Deliver Transformational SEO Performance With Simple Techniques

I find huge value in big site analysis, as the subtleties of prioritisation can have multi-million dollar impact for a business. This analysis can be informative about approaching a new SEO strategy for any site, and reveal a few truths about the true value of a number of SEO techniques.

Big-site SEO is often an exercise in getting the basics right… on a massive scale. For example, it’s hard to prioritise innovative, new SEO techniques when you discover that a new client has around seven million pages considered duplicate because their Hreflang localisation is incorrect (this is a thing).

Your first job there is to fix that implementation. Your second job there: fix that implementation. Now!

However, despite this apparent lack of opportunity for innovation, I find huge value in big site analysis, as the subtleties of prioritisation can have multi-million dollar impact for a business. The reality is: you have a truly transformational opportunity to effect significant business performance.

Going about this analysis can be informative about approaching a new SEO strategy for any site, and walking through that process can reveal a few truths about the real value of a number of SEO techniques… and some unbiased analytics analyses.

Let’s take a few examples from a deep dive into a recent big site project, and you’ll hopefully see what I mean.

Discover The Pain For Yourself

Due to big businesses having a lot of stakeholders from different departments or countries with a say in online marketing strategy, it often may not be clear to a business what their biggest issue is. That’s true even if you’ve been told what the issue is thought to be.

For example, I recently was asked to take a look at a set of sites used to target four different countries (with a ROW catch-all) globally, with the majority of traffic falling onto one particular platform used across most of the domains.

An additional domain for a sub-set of product had been created on a different platform (Magento, since you ask) because the main platform conversion was “poor” (sub 1% conv) due to ‘fundamental issues’ with the checkout process. The Magento site was achieving c3% conversion rate, I was told.

Whenever I hear a flat conversion rate, I’m skeptical: SEO and PPC brand and generic traffic always convert at quite different rates, so bringing them together as an average doesn’t make sense.

A great brand conversion rate may mask appalling generic traffic conversion, which is what drives new visit growth. Add on to that the different conversions expected for different channels, and you really have to say that comparing ‘average’ conversion rates from a site is not just not useful, but actively damaging to good strategy decisions.

Sure enough, digging into the analytics revealed some interesting outcomes.

First Outcome: Conversion Was (Much) Better Than it Seemed

I only had data from November onwards, for complex reasons, so based my analysis on that (limited) data set. Immediately, some stats leapt out.

Although our average conversion rate on the “poor” platform was indeed c1%, as expected, one particular channel stood out: email. This was converting at roughly twice that rate, suggesting the ‘fundamental issues’ may not be quite so fundamental and more to do with poor landing pages or product pricing (email typically represents appropriate landing pages and a value deal delivered to a targeted, pre-qualified audience).

Also, user on-site behaviour was strong for paid and organic search traffic, suggesting that the site may not be as bad at engaging or converting as first stated.

Indeed, brand conversion behaviour was as expected looking at an equivalent time slice of this traffic type on a different domain (different target country and currency but, crucially, same platform).

Even generic slices showed strong conversion on this domain: averaging… 3.5% conversion across organic. So, in fact, better than the Magento platform. Hmm!

At this stage, investigating further really requires context (pricing changes, offline pushes, etc.) to get a more accurate picture, but just in case there was a smoking gun for those poor average conversion rates, I checked out two other common issues.

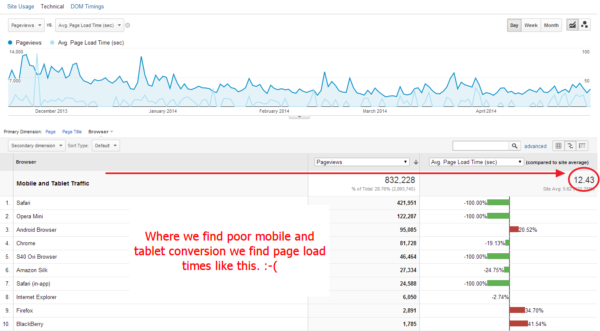

First up? Alternative device conversion behaviour. Returning to the c1% avg conversion site and segmenting out mobile and tablet traffic showed performance was indeed being pulled down for these devices: organic delivering a very poor 0.59% conversion rate, with a mere 0.66% of all revenue from that site generated from these platforms: this is very poor, especially after the triumph of mobile for retailers last Christmas.

Quite likely this is due to poor site speed performance for mobile and tablet… and so it proved to be.

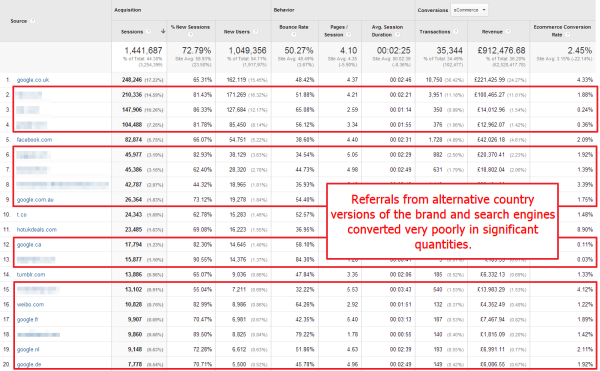

Next up: incorrectly landed international visitors. Two avenues for this: partly geolocated search traffic, and partly referrer traffic from alternative domains intended for other countries. Both proved fruitful for analysis.

The US site delivered fairly standard results, with c79% traffic from the target country (the US). That’s only slightly under average for a prominent brand domain with an existing multinational strategy and multinational domains.

Switching to the UK site, however, and we can see that failed localisation is having a severe effect on conversion. Only c53% of all visits, or c65% of search visits were from the UK; the rest were landing from outside the UK, even when a “localised” domain existed to serve the country.

Conversion for the target searcher traffic in the UK was a respectable 5.61%. Not so bad for a high volume retailer in the end (though I appreciate that this includes brand searches in the mix!).

Looking into referrer data, we can see a big chunk of additional traffic is basically traffic from the wrong country versions of search engines, and brand domains which themselves are intended for different countries but are performing in the UK due to poor localisation.

Doing some back-of-the-fag-packet calculations shows we’re missing out on minimum six figure sums just from incorrect localisation impact on conversion. Factor in improved overall traffic from correct localisation, and you have a hefty smoking gun for the platform’s poor performance that has little to do with any ‘fundamental issues.’

We can also say with confidence, that our platform can quite happily deliver 5.61% conversion where it’s needed: underneath high %age new visitor sessions.

Second Outcome: Shopping Was A Hero Channel, But Failing Frequently

Generally speaking, Google Shopping traffic converted at twice the rate of the equivalent organic traffic, roughly 7.14%. Excellent.

Sadly, this conversion rate was the mean for a distribution graph with a lot of conversion failures. The cause: errors in the feed URLs causing visitors to land on blank landing pages.

So, not only are we losing an easy sale, we’re spending money for the privilege. By building out triggered reports in GA for +60% bounce Google Shopping landing pages, I isolated all instances of this error for investigation.

Since we can’t currently control where budget for the feed goes, we need a technical solution here ASAP to switch back on significant lost sales.

Deep Dive Summary

So, quite quickly we’ve established that the ‘poor’ platform is, in fact, perfectly serviceable to convert traffic; but, issues are caused by the following issues since tracking start:

- Failed hreflang localisation

- Google Shopping feed errors,

- Misinterpretation of conversion rates (i.e., segment by channel and filter brand where relevant)

- Poor SEO performance (there were masses of duplication issues in addition to failed hreflang ‘duplication’)

Building feeds for shopping and hreflang localisation can be done independently of the site platforms in this instance (thanks to some heavy-duty scraping tools we’ve built at QueryClick). It’s a quick fix while we work with the platform developers to get a dynamic solution in place.

A quick investigation of the underlying SEO issues threw up a massive content issue:

- Brand-only titles

- No meta info

- No unique content for category level pages

- Single line descriptions for product pages where products are also available via better-performing affiliate sites that are gaining the credit for the copy as a result

So, a content refresh plan against top performing/highest margin categories and products is scheduled and revisited monthly.

Canonicalisation issues also come into play for our declining organic, after a quick skim through Webmaster Tools identifies multiple causes of duplication:

- Multiple product URLs for different clothing sizes

- Different URLs for different categories for identical products

- Tracking parametered URLs indexed

- Removed product ranges remaining and returning 200 headers

We define rules to ensure a correct canonical map is adhered to by the system when executing via templates to allow all of these functionality elements (good for users and conversion analysis) to remain live.

If you’d like an idea of how to perform this bit of analysis, I can help you out over here.

Looking at opportunity gaps via Google Impression Vs. Click report analysis fills the final ‘big impact SEO’ slot for this set of sites, and we have an actionable plan which will almost certainly deliver +7 figure revere returns in short order.

Nothing in this action list is particularly cutting edge, but the robust implementation of the most appropriate pain-point solutions will deliver performance that will outshine any black-hat or ‘envelope pushing’ SEO technique.

And it all started with an analytics deep dive and an open mind about where our issues may lie.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land