Beyond conventional SEO: Unravelling the mystery of the organic product carousel

New SERP features in the US will soon be rolled out globally and involves the use of inputs and tools that we wouldn’t normally associate with SEO: product feeds through Google’s Merchant Center and Manufacturer Center.

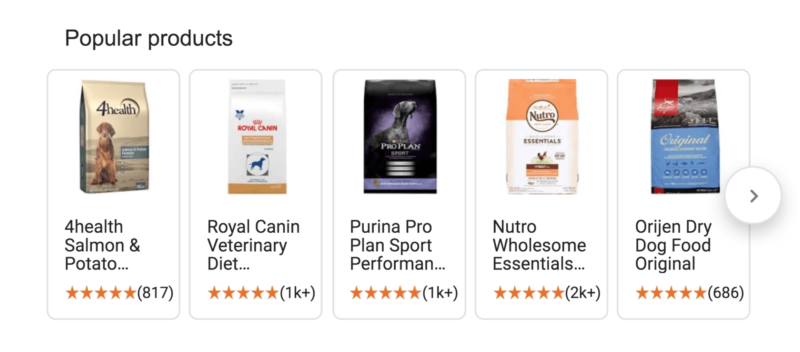

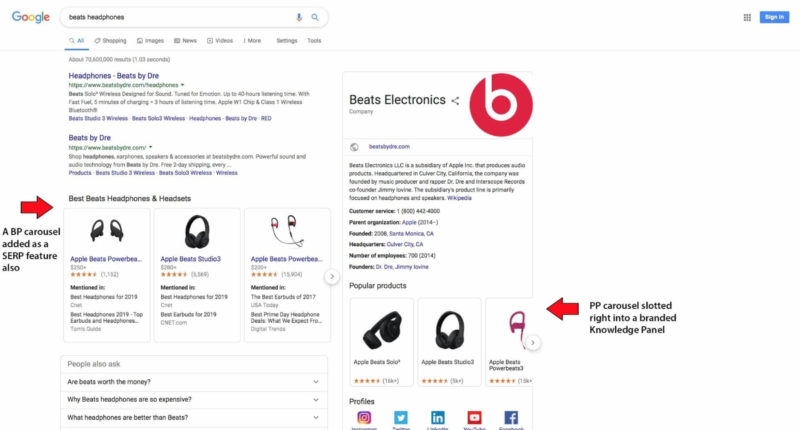

Earlier in the year, Valentin Pletzer found that Google had begun to show a ‘Popular Products’ carousel for a subset of queries in search results.

At the time, many believed that this new carousel was an Ad that Google just hadn’t labelled correctly. But it turns out this feature was in fact an organic result.

On that same day, Google released an article titled: Help customers discover your products on Google. Based on the contents of this article, it wasn’t clear that this was related.

It was only in a Webmaster Central Hangout with John Mueller that I was informed of the connection.

See John’s response to my question at 21:55 here:

The Google article didn’t give any specifics relating to the Popular Products carousel, with the only image referenced being a Product Knowledge Panel.

I was, however, able to locate three new SERP features that operate in a similar way: Popular Products, Best Products

Research based on 250 unique search results, across 20 product segments

As mentioned, this feature is currently only available in the U.S. but is planned to have support in other countries by the end of this year (could be in a couple of months time).

I’m based in Australia, so it’s not something I stumble upon in my day-to-day searches, but I do work with some companies in the U.S. who do have the feature triggered for some important queries that they rank for.

