Anticipating What Products Will Drive Your Holiday Paid Search Sales

With products changing from year to year, how can you predict which items will be hot sellers this holiday season? Contributor Mark Ballard offers some advice.

Thanksgiving is right around the corner, and paid search advertisers have just a few precious weeks to strategize before the holiday shopping season kicks into full gear.

One common piece of advice you’ll see during this time is for advertisers to review historical holiday performance to guide their bidding and other ad optimizations. However, with so much of a retailer’s merchandise assortment turning over from one year to the next, how deep do we need to dig to predict what will sell well this holiday season?

How Much Item Turnover Is There From Year-To-Year?

Paid search would be a lot simpler for advertisers in the retail space if product collections could remain static over time. We would have a wealth of historical performance data; there would be fewer keyword build-outs and less ad copy creation. We wouldn’t have to worry as much about setting initial bids for product-specific keywords or about optimizing our feeds and PLA targeting settings.

But, the individual items we market have a shelf life. They become obsolete, get replaced with newer models, and fall out of style or favor — or, the manufacturer may simply decide to stop producing the item.

Ultimately, a retailer’s product offering often changes dramatically from one year to the next. This can make it difficult to predict exactly which items will drive the bulk of our critical holiday sales.

Our research team at RKG recently looked at some data around this issue and found that for the average retailer, 51% of 2013 paid search holiday sales came from items that didn’t generate any sales during the 2012 holiday season. For apparel retailers, the rate is often much higher.

(Note that we’ve defined the “holiday season” as the 30 day period beginning with Thanksgiving.)

Are More Recent Results More Predictive?

If we expect that over half of our holiday sales will come from products that didn’t exist — or in some cases, just didn’t sell — last year, then we might try looking at more recent history to get a better idea of which items might be hot this season.

Using the month of October as a “pre-holiday” comparison, we found that 32% of 2013 holiday sales were produced by items that produced no sales from paid search during the pre-holiday period. Though that’s a smaller contribution from new items, that still might sound like an alarmingly high rate to try to plan for in 2014.

Why Isn’t The Early Q4 Item Mix More In Line With The Holiday Season?

While some retailers introduce new items in early November and even later in the year, that’s only one contributing factor to why early Q4 results may not be a great predictor of what will sell best during the holiday season.

In the last holiday-themed article I wrote for Search Engine Land, I pointed out how the average order value (AOV) retailers produce tends to fall pretty sharply beginning shortly after Thanksgiving. At its lowest point, AOV is between 20-30% lower during the holiday shopping season than it is during early Q4.

This result is just one indicator of how consumer shopping behavior changes during the holiday season. Simply put, shoppers spend less on gifts than they do on themselves, and this shifts the share of sales from some items to others, including some that don’t contribute at all during other times of the year.

Common sense and experience also tell us that some items are just a much better gift idea than others. There’s a lot more room for error in buying someone a pair of pants than a sweater.

Another factor that can shift paid search sales among product is that, even though AOV falls during the holidays, revenue per click (RPC) skyrockets, and this impacts which items and product categories can be marketed profitably with paid search.

While we might not ever completely turn off paid search ads for certain products at other times of the year, the bids we can afford for them may effectively shut us out of those auctions.

As RPC increases across the board due to holiday demand, it lengthens the tail of items and product categories that we generate traffic for in paid search, particularly when the competition is not, or cannot be, as aggressive at responding to the changes in consumer behavior.

Handling Low Data Ads & Why It’s Especially Important For The Holidays

The holiday season certainly isn’t the only time of year when we have to account for new items, or items and keywords with little historical conversion data. But, holiday predictions are especially important because of how much performance can change from week to week or even day to day. Also, the stakes are raised by the sheer amount of sales volume that is at play.

For the holidays and other times of the year, it’s critical that our paid search bids for low data keywords and PLAs are informed by the performance of close-cousin ads.

For example, we may not have gotten much traffic on a particular houndstooth scarf that just became available, but we know that scarf keywords tend to perform well for the holidays and that patterned scarves have been selling better than solid colors in the early part of the quarter.

Using those insights is going to work out a lot better than, say, giving your ‘houndstooth scarf’ keyword the same bid as all other low-traffic accessories or even scarves in general. But, maybe we can do even better.

Are there any other pieces of information we can use to determine how hard we’ll want to push this product and its keywords?

Here’s where communication across silos can be invaluable. The head of the paid search team may want to ask: How have offline sales been looking? What does the merchandise team think? How does our offering compare to the potential competition? Is there any buzz on social media? Are we likely to sell this product out anyway?

In 2013, the top 6% of items by sales rank accounted for 50% of holiday sales volume for the average retail paid search program. A little extra effort to identify those top products ahead of time could go a long way.

Item-Level Insights Are More Important Than Ever Because Of PLAs

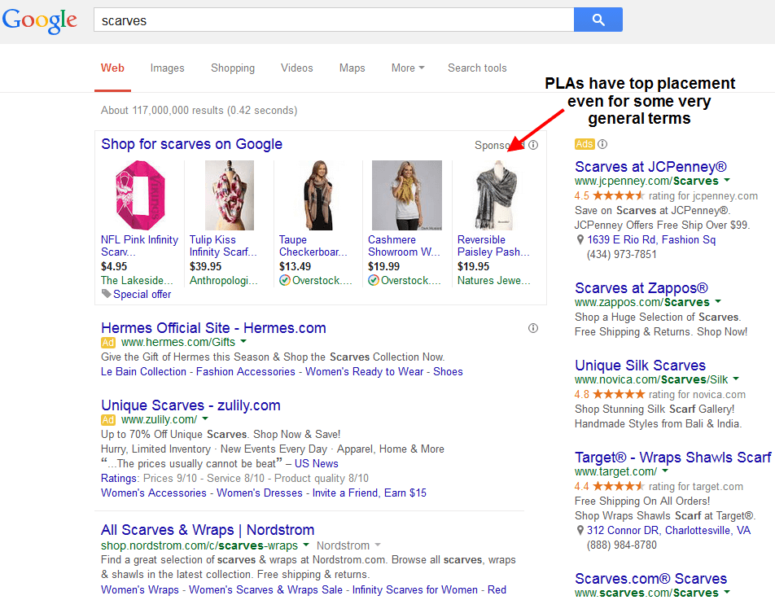

To this point, an unspoken argument of this piece is that item-level insights are just as, if not more important than keyword-level ones. You may have been thinking, “This is all great to know, but 95% of my paid search sales come from keywords that aren’t product-specific. Most people will just search for [scarves], and I’ll land them on a category page with the bestsellers right there at the top.”

Assuming you’ve done your due diligence throughout the year by adding keywords specific to new products as they’ve been introduced and paused keywords that are no longer relevant, you’ll probably be in okay shape on the text ad front if you limit your pre-holiday analysis to making sure you’re pushing keywords that did well last year.

Some product categories may convert a good bit better this year than last, but hopefully your bidding system will catch that fairly quickly and respond, using smart keyword clustering and close cousins to apply appropriate bids on lower traffic keywords.

But, PLAs are product-specific by design, even when the user is searching for something more general, and PLAs now account for about half of non-brand Google paid search traffic for retailers.

When a consumer searches for [scarves], you can’t run a PLA that will show the user your wide assortment of magnificent scarves of many colors and patterns. You can only choose to show one product.

If half or more of your current merchandise offering is new since last year and early Q4 performance isn’t necessarily a great predictor of item demand for the rest of the quarter, anticipating the right products to push in your Google Shopping Campaigns can be a challenge unless you do put in that additional work and ask some of the questions above.

Final Thoughts

With a better understanding of which products are likely to perform best for your paid search program, whether it’s for PLA or text ads, you’ll be ahead of the game going into this holiday season.

As the sales start to come in, it will get a lot easier to see what’s what and adjust from there. Keep an eye on product performance from day to day and even intra-day if you can, and make sure that whatever bidding or other optimization tools you’re using are putting your best products and keywords forward.

Check out more tips on preparing for the holiday season at Marketing Land’s Holiday Retailer section. And keep an eye on trends on the weekly Marketing Land Online Retail Shopping Report.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land