Keyword Insights: How Office Furniture Vendors Can Target Start-Ups

It’s a great time to start a company. Incubator labs are springing up all over the place, sponsored by venture capitalists and universities. Universities are teaching entrepreneurial skill, and have programs to sponsor student startups. Massive layoffs over the past two years have forced new college graduates, and experienced former employees to strike out on […]

It’s a great time to start a company. Incubator labs are springing up all over the place, sponsored by venture capitalists and universities. Universities are teaching entrepreneurial skill, and have programs to sponsor student startups. Massive layoffs over the past two years have forced new college graduates, and experienced former employees to strike out on their own.

The emergence of social media and mobile platforms are providing thousands of start-up opportunities, and you can see them showcased at “network and launch” events such as the Web Innovators Group and Mass Innovation Nights. Most of these start-ups will start life as virtual companies, but at some point they will have to lease space, and acquire office furniture for their growing company.

Search Behavior Categories

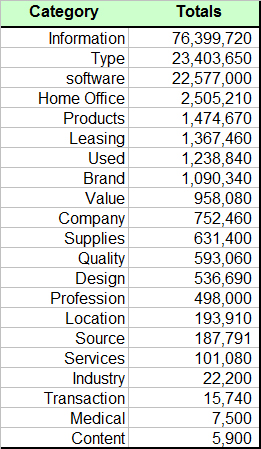

So, how do these companies go about finding a source for office furniture? A thorough examination of the data shows that there are 21 categories of search behavior in the office furniture data set. Understanding what’s going on in these categories is very valuable, because it provides opportunities to develop custom landing pages that mirror user intent.

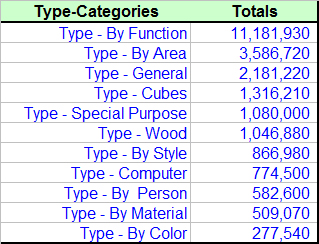

Several of the high-level search behavior categories have numerous sub-categories; the most prominent is the type category, which has 11 sub-categories of search behavior.

The type category with 23 million monthly searches is very prominent, and should be a major focus for information architectural design. The next largest category reflects searches for home-office products and services – coming in at 2.5 million searches a month this is certainly a landing page opportunity.

Noise

There is a lot noise in the office furniture AdWords data. This noise is primarily in the information and software categories. Because the word “office” is somewhat generic, and has multiple meanings, it can be somewhat problematic for search engines. For example, it is widely used by Microsoft to describe its suite of business software, and it’s also a very popular TV program.

The 22 million searches in the software category are almost entirely for Microsoft office products. If you do a search on the term office you will see that both the TV show and Microsoft products dominate the results set, however there are results for an open office design website, and for an office furniture website.

Informational searches account for 76 million queries each month even though there are only 17 keyword phrases in this group. 80% of the traffic is associated with the term office. As noted before, the single-term query office has many meanings, and can be problematic for an office furniture vendor.

Sub-Categories

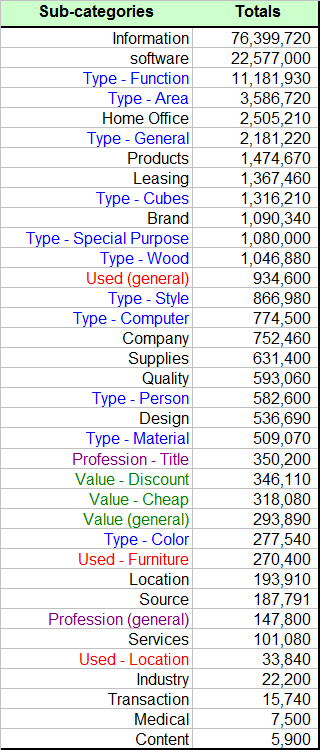

When you review all the sub-categories you see that there are actually 36 distinct categories of behavior, with the type group dominating the list. This list illustrates what behavior is most important when consumers search for office furniture.

Search Behavior Model

The following model reflects category traffic in descending order with Information having the most, and Content having the least. Most of the categories are one dimensional, however there is a lot of complexity in the Type category.

Categories in More Detail

Let’s take a look at each of the high-level categories in more detail.

Information

76,399,720 searches. The informational category is largely noise, but there are a handful queries that are somewhat vague in intent, but probably valuable. For example, you have business furniture and business office furniture, which have enough volume that you can target those phrases in PPC ad campaigns.

Type

23,403,650 searches. Consumers search for furniture by a wide variety of types. For example, they specify the type of furniture they want or the type of wood that it’s made from. They may also search for office furniture by specifying the area it will be used, or by the material that the furniture is manufactured from. The following list details in descending order all the types used by consumers in search.

Now, let’s take a look at each type in more detail.

Type by Function

In this category consumers are specifying a piece of furniture without any secondary attributes. They are simply naming a piece of furniture by function such as office armoire or corner desk. In this category just four pieces of furniture account for 80% of the traffic.

- Desk: 4,832,190

- Chairs: 3,727,240

- Cabinets: 119,500

- Credenza: 117,800

- Bookcase: 23,600

- Tables: 37,300

Type by Area

For whatever reason, there is a fair amount of traffic for dining room, living room and kitchen furniture. My guess is that most of this is probably not valuable traffic, but a certain amount may very well be related to servicing temporary quarters for mobile executives. There are three major clusters in the area sub-category and they are searches for furniture for boardrooms, conference rooms and reception area.

- Reception: 109,800

- Conference: 50,000

- Boardroom: 12,500

Types-General

These are generalized searches for furniture using a wide variety of terms. You have consumers searching for unfinished office furniture or flatpack office furniture. No single term stands out in this category.

Types-Cubicle

With 1.3 million searches in this category, consumers are primarily searching for workstations or cubicles. Workstation is clearly the dominant term. They are also searching in significant numbers for partitions, dividers, panels and screens. This would make a good landing page called: workstation cubicles “your source for partitions and dividers.”

- Workstation: 1,239,300

- Partitions and dividers: 41,210

- Cubical: 35,700

Type by Special Purpose

In this category, consumers are searching for furniture that has special attributes such as adjustable office chairs or armless office chairs. In order of importance consumers are looking for chairs and tables that have the following attributes.

- Folding: 437,900

- Rocking: 301,000

- Stackable: 118,900

- Swivel: 79,400

- Kneeling: 24,100

Type by Species of Wood

50% of the time consumers use either the terms wood or wooden to specify the materials the furniture is made from. When consumers specify a specific wood the three most popular species are oak, pine and rattan. You do see requests for other specialty woods such as mahogany, maple, beech and teak, but these are much smaller numbers.

- Wooden: 551,120

- Oak: 259,600

- Pine: 111,300

- Rattan: 110,000 (not really a wood, but wood-like)

- Cherry: 9,880

Type by Style

When consumers look for a style of furniture, they use a variety of terms to describe what they’re looking for. You see terms like antique, classic, commercial, European, retro and mission. However, the most common style of furniture consumers are interested in is modern furniture, followed by contemporary and modular.

- Modern: 421,490

- Contemporary: 226,700

- Modular: 91,620

- Italian: 75,600

Type by Computer

In this category the keyword phrases are compound queries that couple a computer term with a type of functional furniture. An example of this would be laptop workstation. The top terms in this category include:

- Desk: 379,900

- Laptop: 173,100

- Armoire: 60,500

- Workstation: 51,900

- Chair: 35,500

Type by Person

There are only five search queries in this category, but it accounts for nearly 600,000 searches a month. Here consumers are searching for furniture for their children using the term kid, but they more commonly use the term student.

- Student: 401,100

- Kids: 181,500

Type by Material

Consumers are also interested in furniture manufactured from non-organic materials, and they use terms such as metal, mesh and fabric. The most common non-organic material specified is glass. The most common organic material specified is leather.

- Leather: 351,900

- Glass: 128,700

Type by Color

When consumers search for furniture by color, they overwhelmingly prefer white furniture, followed by black furniture. You do see searches for brown, pink and red furniture but these are fairly small search numbers.

- White: 202,940

- Black: 65,600

Each one of these sub-groupings in the type category provides excellent opportunities for experimenting with micro-sites or custom landing pages.

Software

22,577,000 searches. All this search traffic is useless to an office furniture vendor. The term office does appear in each of the queries in this group so you have to be careful not inadvertently target this traffic in your advertising campaigns.

Home Office

2,505,210 searches. 1.5 million of these searches are for the single two word phrase home office. In this particular case it’s difficult to say what the user’s intent is. They could be looking for furniture, design ideas, or they could be looking for office supplies.

The remaining million queries are clearly about furniture. The most common items consumers are looking for are desk followed by cabinets. There is a good micro-site opportunity in this home office category which is home office design ideas which generates over 75,000 searches each month.

- Desk: 179,080

- Design ideas: 77,720

- Cabinets: 19,380

Products

1,474,670 searches. In the product category consumers are searching for related accessories such as desk organizers, chair cushions, mats and lamps. 600,000 of these queries are somewhat vague in nature where consumers are using the terms office products and office accessories.

- Accessories: 59,200

- Lamps / lighting: 55,200

- Mats: 27,100

Leasing

1,367,460 searches. There are two things going on in this category, consumers are interested in renting office space or renting office furniture. The majority of this traffic is for office space.

Used

1,238,840 searches. There’s quite a bit of traffic for used furniture – business owners are using terms such as surplus office furniture, recycled office furniture or refurbished office furniture. But there are two high-level phrases that dominate this category of search behavior. These are:

- Second hand: 562,720

- Used office furniture: 143,700

Brand

1,090,340 searches. If consumers are specifically searching for your brand then you’ve got it made. The only real insight in this category of behavior is that the consumers will occasionally specify a type of furniture that they are looking for, and this tends to be either a desk or a chair.

Value

958,080 searches. Consumer intent is very focused when they use value-based terms. You see terms such as affordable, inexpensive or on sale in the general category, however the dominant sub-categories are discount and cheap. Cheap furniture and discount furniture are both excellent micro-site opportunities.

- Value using Discount: 346,110

- Value using Cheap: 318,080

- Value (general): 293,890

Company

752,460 searches. In this category consumers are searching for a company without specifying a brand. You see consumers using terms like showroom, suppliers and retailers interchangeably for the term company. The terms used to specify a company are variable, but the following are the most common.

- Outlet: 206,400

- Store: 128,000

- Wholesale: 124,700

- Shops: 126,380

- Manufactures: 83,700

- Companies: 43,300

Clearly the term outlet and store would be the preferred terms for website copy and PPC ads.

Supplies

631,400 searches. These searches are somewhat vague in that they do not specify any particular products. Nonetheless, they are transactional and therefore valuable. The most common two-word phrase in this group is office supplies.

Quality

593,060 searches. Consumers are using a wide variety of terms to describe a quality they are looking for in the furniture they want to purchase. You see them using terms such as comfortable, cool, funky and heavy-duty. The most common terms used to specify a quality include:

- Ergonomics: 393,200

- Fantastic: 74,000

- Small: 38,470

- Custom: 11,320

- Big and tall: 24,700

- Designer: 9,300

In this category, ergonomic furniture would be an excellent micro-site opportunity to experiment with.

Design

536,690 searches. In this category consumers are searching for information and services to help with design, planning and layout for their office. The three most common terms in these queries include:

- Planning: 37,890

- Layout: 31,580

- Ideas: 18,100

Design planning and layout would make a great service-oriented landing page.

Profession

498,000 searches. In this category consumers are searching for furniture by including professional terms. They are searching for furniture for a type of business, such as a doctor’s office. The second way consumers search is by professional title and the most common terms are executive followed by secretary.

Location

193,910 searches. Remarkably, when consumers search by location they do so in just three ways, and it’s always in the same order. Office furniture is the dominant two-word phrase in this category of search behavior, and accounts for close to 90% of search traffic.

- Office furniture [location]

- Office chairs [location]

- Office desk [location]

Source

187,791 searches. These are high-level searches where consumers are looking for a source for furniture. These can be websites, lists or directories. The dominant term here is online.

Services

101,080 searches. Though these searches are about office furniture, they are mostly off-topic if you sell used or new furniture. In this category you see consumers looking for furniture auctions, liquidators and installation services.

Transaction

15,740 searches. Transactional queries are very valuable. In these cases consumers are indicating their intent to transact with just the single term buy, as in buy office furniture.

Medical

7,500 searches. Though there’s not a lot of traffic in this category, it is valuable in that consumers are specifying a medical reason why they need a chair. They use the term lumbar support, back support and bad backs as part of their keyword phrase.

It would make sense to combine this medical category with the ergonomic category and develop a very focused micro-site.

Content

5,900 searches. This entire category is requests for office furniture catalogs and office-supply catalogs.

Term Density

Looking at how often a term appears across all searches in the data set is a very useful exercise. The following lists of 25 terms appear in about 80% of the search traffic. With this critical mass across so few terms, it provides a very focused textual pallet for writing page and ad copy. A second important significance of this list is that it reveals micro-site opportunities.

For example, the third most common two word phrase is open office which appears in 5 million searches every month. The concept of an open office is becoming very popular among start-ups today. I think this concept provides an excellent micro-site opportunity to position specialty furniture for the open office environment.

When examining the terms lower on the list you see three of four opportunities that could be developed into custom landing pages. Modern furniture, ergonomic furniture and design services should be considered.

Key Insights

- The type category is rich with micro-site opportunities. There are 11 sub-categories here that provide the office furniture vendor with plenty of options for developing very focused landing pages.

- Three categories dominate search traffic; these are type, home-office and products. These three should provide architectural focus for website design.

- There are two categories where consumers are searching for value; the used furniture category and the value category. The combination of these two categories account for 2.2 million searches a month. The opportunity here is to position high-quality, but inexpensive furniture as an alternative to purchasing used furniture.

- Each category of behavior has its particular set of terms. Each category also has a dominant term, for example if you look at the type by special purpose category you see consumers searching for tables and chairs that fold. Would a special landing page titled folding furniture be an interesting marketing tool? It would be worthy of an experiment.

- Statistically when a consumer searches for an office furniture company without specifying a brand name, they are using a little over a half a dozen synonyms to describe a company. The dominant synonym is outlet followed by store, wholesale and shops. So, do you have a rule of thumb for what your firm is called? Are you an outlet or would you call yourself a store?

- The quality category is interesting because consumers use a variety of quality-based terms to describe furniture that they’re interested in. This provides the option to develop custom copy for your website that exactly mirrors consumer intent. The dominant term in this category is ergonomics, and this provides the option to develop a focused micro-site.

- Consumers are clearly looking for help with ideas, planning and layout when it comes to designing their new office environment. If you can provide these services as well, you probably have a better chance of selling them furniture.

Parting Advice

Your office furniture company may be national, but most of your business is local. If you have not claimed your company in Google, Yahoo and Bing’s local search services, you should do so. You will not automatically get added to these local search indexes. There are local search requirements for being included. Make sure you understand what they are.

The data used in this analysis were extracted from AdWords.

Need To Know More?

A search behavior model is a data-driven process for classifying user intent for each search query to a specific source, type or subject. It’s a reflection of the total consumer search experience for products and services in any single market segment.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land