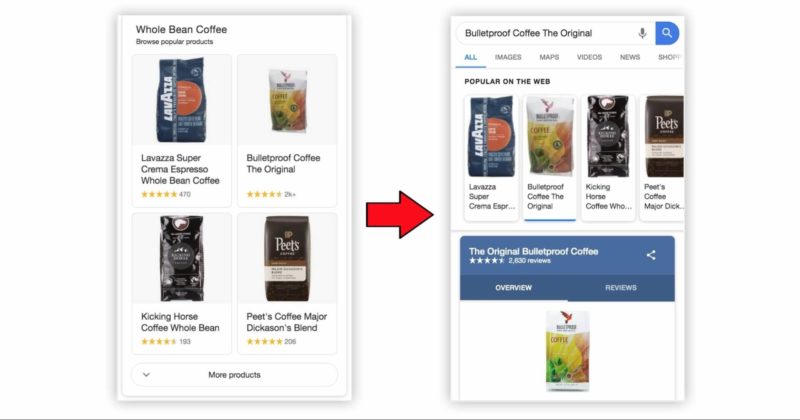

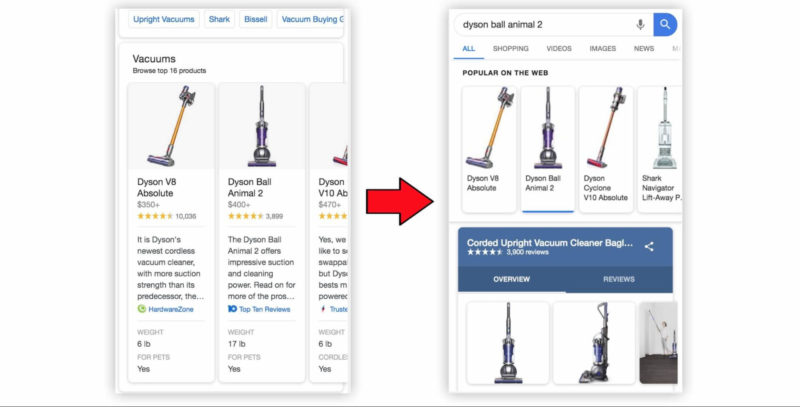

Both the Popular Products and Best Products carousels take up a fair bit of SERP real estate, with placement generally being above-the-fold on desktop. This is also true for the Product Knowledge Panel which is often triggered after a selection has been made from an Organic Product Carousel (OPC).

According to Mobile Marketing Expert, Cindy Krum of MobileMoxie, these carousels are also very visible within mobile search results. She explains:

“This is a new way to rank products and drive conversions without actually ranking entire pages –

per-se . It is especially vexing for SEOs because none of the tools are reporting that the carousel is even there. The only way to know is to do testsearches, because Google doesn’tincluded the OPCs in Search Console, when reporting on clicks, impressions, CTR and average position.The other thing that is interesting, and potentially threatening for SEOs is that these results are linking through to Product Knowledge Panels, before they link to your web page. That means anyone who sells the product can be included in the carousel and potentially put into a price-comparison grid on the Product Knowledge Panel, all before anyone gets to a page where they can convert on your site. An important, new part of eCommerce SEO may be tracking and optimizing these Product Knowledge Panel results, to drive better conversion, since they could now be a gate-keeper. Humorously, the way that they work is somewhat like the old doorway pages that Google fought so hard against years ago.”

– Cindy Krum

By looking at 250 unique search results across 20 product segments in the U.S., I was able to understand the three new SERP features:

1. Popular Products (PP): out of the three different carousels, PP appeared most commonly based on my analysis. They operate in carousels of up to 10 products, with 5 being visible at a time on desktop and four on mobile. The listings include a product image, a title and a review star rating and count.

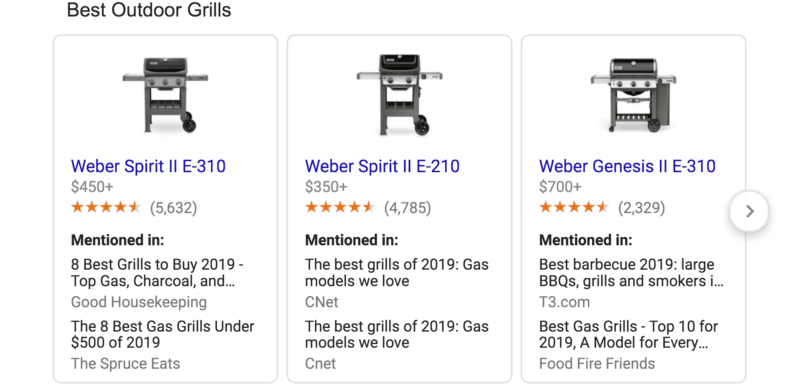

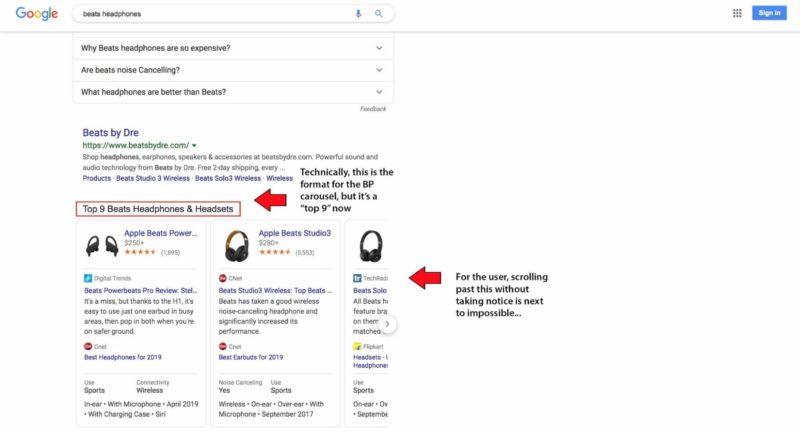

2. Best Products (BP): BP appeared less frequently than PP, but take up considerable SERP real estate when they are triggered. They operate in a carousel of up to 16 products, with three being visible at a time on desktop and 2.5 on mobile. The product listings typically show an image, title

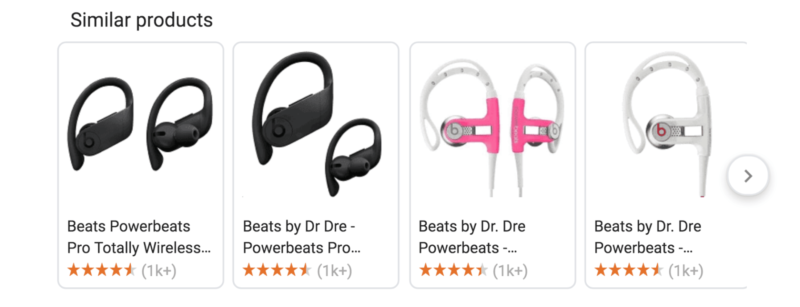

3. Similar Products (SP): SP carousels appear to usually be triggered when the buyer is further down the funnel and is researching a specific brand. This is your opportunity to get your product in front of a customer who thinks they’ve narrowed down their choice to a competitor’s offering (but this can work in the reverse). They tend to have up to six products in a carousel, with four being visible at a time on desktop and 2.5 on mobile. SP generally contain the same details as PP.

How to influence the organic product carousel

In Google’s blog post, they detailed three factors that are key inputs: Structured Data on your website, providing real-time product information via

This section of the article will explore Google’s guidance, along with some commentary of what I’ve noticed based on my own experiences.

1. Make sure your product markup is validated

The key here is to make sure Product Markup with Structured Data on your page adheres to Google’s guidelines and is validated.

You can do this by using the Structured Data Testing Tool, along with the Products Report within Google Search Console. For more information on validating markup see Google’s guidelines along with guides written by industry experts.

The key here is to make sure that Google can access your product information in order to display as snippets in various applications.

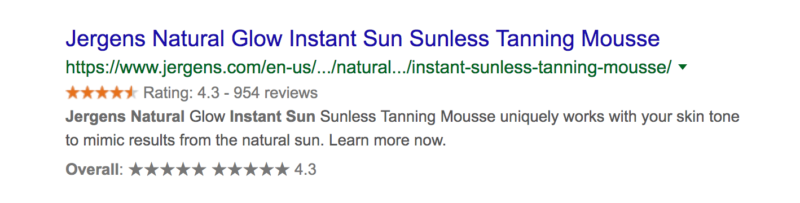

On a related (also unrelated) note, check out this SERP snippet I found while doing research for this article:

Jegens are glowing both on and off the SERPs. With the orange stars you’re seeing standard rich snippets using AggregateRating through schema.org (what this first step relates to).

But the ratings below in black are from tabular data. This sometimes happens when you use <table> on a page. Can’t really control those snippets. Very rare to see both together.

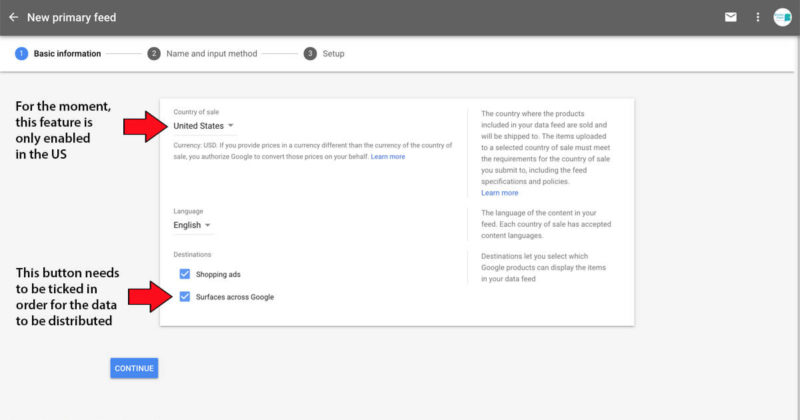

2. Submit your product feed to Google via Merchant Center

This is where it starts to get interesting. By using Google’s Merchant Center, U.S. product feeds are now given the option to submit data via a new destination.

The difference here for Google is that retailers are able to provide more up-to-date information about their products, rather than waiting for Google to crawl your site (what happens in step 1).

Checking the box for “Surfaces across Google” gives you the ability to grant access to your websites product feed, allowing your products to be eligible in areas such as Search and Google Images.

For the purpose of this study we are most interested in Search, with the Organic Product Carousel in mind. “Relevance” of information is the deciding factor of this feature.

Google states that in order for this feature of Search to operate, you are not required to have a Google Ads campaign. Just create an account, then upload a product data feed.

Commentary by PPC Expert Kirk Williams:

“Setting up a feed in Google Merchant Center has become even more simple over time since Google wants to guarantee that they have the right access, and that retailers can get products into ads! You do need to make sure you add all the business information and shipping/tax info at the account level, and then you can set up a feed fairly easily with your dev team, a third party provider like Feedonomics, or with Google Sheets. As I note in my “Beginner’s Guide to Shopping Ads”, be aware that the feed can take up to 72 hours to process, and even longer to begin showing in SERPs. Patience is the key here if just creating a new Merchant Center… and make sure to stay up on those disapprovals as Google prefers a clean GMC account and will apply more aggressive product disapproval filters to accounts with more disapprovals. ”

– Kirk Williams

For a client I’m working with, completing this step resulted in several of their products being added to the top 10 of the PP carousel. 1 of which is in the top 5, being visible when the SERP first loads.

This meant that, in this specific scenario, the product Structured Data that Google was regularly crawling and indexing in the US wasn’t enough on it’s own to be considered for the Organic Product Carousel.

Note: the products that were added to the carousel were already considered “popular” but Google just hadn’t added them in. It is not guaranteed that your products will be added just because this step was completed. it really comes down to the prominence of your product and relevance to the query (same as any other page that ranks).

