Half Full Or Empty?: Yahoo Q3 Profits Up, But Revenue Flat

Yesterday afternoon Yahoo released Q3 earnings. The company reported higher-than-expected income on basically flat revenues (2 percent growth YoY). The following two charts from the earnings slides show that revenues are not growing (except in Asia) but CEO Carol Bartz & Co have done a good job of helping the company generate more income from […]

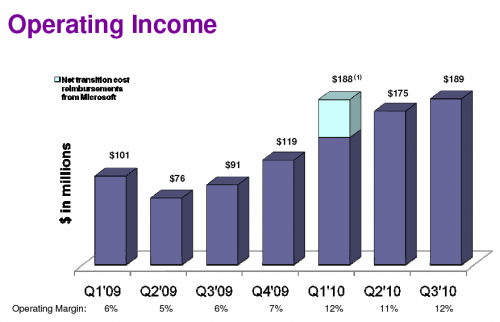

Yesterday afternoon Yahoo released Q3 earnings. The company reported higher-than-expected income on basically flat revenues (2 percent growth YoY). The following two charts from the earnings slides show that revenues are not growing (except in Asia) but CEO Carol Bartz & Co have done a good job of helping the company generate more income from existing revenues.

Like the slides above there’s a “half empty” and “half full” version of the Yahoo results and accompanying narrative.

The half full version argues that Bartz and her team are executing on their plan, increasing efficiencies and bringing down costs. And there is some growth. According to Yahoo CFO Tim Morse’s presentation on the earnings call:

Highlights of our third quarter performance include 17% O&O display growth, 107% operating income growth and meaningful progress transforming our search business. Let’s begin with an overview of headline revenue, core profitability, and EPS metrics.

Revenue grew 2% year-over-year to $1.601 billion in the third quarter. The difference versus midpoint of our guidance was driven by the divestiture of HotJobs, which was completed in late August, and our algo search transition to Microsoft, which I’ll touch on more in a moment.

Operating income was $189 million more than doubling prior year for the second straight quarter and above the midpoint of our guidance. Excluding restructuring charges from both years, operating income improved 80% versus third quarter 2009.

GAAP operating margins were 12% for third quarter, again more than double last year’s rate on a reported basis and up more than 500 basis points excluding restructuring.

As mentioned, there’s also a good deal of strength for Yahoo in Asia. However Yahoo’s search business is basically flat. According to Morse:

O&O search revenue was $331 million, a decline of 7% versus the prior year, but notably flat sequentially . . .This quarter we saw half of our search categories rise, and half decline with particular strength in auto and retail largely offset by softer results in entertainment and finance.

Operationally, search query volume was flat both year-over-year and quarter-over-quarter, and RPS was up roughly 1% versus both comparisons. That’s the first year-over-year RPS growth we’ve seen since third quarter 2008, an encouraging sign of stabilization. While the RPS trend is improving, it did fall roughly $10 million shy of expectations this quarter, the reasons related to our transition to Microsoft’s algo platform.

Specifically, as users experience fresher and more relevant results on Yahoo! search pages powered by Microsoft, they clicked more on the organic results and less on the paid results lowering RPS. This accounted for the majority of the revenue difference relative to our expectations.

We also noted a search page view decline as users found what they needed faster, and therefore clicked through to the next page of search results less often, lowering volume.

Despite the unfavorable revenue impact in the third quarter, the user experience is clearly better, and we’re confident that will lead to longer term volume and market share improvements.

The company said that the paid search transition to Microsoft’s platform should be complete in the US and Canada by the end of the month.

Now for a summary of the familiar half empty version:

- There’s no meaningful growth going on in the topline and competitors (read Google, Facebook) are encroaching on Yahoo’s bread and butter business: display.

- Yahoo continues to reorg and/or lose good people

- An overall vision remains lacking

Here’s how Bartz described Yahoo in her earnings call remarks: “Yahoo! is an innovative technology company that operates the largest digital media, content, and communications business in the world.”

While Yahoo remains a global brand and business with 600 million users around the world it’s hard to see, given its current trajectory, where future growth will come from. And right now a cost-cutting story just isn’t that sexy to the market — especially with massive revenues coming out of competitors and adjacent companies.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land