After Weak Q2 Time May Be Running Out For Yahoo’s Bartz

She was supposed to help turn around the company, but Yahoo’s CEO Carol Bartz may soon be the one in turnaround because of another mixed or mediocre quarter. The search alliance and revenue share with Microsoft was partly blamed for Q2 revenues being down compared the same period last year: Revenue excluding traffic acquisition costs […]

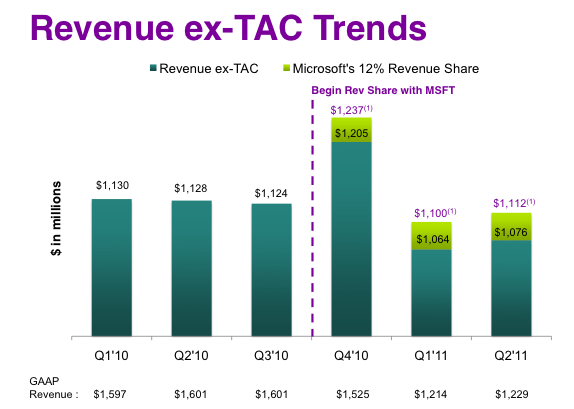

Revenue excluding traffic acquisition costs (“revenue ex-TAC”) was $1,076 million for the second quarter of 2011, a 5 percent decrease from the second quarter of 2010, primarily due to the revenue share related to the Search Agreement with Microsoft . . . GAAP revenue was $1,229 million for the second quarter of 2011, a 23 percent decrease from the second quarter of 2010, primarily due to the required change in revenue presentation related to the Search Agreement and the associated revenue share with Microsoft.

This was the sixth successive quarter in which search revenues had declined. However Bartz cited incremental progress and improvements in search performance, as well as coordination with Microsoft on addressing “technical limitations” or gaps in adCenter that prevent the full monetization of search queries.

Here’s some of what Bartz said about “revenue per search” on the earnings call yesterday:

As we discussed last quarter, RPS is below the expectations we have for the alliance due to technical limitations in Microsoft’s adCenter platform. The alliance has worked aggressively to implement a plan to address these issues. Working together, Microsoft and Yahoo! have uncovered and addressed several platform gaps and inefficiencies in the adCenter marketplace. With a lot of collaborative work and planning, Microsoft systematically launched many new capabilities throughout Q2, including improvements to campaign budgeting features and click prediction models.

These launches are improving the monetization of paid search results and lifting RPS on both Yahoo! O&O and Affiliate sites . . . We’re really pleased with our improvement. Additional initiatives to improve the adCenter platform have been identified, and hence, are scheduled to launch throughout the year . . .

Display advertising, Yahoo’s core strength, was also mixed or soft. Display revenues increased outside the US but were flat in the US market. This was blamed largely on structural and personnel changes in the sales organization, which Bartz now says are stabilizing.

Competitive pressure on Yahoo is increasing, which is not good news for the company’s display business. According to a forecast released last month by eMarketer, Google will challenge Yahoo’s position in US display next year.

Currently Facebook serves more display impressions than any other site in the US market. Facebook will control 19.4 percent of US display revenues to Google’s 12.3 percent and Yahoo’s 12.5 percent in 2012, according to eMarketer.

For the past few years Yahoo has been in what feels like a perpetual transition — in one way or another. Some of this is understandable but board members and investors will ultimately run out of patience, especially when Google earlier in the week posted a $9 billion quarter.

Yahoo has always suffered by comparison to Google’s revenue growth and performance.

Bartz was confronted by unhappy shareholders at Yahoo’s June investor day. And there have been numerous rumors in the past several months that a new CEO search was being considered by the board. It seems increasingly clear that Bartz needs a solid win relatively soon — Yahoo is supposedly in talks, among others, to buy Hulu — to salvage her position.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land