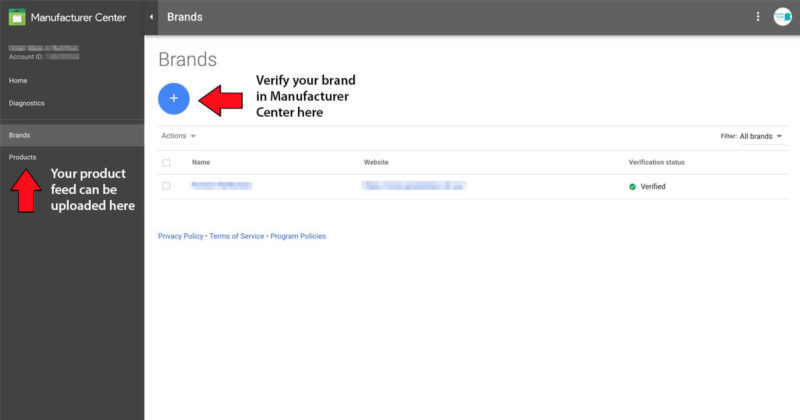

3. Create an additional feed via Manufacturer Center

The next step involves the use of Google’s Manufacturer Center. Again, this tool works in the same way as Merchant Center: you submit a feed, and can add additional information.

This information includes product descriptions, variants, and rich content, such as high-quality images and videos that can show within the Product Knowledge Panel.

You’ll need to first verify your brand name within the Manufacturer Center Dashboard, then you can proceed to uploading your product feed.

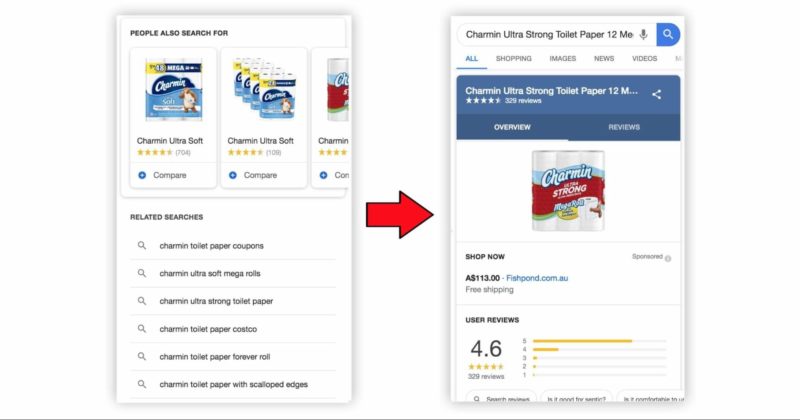

When Google references the “Product Knowledge Panel” in their release, it’s not the same type of Knowledge Panel many in the SEO industry are accustomed.

This Product Knowledge Panel contains very different information compared to your standard KP that is commonly powered by Wikipedia, and appears in various capacities (based on how much data to which it has access).

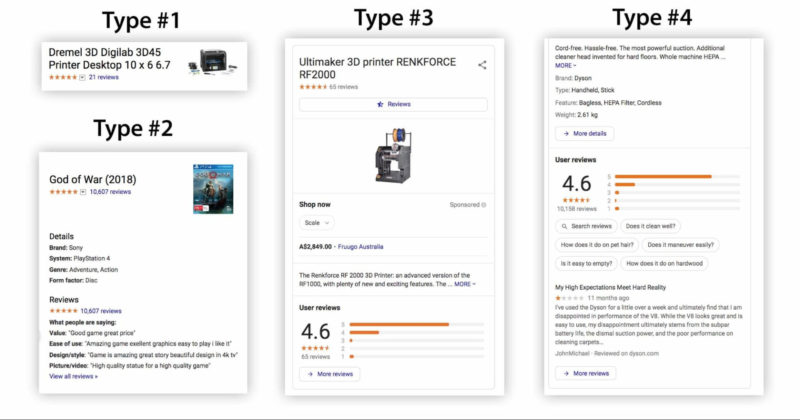

Here’s what this Product Knowledge Panel looks like in its most refined state, completely populated with all information that can be displayed:

Type #1 just shows the product image(s), the title and the review count.

Type #2 is an expansion on Type #1 with further product details, and another link to the reviews.

Type #3 is the more standard looking Knowledge Panel, with the ability to share a link with an icon on the top right. This Product Knowledge Panel has a description and more of a breakdown of reviews, with the average rating. This is the evolved state where I tend to see Ads being placed within.

Type #4 is an expansion of Type #3, with the ability to filter through reviews and search the database with different keywords. This is especially useful functionality when assessing the source of the aggregated reviews.

Based on my testing with a client in the U.S., adding the additional information via Manufacturer Center resulted in a new product getting added to a PP carousel.

This happened two weeks after submitting the feed, so there still could be

Where does Google get the review data from?

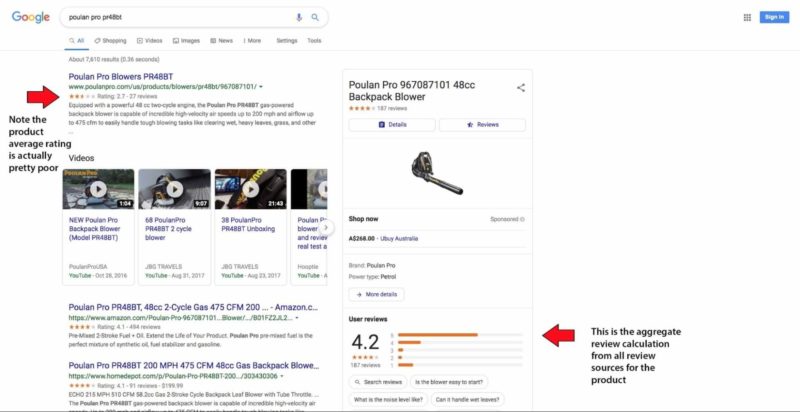

Investigating where the review data that populates the Product Knowledge Panel comes from was one of the bigger mysteries of this study. There were cases where the source was clear, and others where it was not at all.

Out of the 250 results I analyzed, there were 36 results (14%) where I was not able to determine the source of the reviews. This was primarily because there was not an active Product Listing Ad (PLA) for the product.

For instance, clicking the listing from the PP carousel below for “Jack Daniel’s Winter Jack Apple Punch” does not take you to a Product Knowledge Panel:

The next step for investigation is clicking the Shopping tab, making sure your Search Settings are altered to the U.S. as the country (if not located there), then filtering through to see if that product is active.

Based on my experiences, the product will generally be the first result to appear. But it is sometimes pushed down lower to page two or even further, which gets confusing.

If the product is not active, then it becomes far less clear as to where those six product reviews are being taken from. They could be from product schema on your site or from a wholesaler, but if that calculation of “6” does not match up with a single source then it’s anyone’s guess.

It is also interesting to note that the product ratings seem to update in real-time. So the review count for a product listing on the Organic Product Carousel should be the same as the PLA (if active).

This can be especially troubling for a business owner, as they may need to troubleshoot why their review rating is so low or not representative of their products actual popularity based on review count.

The inverse scenario of this is where the review source is clear and result Type #4 is being triggered for the Product Knowledge Panel. You’re able to clearly see where reviews are coming from and troubleshoot accordingly.

In this example, the aggregate review score is actually better than the ratings on the website product page. This retailer has received a higher rating due to the various review sources.

This is where it is important to do your own testing. You may be placed within the Organic Product Carousel with a Product Knowledge Panel being triggered, but this could result in more sales for wholesalers via Ads, rather than your own site (not an ideal SEO scenario).

