Will Enhanced Campaigns Drive Mobile CPCs Down?

There are two pieces of conventional wisdom surrounding Google’s Enhanced Campaigns that seem to get tossed around a lot without much thought or examination. The first is that this new campaign model will make it easier for small advertisers to get into the mobile advertising game. The second related piece is that Enhanced Campaigns will […]

The first is that this new campaign model will make it easier for small advertisers to get into the mobile advertising game. The second related piece is that Enhanced Campaigns will likely lead to higher mobile CPCs and that this is one of Google’s primary motivations for changing its model.

I have personally been guilty of echoing both of these sentiments to varying degrees — but as we get closer to the mandatory transition in July, the conventional wisdom seems less convincing. Maybe it is the contrarian in me, but I think there is a decent argument to be made that the move to Enhanced Campaigns will lead to lower mobile CPCs in the near term, but higher overall CPCs.

Will Enhanced Campaigns Really Bring In More Mobile Advertisers?

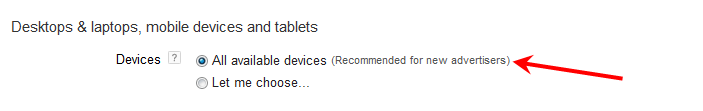

At RKG, we manage large-scale, enterprise-level paid search programs, so we don’t have much direct insight into how the typical mom and pop organization sets up their AdWords program. But, it’s important to note that the default setting for a legacy AdWords campaign is to target all devices, and Google even includes a recommendation that new advertisers keep that setting:

So, it has required some effort to opt out of mobile entirely, and a certain amount of knowledge and motivation to do so. In his article a few months back, Larry Kim noted that only 1 in 25 SMBs were creating separate, mobile-optimized campaigns. That sounds reasonable, but it is not the same as saying only 1 in 25 SMBs are advertising on mobile devices.

The bottom line is that Enhanced Campaigns may simplify bidding segmentation for less sophisticated advertisers, but it doesn’t make it any easier to turn on mobile. To the extent that SMBs have been sophisticated enough to know that smartphone traffic should be segmented, but have been unwilling or unable to do so and simply turned it off, this change will lead to greater mobile adoption.

It’s unclear, though — at least to me — that this comprises a large enough group to have an appreciable impact on the competitive landscape for the larger players in the industry.

Mobile CPCs Are Already Higher Than They Should Be

For all the consternation Google stock watchers express over the size of the smartphone to desktop CPC gap and why it isn’t closing faster, the reality is that mobile CPCs are likely higher than they ought to be for most advertisers.

Most industry reports show smartphone CPCs running somewhere around 50-60% of desktop levels, while tablet CPCs run at 90%-100% of desktop levels. Performance breakdowns on the conversion side are scarcer, but over the last several years, RKG has consistently found average revenue per click (RPC) for smartphones running far below the RPCs of computers and tablets.

In the first quarter of 2013, smartphone RPCs were just 23% of those for computers. If those results are fairly representative of the industry, it suggests that advertisers are placing a pretty hefty premium on smartphone traffic.

While there are a number of rational reasons why advertisers would be willing to accept a lower directly measurable return on ad spend (ROAS) for smartphones — cross-device purchases, offline spillover, and other tracking difficulties, to name a few — do all of these elements really add up to a level that justifies an online ROAS that is roughly a third of that for desktops and tablets?

For many, if not most, the answer is probably no. With mobile generating an ever-growing share of advertisers’ traffic and Enhanced Campaigns forcing all Google advertisers to reassess their mobile strategy, we could see increased scrutiny lead to tighter efficiency targets that ultimately push down smartphone CPCs. How might that play out?

How Lower Smartphone CPCs Could Benefit Advertisers & Google

Let’s consider a fairly simple but hopefully realistic scenario. An advertiser’s goal for their AdWords program is to achieve a measurable ROAS of $5. As long as they can hit that efficiency target, they will keep investing more ad dollars into the program.

With smartphone CPCs at 60% of those for computers and tablets, the advertiser sees smartphones generate 15% of their traffic. Their revenue per click for smartphones is just 25% of that for desktops and tablets, though. Throwing in some specific values, we might get campaign performance stats that look like this:

Overall, the advertiser hits its efficiency target and generates over $3.5K in revenue. But by the definition of this scenario, they are more efficient on the desktop and tablet segment than they need to be and not hitting their target for the smartphone segment.

Our hypothetical advertiser is an online pure-play and believes that the extrinsic, or at least difficult to measure, revenue impacts from smartphones are roughly equal to those for other devices and decides that both segments must hit the same efficiency target. They bid up the desktop and tablet traffic, and pull back significantly on smartphone bids as shown below.

In total, click volume falls a bit, but the advertiser is able to generate more revenue, spends more and pays a higher overall cost-per-click. Seemingly, this would be a win-win for the advertiser and Google.

Okay, in the real world, there are plenty of complicating factors that make it difficult to extrapolate the scenario above to the larger AdWords ecosystem. Not all advertisers share the same goals and metrics for success, or even operate on a rational level. Those differences may also be spread inconsistently across advertisers.

In addition, the changes in traffic levels above are based off of Google’s own Bid Simulator data; but, were all advertisers to make a similar move at the same time, we wouldn’t expect the same result. There are a finite number of desktop and tablet searches and ad inventory; and, if advertisers bid more, that doesn’t change.

We must also consider the effect Google has directly had on influencing mobile click costs and how that might change under the Enhanced Campaigns model.

Smart Pricing

If you Google (or Bing) the phrase “AdWords Mobile Smart Pricing,” you’ll have trouble finding authoritative and accurate information on the subject. There was, however, a point in time when Google’s AdWords help pages offered some detail on how they would adjust CPCs based on device for campaigns targeting all devices.

When I did comparison of mobile and desktop CPCs for RKG a couple of years ago, I found that, all else being equal, mobile CPCs were 41% lower than desktop — not dissimilar to most of the figures you hear today. At the time, I offered speculation on other factors that could have led to the observed results, but I now believe that Google’s smart pricing was far and away the primary driver of that differential.

Why does that matter now? There are reports out there noting that smart pricing will be going away with Enhanced Campaigns, and this could be a big wildcard in how the landscape evolves over the next few months.

Large and sophisticated advertisers should adjust quickly to that new reality, but it will likely take much longer for others to get a handle on what is happening with their AdWords program. During that period, it’s hard not to see Enhanced Campaigns as levying a form of tax on those that aren’t able to accurately assess the value of their traffic from each of the two broad device classes that exist under the new model.

We may never get a precise read on this, but the Enhanced Campaigns transition seems likely to drive mobile CPCs up for some, but down for others.

Google’s Real Incentive For Mobile Search Ads

Rightfully, Google cares more about the revenue they generate than what their average CPC is overall or for smartphones, specifically. If mobile clicks are overpriced, it hurts advertiser efficiency and should lead them to decrease their total investment in search ads. The notion that Google would engineer Enhanced Campaigns the way it did in order to drive up mobile CPCs, without generating additional value to advertisers, doesn’t make much sense in the long term.

Google’s real incentive when it comes to mobile is to help advertisers find and accurately quantify any hidden value it presently holds. Google is uniquely positioned to do this, given the myriad ways it has to identify and track users.

At Google I/O a couple of weeks ago, we heard more about how cross-device tracking will work in Google Analytics. I’d expect to see more of this, and it’s less a question of what Google can do in this area than what they should or will do as they try to strike a balance between addressing the concerns of its users and the wishes of its advertisers.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories