5 Areas That Demonstrate The Growing Potential Of Local Search

As those of you who read my column know, I believe strongly in the potential of an integrated, multi-platform approach to local search, and the importance of educating small businesses about the various advertising opportunities available to them. Small businesses today often struggle with the idea that local advertising can no longer be executed using […]

As those of you who read my column know, I believe strongly in the potential of an integrated, multi-platform approach to local search, and the importance of educating small businesses about the various advertising opportunities available to them.

Small businesses today often struggle with the idea that local advertising can no longer be executed using a small number of platforms. In the past, print Yellow Pages, newspapers, direct mail and possibly television were the key driving forces in attracting consumers and getting them in the door.

Today, these platforms – in addition to new tools including search engines, local sites, mobile apps, daily deal sites, and others – are all becoming as equally valuable. Our industry is often challenged to convince small businesses that this transformation is real and to demonstrate the individual and collective performance of both old and new local search tools.

A new national survey sponsored by YP and conducted by immr and Street Fight, entitled “How Consumers Are Using Local Search,” provides powerful insight into this topic. The survey asked 1,100 respondents questions about how they search and what they search for across 11 business categories. The survey responses both enhance our understanding of local search behavior and confirm our conviction that small businesses benefit from implementing dynamic and comprehensive local advertising strategies.

In today’s column, I will share my five key takeaways from this study and how I believe these concepts should influence small business advertising decisions moving forward.

1. More Devices = Greater Local Search Volume

There’s a false perception among many small business owners that in today’s changing media environment, consumers are rapidly replacing old habits with new ones: the traditional print Yellow Pages user who starts searching online or via mobile for local information stops using the phone book completely, the online user who buys a tablet stops relying as heavily on his or her PC, etc.

As such, small businesses have a tendency to want to completely replace the platforms they advertise on with new ones instead of extending and shifting resources gradually to correspond with changing habits.

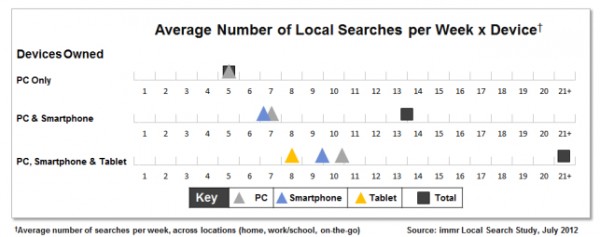

The YP study discloses an interesting finding that debunks common perception on this topic. As the above chart shows, the more devices a consumer owns, the more likely they are to conduct local searches on each individual device as well as in total.

The study found that consumers with PCs, smartphones and tablets do more than 21 local searches per week, or an average of three searchers a day. This compares to 13.5 local searches per week for consumers with PCs and smartphones, and five local searches a week for consumers with PCs only. Therefore, as more consumers purchase smartphones and tablets, we can expect local search queries to increase, both across devices and overall.

2. Mobile & Tablet Searches Increasing Towards PC Levels

The survey looked at how consumers are searching for local information in key categories such as entertainment, restaurants and dining, and the like. At first glance, we see how strong local search performance is across all surveyed business categories.

The chart below shows both the percentage of consumers making purchases within each category and, of those, the percentage who did a local search in each category in the last year. Interestingly, local search is prevalent in frequently purchased categories, such as entertainment, as well as in less-frequently purchased categories, such as transportation and professional services.

For example, while only 41% of consumers purchased transportation in the last year, 80% of those had done a local search for transportation. That’s a pretty significant figure.

What’s even more striking is the number of consumers who conducted mobile and tablet local searches. In some categories, such as entertainment, restaurants, and transportation, the percentage of consumers who searched for local information on PCs and those who searched via mobile were extremely close or even on par with one another.

Searches via tablets – which have only been available for a few years – are already being made by 20%-40% of those making purchases in each category. It’s clear that no matter what the business category, small businesses need to invest in advertising that reaches consumers across the growing number of digital platforms.

3. Local Searchers Require More Complete Content

As local search continues to soar and more options are available in the marketplace, consumers are increasingly looking for more comprehensive business information. Until recently, local search data comprised primarily of NAP (name, address, and phone number), and sometimes possibly a brief description and hours of operation.

Today, a much wider array of information is available. This includes basic information, more personalized information (directions to the business from a user’s location), and dynamic information that changes regularly, including product availability, prices, deals, and more.

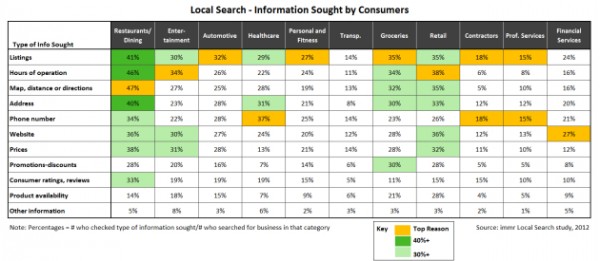

The survey asked consumers to indicate the reasons why they search for local businesses in different categories. While listings and other basic information are among the most frequent responses, other reasons are becoming increasingly important.

For example, 38% of those surveyed said that prices are a factor when they search for restaurant information, just a few percentage points less than the 41% of those who said looking up the actual restaurant listing itself is a reason they search. In the groceries category, 30% of respondents said that promotions and discounts were a reason they conduct a local search, on par with the percentage who said they’ve conducted a search for a grocery store’s address.

As we can see can, consumers are looking for an increasing amount of information across various business categories. Small businesses of all types need to ensure that comprehensive information about their business is available in order to be considered by today’s local searcher.

4. “Local” Is Not Clearly Defined

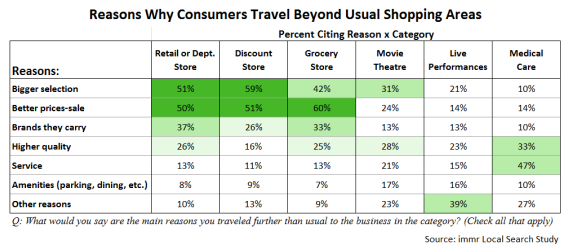

The YP study shows that the definition of local changes based on a variety of factors, ranging from personal preference to business category. Often, consumers are less likely to travel far for basic and regular services, but more willing to venture longer for services they don’t use often.

However, there are various reasons why consumers might decide to travel further than usual for local products and services. In those cases, the definition of local is stretched beyond traditional boundaries.

As the above chart indicates, businesses offering a wider selection, better prices, more brands, and higher quality can incentivize consumers to traveler further.

With that in mind, small businesses should not allow themselves to feel tied to a specific local area. Instead, they should test varying boundaries to see if aspects of their business are notable enough to drive customer traffic outside their area. Each business category and individual business will realize different results.

5. Tap The “Avid” Local Search User

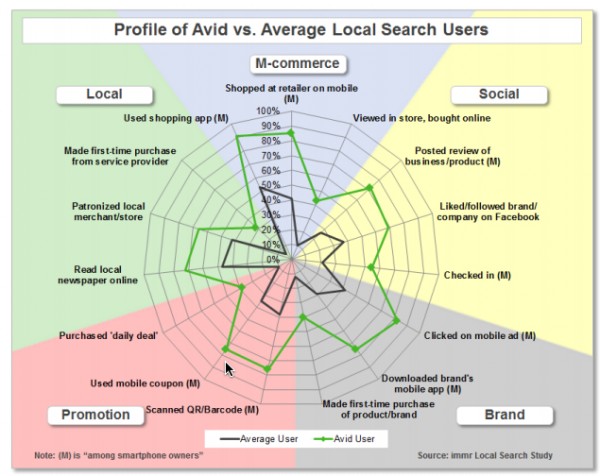

The YP study indicates that a large share of consumers use local search on a regular basis. But the study also found that a specific population subset, labeled avid local search users, use local search tools much more extensively than average users. These users use local search daily on average and across a range of business categories.

While avid local search users represented only 24% of those surveyed, they accounted for more than half of all local search activity. These users, who are more likely to own smartphones and tablets and use them for local search, could be seen as early adopters and representative of what’s to come in the local search space.

As the above chart of activities over the past 30 days shows, avid local search users are almost evenly split between men and women. They are often younger, employed full-time, and college graduates. Their income is also usually higher.

Avid local search users are more likely to engage in a variety of local activities, including patronizing local stores or shopping using a local app than average users. They are also more likely to check in to a store, purchase a daily deal, scan a QR code, download a mobile app, and click on a mobile ad.

Avid users represent a significant share of today’s local search activity presaging the types of consumer behaviors we can increasingly expect from current average users in the months and years to come. All small businesses should keep a close eye on the changing face of local search to ensure that they can adequately attract new and existing customers.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories