed substantially to the revenues for the campaign.

Thus, just as discussed last time, big ticket items are a study in outliers. The data also suggests that many of these “quick” transactions happened because of offline activity. Consumers went offline to look at the products in the store and purchased the product online because of an incentive or because of the convenience in the purchase process.

Takeaways For Marketers

The order size distribution curve suggests that consumers like to buy at arbitrary price points for smaller size orders. It also suggests price consciousness for smaller ticket items. Advertisers will be well advised to experiment with price information for smaller ticket items.

As consumers take a longer time to purchase more expensive items, different strategies of SEM bid management should be employed for small and big ticket items. As we discussed last time (albeit from a different point of view), small ticket items should be monitored closely to gain maximum efficiency from the campaigns while keywords related to big ticket items should be monitored with a longer time window.

Further, ad copies for big ticket items should be more upper funnel, inviting the consumer to research the product. However, this should be back with solid content onsite giving all information possible.

We have often heard of online searches converting to offline transactions but for very expensive items the opposite might be true. This is tantalizing as it opens several new questions. Should store reps who engaged with customers for a high value product consider their efforts as lost when consumers leave the store? Perhaps not.

But then retailers could provide CRM tools for their sales reps to connect with their prospects once they leave the store. This would let brands measure this effect. I would love to hear your thoughts on this idea.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land