Report: Google Losing Share Of Mobile Search Ad Market

Data aggregator and prognosticator eMarketer is out with a new mobile advertising forecast that shows Google losing share of the mobile search ad market. The company says that apps are taking their toll on Google’s mobile ad dominance. The firm says that US mobile advertising in total will be $17.73 billion this year. That would […]

Data aggregator and prognosticator eMarketer is out with a new mobile advertising forecast that shows Google losing share of the mobile search ad market. The company says that apps are taking their toll on Google’s mobile ad dominance.

The firm says that US mobile advertising in total will be $17.73 billion this year. That would mark huge growth over the $7.1 billion recorded in 2013, according to the IAB. Indeed mobile ad revenues would have to more than double, which is possible but an extremely aggressive scenario.

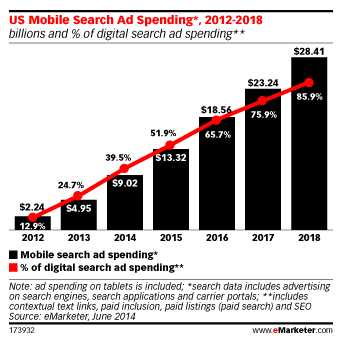

Specifically eMarketer asserts that the US “mobile search” ad market will reach more than $9 billion this year.

Mobile search advertising is defined to include “paid ads served by search engines, search applications and carrier portals to all mobile devices, including smartphones and tablets.” Search applications is further broadly defined to include sites such as Yelp and YP.

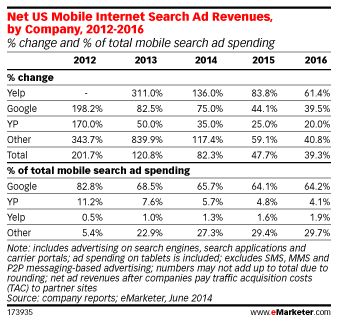

Apps are eating away at Google’s market share as users go directly to content sources rather than turning to a mobile web browser. According to eMarketer, “Google owned 82.8 percent of the $2.24 billion mobile search market in 2012 . . . [dropping to] 68.5 percent in 2013.”

The report calls out Yelp in particular, saying that it has “emerged from the pack” of search apps. YP is also presented as a market leader.

This report will get a lot of play and probably boost Yelp. However it’s important to keep in perspective the fact that Google will continue to have considerably more mobile ad revenue than others. The company controls more than half of all global mobile ad spend (search + display) though it does have a well-documented problem with mobile CPCs.

This report does clearly demonstrate that Google continues to be vulnerable to specialized apps that establish a direct relationship with end users. On the PC, Google remains the “gatekeeper” between users and content publishers. That’s not true in mobile — though Google is working hard to recreate that scenario, especially on Android devices.

Postscript: eMarketer has an expansive definition of mobile advertising. In particular the firm includes the following in its definition of spending categories generating “search revenue”:

- Paid listings – payments made for clicks on text links that appear at the top or side of search results for specific keywords. The more a marketer pays, the higher the position it gets. Marketers only pay when a user clicks on the text link.

- Contextual search – payments made for clicks on text links that appear in an article based on the context of the content, instead of a user-submitted keyword. Payment only occurs when the link is clicked.

- Paid inclusion – payments made to guarantee that a marketer’s URL is indexed by a search engine (i.e. advertiser isn’t paid only for clicks, as in paid listings).

- Site optimization – payments made to optimize a site in order to improve the site’s ranking in search engine results pages (SERPs). (For example, site owner pays a company to tweak the site architecture and code, so that search engine algorithms will better index each page of the site).

The final one, “site optimization,” probably should be excluded from any definition or set of sources of “search revenues,” however.

Postscript 2 (from Danny Sullivan): We’re checking back with eMarketer for more details about what’s happening with the “Other” category that effectively is causing Google’s near doubling of mobile search spend earnings to appear as a loss. Consider this chart:

The top part shows the percent of mobile search ad revenues for the last three years, as estimated by eMarketer. You can see how Google drops from 82.8% to 68.5% — which to some, will also seem like Google has lost revenue.

It has not. The bottom chart shows you the total mobile search ad revenue spend for each year, again as estimated by eMarketer. What I’ve done beyond the total is used eMarketer’s share figures for each year to figure out how much actual revenue each source generated, rather than just a percentage of the total.

Google went from $1.85 billion in 2012 to $3.39 billion in 2013. That’s nearly doubling the revenue, growth of nearly 100%, rather than a drop that the percentage of overall spend might lead some to think.

Google’s growth is downplayed because the overall “pie” of spend got larger. “Other” spend went from 120 million in 2012 to $1.13 BILLION the following year. That’s about $1 billion in mobile search ad spend coming into the space seemingly out of nowhere.

Hopefully, we can get more details about what’s happening in that “Other” space — how it grew so much, so quickly.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land