The Google expanded text ad CTR lift that never was

Contributor Andy Taylor shares his take on Google's expanded text ads (ETAs), drawing comparisons to the new responsive search ad (RSA) format.

In exchange for testing the new format, advertisers can show up to three headlines instead of two, as well as showing two 90-character descriptions instead of one 80-character description. Google recently announced the expansion of RSA formatting to regular text ads.

The jury is still out as to whether RSAs will have a meaningful impact on text ad click-through rates (CTRs), but the dust is more or less settled on the last major text ad update to take the pay-per-click (PPC) world by storm: expanded text ads (ETA).

New paid search blood might think nothing of the two 30-character headlines and 80 character description available through ETAs, but in (puts on spectacles) MY day, we had to make do with one 25-character headline and two 35-character description lines.

Despite ambitious expectations from marketers and Google alike, the results since ETAs became the text ad standard indicate the format hasn’t had quite the effect many predicted it would.

No sign of text ad CTR improvement since ETA deadline

ETAs entered the testing phase in early 2016, and advertisers could choose to load standard (which I’ll refer to as “OGAs” from here on for their status as the original text ad format) or expanded ads through January 31, 2017, at which time only expanded text ads could then be loaded.

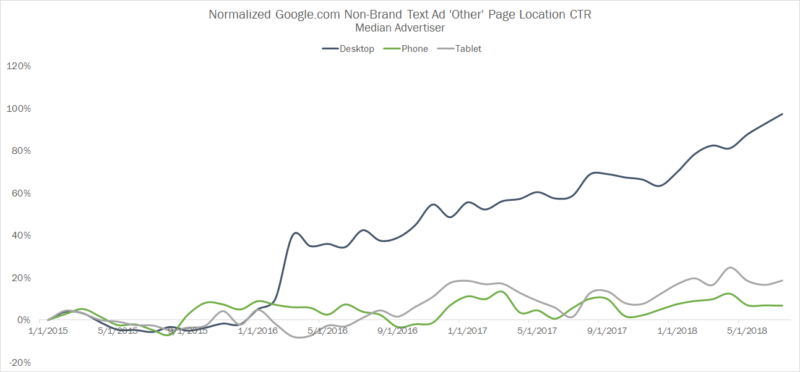

Looking at the CTR of non-brand text ads shown at the top of the page on Google.com (top of page accounted for 76 percent of all non-brand Google.com clicks in July 2017) for a sample of Merkle (my employer) advertisers, it seems that CTR can be pretty variable from month to month. That said, there’s been no consistent, meaningful lift on any device since 2015 to suggest an ETA impact.

There are a few things that should be mentioned about this chart.

First, there are some search engine result page (SERP) changes which directly impact CTR and may have had some role in mitigating any improvements in text ad CTR as a result of ETAs.

For example, you’ll notice a drop in phone text ad CTR in mid-2015, which can most directly be tied to the addition of a third text ad above organic links on phones at that time. While that change doesn’t line up with the timeline of ETA changes, it gives an idea of how CTR can be impacted by shifting ad layout.

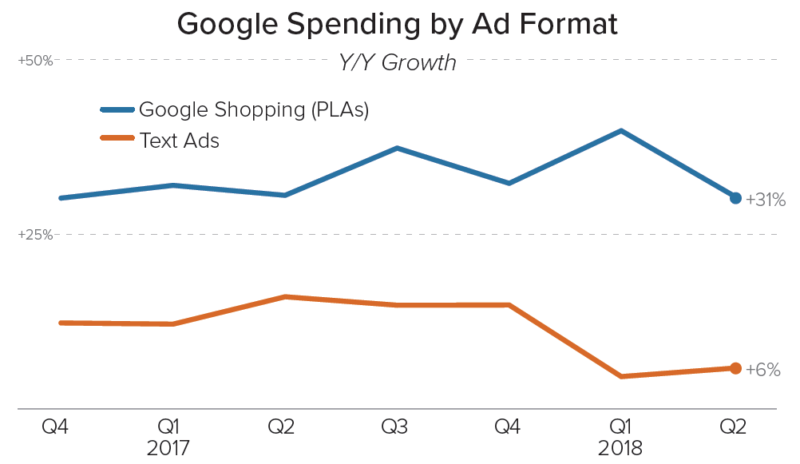

Another such change has been the steady rise of Google Shopping over the past couple of years. At least some of that growth has likely come at the expense of text ads, which are pushed farther down the page in some layouts when shown with Shopping ads and have grown significantly slower than Shopping for some time.

Still, we should have expected some sort of increase in CTR once ETAs became the law of the land if the new format were truly superior at drawing user clicks, but there’s no evidence of such improvement at the top of the page.

Outside of SERP changes, another consideration is that CTR is directly impacted by the advertiser’s average position, which can change over time. This is particularly true with changes in advertiser strategy, such as becoming more or less aggressive with return on ad spend targets.

The advertisers studied are longtime clients that have not significantly changed strategy over the past few years. Figures are based on the median to limit the effects of any short-term shifts for events like holidays and clearance sales for one or two advertisers. No sample is perfect, but there’s at least no obvious reason why the one used here would hide an increase in CTR from ETAs over time.

It’s also the case that every keyword, ad group, and advertiser is different, and there’s no clean way to cover every base when looking at the impact of ETAs.