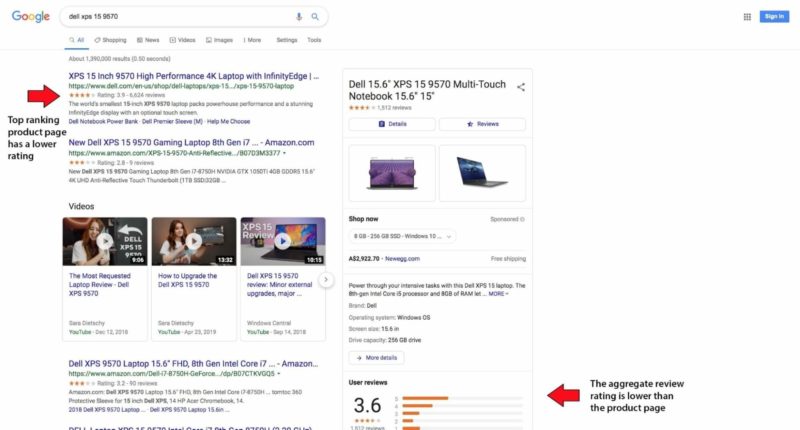

It’s important to be cautious of this SERP feature, as there are a lot of factors that come into play and could easily hurt your brand. Here is an example where the rating has not worked in a retailer’s favour:

This product is clearly low rated in general, but you may want to work towards a fix if you were managing the SEO for Dell.

The above scenario was definitely an outlier based on my research, however. Across the 215 results I analyzed that triggered a Product Knowledge Panel with a review rating, the average for this rating was 4.5.

This is considered to be extremely high. More analysis would be needed to figure out why this was the case (whether relating to review sources, Google taking preference,

Additional third party research relating to the Organic Product Carousel

I reached out to Bill Slawski to check whether there were any Google patents relating to this set of SERP features.

The features reminded Bill of Similar Items Schema for image search on mobile, directing me to this blog article released by Google in April of 2017.

Bill also noted there was a Google patent regarding inventory from the same store submitted by the store owner, but said it appeared to be unrelated.

In terms of other research relating to these features, I came across some highly useful guides developed by Hamlet Batista worth checking out.

Hamlet has written the following articles I would recommend reading:

- Measuring Traffic from Google Shopping’s New Organic Listings

- How to Expedite Product Changes in Google Organic Listings

What does the future hold for this SERP feature?

I believe what we are seeing in the US is just the beginning. Google has rolled this feature out on quite a sizeable spread of product-related queries in the US, but there’s still a lot of room for expansion.

The two organic product carousels to keep an eye on are definitely the Popular Product and Best Product carousels. Both are given considerable visibility in search results for commercial queries on both desktop and mobile.

Something else to consider is how Google has the ability to slot these in the carousel wherever they like. Not only are they visible as a distinct feature in web search like you’re seeing in this article,

This could mean that each of these carousels could be added within other SERP features in the future and not just in standard web search as a distinct result.

And it doesn’t stop there. We will likely see each of the features mentioned in this article evolve to be hybrids of many different data sets from the web.

Here’s an example for the exact same query where a version of the BP carousel is being tested, but it’s now a “top 9.” This

While I’m approaching this feature with caution, I’m still excited by the prospect of having a whole new layer of SEO to work with.

I would invite others to continue the research I’ve presented in this article, and for SEO tool providers to put forward some insights for the community.

If you work in SEO and have never used Merchant Center or Manufacturer Center, then it could be time to get your hands dirty and bookmark those links.

Quick recap:

- Organic Product Carousel features are due to launch globally at the end of 2019.

- Popular Product and Best Product carousels are the features to keep an eye on.

- Make sure your products have valid Structured Data, a submitted product feed through Merchant Center, along with a feed via Manufacturer Center.

- Watch out for cases where your clients brand is given a low review score due to the data sources Google has access to.

- Do your own testing. As Cindy Krum mentioned earlier, there are a lot of click between the Organic Product Carousel listings and your website’s product page.

- Remember: there may be cases where it is not possible to get added to the carousel due to an overarching “prominence” factor. Seek out realistic opportunities.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories