What Yahoo’s Firefox Deal Tells Us About Paid Search In 2015

Has Firefox's switch to Yahoo as the default search engine impacted PPC campaigns? Contributor Mark Ballard from RKG examines the data.

In late November of 2014, Yahoo and Mozilla announced that Yahoo would become the default search option for the Firefox browser in the United States, ending Google’s decade-long run in that position. Those plans went into effect at the beginning of December when Firefox 34 became available for download.

The paid search data since then has given marketers unique insight into the importance of default search status, and the results from Firefox could also serve as a helpful guidepost should a bigger search default upheaval come to pass down the road.

Importantly, the outcome of this type of deal-making and wrangling for search market share isn’t just fodder for the financial analysts trying to predict stock prices — it could have a material impact on the success of our paid search programs.

What The Firefox Data Tells Us So Far

Looking at the share of all U.S. Firefox paid search clicks generated by the new Firefox 34, we can see that although it was available at the beginning of December, Mozilla didn’t really ramp up pushing the upgrade out to existing users until the second week of the month.

Between December 8 and 15, Firefox 34’s share of all U.S. Firefox clicks jumped from about 9% to 67%. Over the second half of the month, that rate edged up much more slowly, and Firefox 34 accounted for about 76% of U.S. Firefox clicks at the end of the year.

With Yahoo being the search default for Firefox 34, we might expect that its share of overall Firefox traffic would follow a similar-looking curve as adoption of the new version took off.

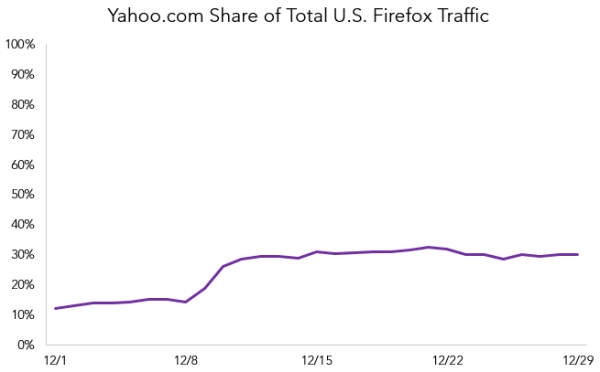

While Yahoo.com has seen its share of U.S. Firefox traffic jump from about 12% at the beginning of December to 30% at the end of the month, that is a far less dramatic rise than the adoption rate of Firefox 34 for a couple of reasons:

- These figures include clicks from AdWords and Bing Ads search partners, which make up about 9% of total Firefox paid search clicks.

- More importantly, Firefox user “switchback” rates to Google as their search default have been high.

Switchback Rates

The big question when Mozilla and Yahoo made their announcement was the extent to which users would simply switch the search default back to Google once Firefox began defaulting to Yahoo.

The data on switchback rates was sparse because there hasn’t been much precedent, but before Firefox 34’s release, my colleague Andy Taylor and I decided to look at cases where Bing has been the default search option to estimate how much Firefox share Yahoo could realistically expect to gain and keep under its new deal with Mozilla.

Using Internet Explorer data as our primary guide and considering a best-case scenario for Yahoo, we put a ceiling on Yahoo.com’s future share of Firefox paid clicks from the big three engines at 43%. After accounting for search partners, that would be a little less than 40% of total paid search clicks from Firefox browsers.

The results that have since come in suggest Yahoo won’t do as well as that intentionally optimistic estimate. Yahoo.com’s share of Firefox 34 paid search clicks peaked at 43% on December 10th as Mozilla ramped up pushing the upgrade out to users; since then, however, there have been gradual but continual losses back to Google, and Yahoo’s share of Firefox 34 clicks now stands at about 36%.

It’s interesting to see that Google’s share of Firefox 34 clicks was stronger in the early days of its availability, but before Mozilla began pushing it out to users en masse. This suggests that users savvy enough to download the new version early were also more likely to switch the search default back to Google. But again, even later adopters appear to be switching back to Google over time.

Does The Search Engine Matter To Advertisers?

Ultimately, the Yahoo-Mozilla deal will end up moving 2% of U.S. paid search clicks, or even less, from Google to Yahoo. On its own, that isn’t likely to be significant to the overall success or day-to-day management of most paid search programs, but the source of our paid search traffic does matter.

In recent editions of our quarterly RKG Digital Marketing Report, we have consistently found that Google AdWords generates about a 50% higher conversion rate than Bing Ads when comparing non-brand ad clicks. This is among programs managing both engines to the same ROI objective, so it’s not a fluke of budget allocation or the like.

A big part of the performance difference, at least for retailers, is due to Google’s heavy use of Product Listing Ads (PLAs), which convert about 40% better than non-brand text ads. While Bing Ads has ramped up the display of its own Product Ads, they still have a lot of ground to make up here.

Looking at the early results from Firefox 34 users, Google ads are performing better than Yahoo ads served by Bing Ads, but the gap isn’t that large. Still, there’s the related question of the engines’ ability to serve quality ads at volume. PLAs tend to produce higher click-through rates than text ads, but advertisers may also need to be concerned that, regardless of format, Google simply does a better job at delivering ad traffic volume.

It’s too soon to make a call (because the data right after Christmas tends to be abnormal as many people are travelling, off work or using a new mobile device), but we have seen a dip in Firefox’s share of total paid search traffic since the beginning of December.

We could very well see this reverse itself soon, but it could also be a reflection of a deadweight loss, of sorts, that advertisers are experiencing just from Google being better at serving ads than its competition.

Longer term though, Firefox’s share of paid search traffic is likely to decline, regardless of who is serving ads, simply as a result of the growth of phone and tablet search. On the flip side of that trend is Apple’s Safari browser.

Apple Safari Default Is The Bigger Jewel For Engines & Concern For Advertisers

Phones and tablets already produce between 40-50% of paid search clicks and Apple’s iOS devices account for about two-thirds of that. Add desktop Safari traffic on top of that and we’re talking about roughly half of total paid search traffic being at stake in 2015 if the Safari search default is really up for grabs across devices, as reports suggest.

Should Yahoo or Bing become the Safari default, and even if Google can achieve the same switchback rates it is seeing on Firefox, it would shift about five times as much traffic as the Firefox deal, and more over time.

Whether Google could actually keep as high a percentage of Safari traffic after losing default status is an important question and I think there are good arguments to be made either way. If Google fares just a little worse than it has with Firefox, we could see as much as 15% of U.S. paid search traffic move from Google to either Bing or Yahoo.

Considering all of this, I have to wonder if Google wasn’t all that upset about losing Firefox since its importance is on the wane and the data from the experience would allow Google to better value any future deals with Apple.

For advertisers though, the primary concerns of a Safari shake-up are again that any shifts in traffic away from Google will result in lower overall volume and lower quality clicks. While advertisers can’t prevent such a shift, they can do their best to anticipate it.

Any programs that have fixed paid search budgets by engine will need to plan to adjust those accordingly or risk hampering the scale of their program. Advertisers that are adhering very closely to ROI targets should already be accounting for performance differences across engines and will need to respond quickly to the landscape that would develop if Google lost default status on Safari.

Finally, it’s important that paid search advertisers understand the impact that search deals can have on other key performance metrics. When eBay moved its mobile search ads from Google to Bing in mid-2014, it shifted a huge amount of ad impressions for many programs, but those impressions had a very low click-through rate (CTR).

Without knowing about the deal, it would have appeared that Google CTR surprisingly shot up, while Bing CTR mysteriously dropped. A lack of knowledge like this can cause unnecessary hand wringing and may lead to wasting resources to solve a problem that doesn’t exist.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land