All that said, the lack of meaningful CTR growth in the 18 months since the ETA deadline aligns with analysis that pointed to little difference between ETAs and OGAs in 2016 when the two were running alongside each other.

ETAs never appeared to meaningfully outperform standard text ads

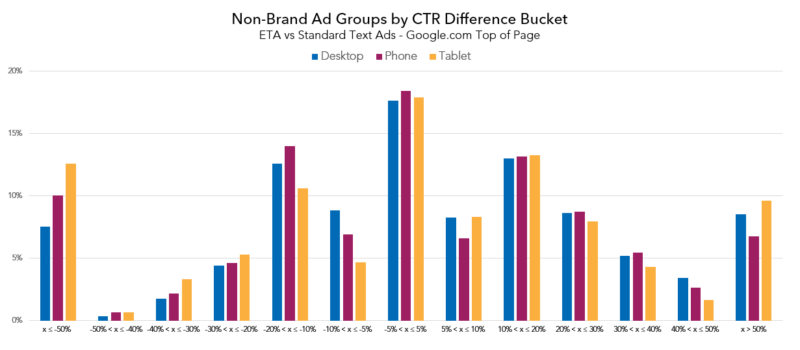

Two years ago, I wrote about comparing the CTR of OGAs to ETAs for ad groups running both formats and for which both formats were getting meaningful impressions. Looking at the median ad group across thousands that qualified, we found little difference in CTR for top-of-page text ads between the two.

Some in the paid search industry have long attributed results that show a minimal difference between ETAs and OGAs as evidence of ineffective ad copywriting. This might be true in some cases, but it is simply not a valid explanation for a seemingly identical performance of OGAs and ETAs across many thousands of ad groups.

If we look at the distribution of top-of-page CTR comparisons for the different ad groups studied, it was a near-textbook example of a normal distribution, centered on ad groups with less than 5 percent difference in CTR between the two formats.

Were there ad groups that saw significantly better top-of-page performance with ETAs than OGAs? Absolutely. But the likelihood this was the case was about the same as the likelihood that an ad group saw a worse performance with ETAs than OGAs.

That was not the case with bottom-of-page non-brand ads, which did see a CTR bump of 7 percent to 9 percent when using ETAs instead of OGAs back in 2016 for the median ad group.

Looking at how CTR for the “Other” page location on Google moved over the last couple of years, there’s been steady, meaningful growth on desktop dating back to March 2016, with more or less flat CTR on phones over time.

March 2016 was the first full month following Google’s decision to sunset text ads on the right rail of desktop search results. This decision reduced the total number of potential text ad impressions on a desktop. The change also meant the “Other” page location in the “Top vs. Other” AdWords column now refers almost entirely to the bottom-of-page text ads, since there are no side text ads.

As you can see, that change instantly drove up CTR on desktop. The strong growth ever since then is a bit harder to explain, but given the steady nature of the trend, it doesn’t seem tied to a one-off event such as the elimination of right-rail ads.

The growth is also isolated to desktop, which would seem to indicate it’s not the implementation of ETAs in and of itself that’s growing CTR over time for ads at the bottom of the page. Taken together with comparisons of OGA and ETA CTR in 2016, it’s believable to think ETAs did provide some positive pressure on the bottom-of-page CTR, but the significant movement on desktop since March 2016 has been caused by other variables as well.

It was only possible to do this analysis for a short time, as ETAs slowly took over and the number of ad groups with meaningful traffic coming from both ETAs and OGAs dwindled. In light of the lack of meaningful improvement in text ad CTR for most combinations of device and page location over the past couple of years, it seems that this analysis still rings true today.

Conclusion

Why didn’t ETAs have as big an overarching impact on CTR as everyone expected? I can’t say for sure, but my hunch is there were already so many ad extensions adding bells and whistles by the time ETAs were launched that the added characters didn’t do a whole lot to attract new clicks at the top of the page.

This might also explain why we specifically saw some positive movement for bottom-of-page ads, since there are likely disparities in how frequently ads at the bottom of the page show extensions versus ads at the top of the page.

There’s also the question of how well searchers even bother to read ad copy besides scanning for pricing, discount and/or free shipping language. I know I don’t. Then again, I also almost never click on ads.

Regardless, there’s just not much evidence that I’ve seen to suggest ETAs boosted CTR across the board. But why would Google implement these changes if it weren’t of some benefit to them, especially when it trumpeted higher CTR as part of the rollout of ETAs?

Maybe there really was a meaningful boost in CTR, and it’s just undetectable to us as a result of those background updates I mentioned earlier keeping CTR steady. Perhaps Google’s expectations were off when they rolled out ETAs for one reason or another, such as a weird testing environment when experimenting with ETAs early on.

Or maybe Google just likes to keep everyone busy!

It’s too soon to say if RSAs might be in a similar boat of updates that fall short of expectations, or if Google’s “machine learning” (and copious new characters) will actually take text ad CTR to new heights. Either way, when it comes to assessing the RSA figures and case studies that will inevitably get published in the coming months, I’ll be looking for segmentation by key variables like device, page location and keyword type (brand vs. non-brand).

As we saw with ETAs, results can vary significantly for ads in different settings. Fully understanding the impact of the change requires unpacking the numbers as best we can.

Want more info on Paid Search? Check out our comprehensive PPC Guide – Nine chapters covering everything from account setup to automation and bid adjustments!

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories