How to navigate Amazon’s sponsored brand ads updates

How have Amazon's changes to sponsored brand ads affected performance, and how should marketers adjust their strategies? Read on to find out.

Amazon recently announced several updates to Sponsored Brand Ads (formerly Headline Search Ads) including additional placements on desktop and mobile, expanded bidding capabilities, and enhanced reporting insights.

Amazon’s intentions for these updates were simple — to increase reach, efficiency, and overall performance of an already lucrative, albeit highly competitive, ad type.

In theory, that should be a huge win for advertisers looking to further scale their Amazon programs by increasing brand awareness and driving incremental sales. However, it may be premature to jump to that conclusion based on our analysis of multiple high-volume retailers leveraging Amazon’s Sponsored Brand Ads.

What has changed?

Let’s start by reviewing each update in greater detail before I dive into my analysis following the Sponsored Brand Ads Updates.

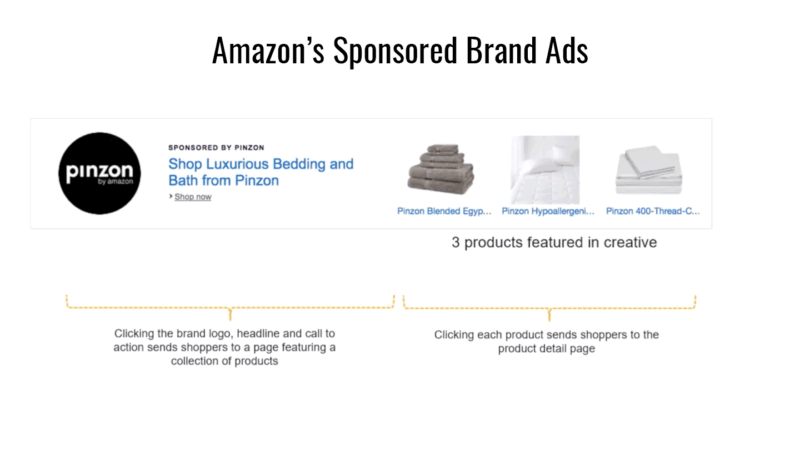

→ New Feature: More Placements for Desktop and Mobile

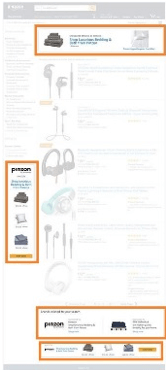

In addition to the placement displayed prominently above-the-fold on Amazon’s search results page, Sponsored Brand Ads can now serve in each of the following locations on the search results page:

- Desktop: left-hand rail – one placement is available.

- Desktop: below-the-fold – four placements are available.

- Mobile: below-the-fold – three placements are available.

- Mobile: every 13th slot– one placement is available.

For reporting purposes, the above-the-fold placement is labeled “top of search” and all other placements are collectively referenced as “other placements.” Note that there is no way to opt out of these additional placements.

The image below will give you a sense of where these placements reside on the page.

Key Takeaways: Adjust budgets and bidding strategy to account for additional traffic. Per my analysis below, we’ve seen a 15% lift in spend following these updates. For advertisers with tight budgets, this may require reductions to daily budgets or a more refined bid strategy depending on your advertising objectives.

[related-posts section_title=”Key Resources” top_post_title=”Get the report: Amazon Advertising Forecast 2019″ top_post_url=”https://downloads.digitalmarketingdepot.com/SEL_1808_2018AmzSur_landingpage.html?utm_source=sel&utm_medium=newspost&utm_campaign=amaz+results” sel_ids=”307064″ ml_ids=”250438,250389,250489″ mtt_ids=”227047,226986″ post_list_limit=”3″]

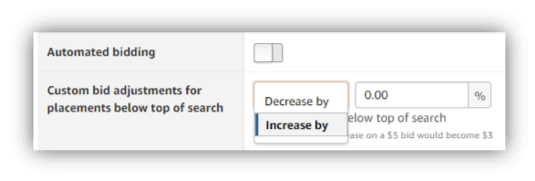

→ New Feature: Expanded Bidding Capabilities

To manage these additional placements more effectively and improve overall efficiency, Amazon has enabled advertisers to choose between one of two bidding settings at the campaign level:

- Automated Bidding: Amazon will automatically adjust bids for other placements based on the percent delta in their expected conversion rates relative to the top of search placement. Automated bidding cannot increase your bids for other placements. This is the default setting; all active Sponsored Brand Ads were opted into this setting automatically.

- Custom Bid Adjustments: Advertisers can increase or decrease bids for other placements by applying a percent modifier. If an advertiser turns off automated bidding and does not set a custom bid adjustment, then the default bid will be evenly applied across all placements.

Key Takeaway: Determine whether automated bidding delivers performance in line with your efficiency goals. Based on what I’ve seen to date, Amazon has effectively implemented automated bidding with average cost-per-click being reduced proportionally to the expected reduction in conversion rate for other placements.

If conversion rate and average cost-per-click differences do not align for your account, then I’d strongly recommend testing manual bid adjustments. Remember that in the absence of an automated solution, this will require regular analyst oversight.

→ New Feature: Enhanced Reporting Insights

In addition to the keyword report, advertisers can now request three new Sponsored Brand Ad reports: keyword placement, campaign, and campaign placement.

Neither the keyword report, nor the campaign report, come with any special bells and whistles — they just provide your standard performance metrics across Sponsored Brand Ad campaigns.

The keyword placement and campaign placement reports, however, provide advertisers a new level of insight by further breaking down performance for “top of search” vs. “other placements.”

Note that Amazon does not currently differentiate performance beyond “other placements” so advertisers do not have visibility into how the left-hand rail is performing relative to below-the-fold placements. Likewise, there is no way to differentiate between mobile and desktop performance.

Key Takeaway: Analyze performance by placement on a regular cadence. If Amazon is still optimizing these new placements and/or automated bidding on the backend, then there may be future implications for performance. Analyzing performance by placement regularly will ensure that you don’t miss any shifts in key metrics.

The impact of these changes

Determine when your account was migrated

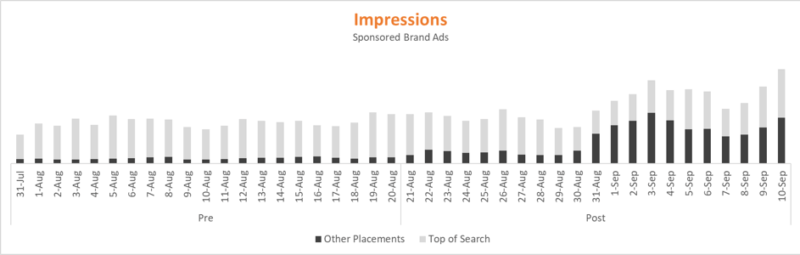

Amazon officially announced several updates to Sponsored Brand Ads on August 21st; however, impression data across several high-volume retailers indicates: (1) that testing occurred well before August 21st, and (2) that additional placements were dialed up slowly through the end of the month. Advertisers may not have seen noticeable changes until September.

Advertisers were migrated over at various times following the announcement, so I would recommend pulling the Campaign Placement report for Sponsored Brand Ads (still referred to as Headline Search Ads in the Advertising Reports UI) by day to determine when your account transitioned and to validate any sudden changes in performance.

New placements significantly increase reach, however, their initial impact on engagement and conversions may leave much to be desired.

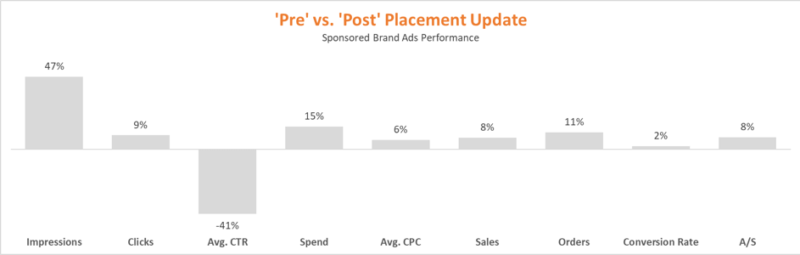

Below is a chart outlining relative performance after Amazon added new placements for Sponsored Brand Ads.

Overall impressions increased 47% following the update; however, clicks did not increase in a meaningful way, which caused the click-through rate to plummet 41%.

This isn’t surprising, given that each of the new placements occurs below the fold in much less prominent locations. We also know that, according to a Millward Brown/Compete study from 2014, 70% of Amazon customers never click past the first page of search results and 64% of total clicks occur on the first three items displayed in Amazon’s search results.

Collectively, these statistics validate why click-through rate has decreased dramatically — most users never see these new ad placements, let alone click on them.

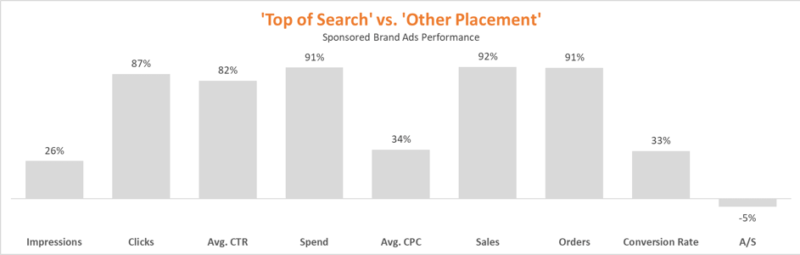

Top of search clearly outperforms other placements across all metrics, which shows just how important it is for advertisers to dominate that space. Most notably, our analysis found that top of search drives 92% more sales and 87% more clicks. Advertisers must, therefore, be prepared to pay a relatively higher cost-per-click to capitalize on these high-converting clicks.

On the flip-side, advertisers should still value other placements and carefully consider their bidding strategy to deliver on efficiency goals. Other placements comprised 8% of total sales within our data set, which confirms that the incremental sales and orders shown above are indeed attributable to the additional placements.

It is also noteworthy that each retailer leveraged the automated bidding feature, which performed exactly as Amazon promised, based on a proportional difference in average cost-per-click and conversion rate.

- Ultimately, the updates’ overall impact on performance will vary by advertiser, given variations in search tactics, keyword coverage, etc., so it’s critical to determine how these updates will impact your account’s performance by leveraging the new features at your disposal and leaning on these three key takeaways discussed in detail above. Adjust budgets and bidding strategies to account for additional traffic.

- Determine whether automated bidding delivers performance in line with efficiency goals.

- Analyze performance by placement on a regular cadence.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land