Where Is Google Investing Its Marketing Spend Internationally?

If Google reigns supreme and leads the majority of the world’s markets taking a comfortable first place, why would the company decide to dramatically expand its sales and marketing efforts? This is a question many analysts were asking following Google’s recent first quarter 2011 results announcements – and with good cause, when you start to […]

If Google reigns supreme and leads the majority of the world’s markets taking a comfortable first place, why would the company decide to dramatically expand its sales and marketing efforts? This is a question many analysts were asking following Google’s recent first quarter 2011 results announcements – and with good cause, when you start to dig into the figures.

Since 2006, I have been tracking Google’s pronouncements on their progress particularly with regard to international performance. In the early days, these announcements were rudimentary and broke out only international revenue versus that in the US.

Later, in the first quarter’s results in 2007, Google began to detail sales revenues split out for the UK. For the first of the following year, the headcount figures were included.

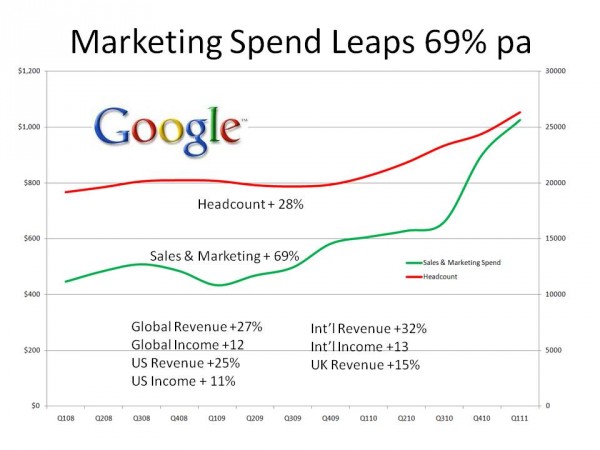

Marketing Spend Leaps 69%

As the graphic below shows, the total amount invested in sales and marketing by Google during this year’s first quarter increased by 69% over the same first quarter last year. That’s a significant increase which could be justified in one of two ways; firstly, that it’s inline with company growth and revenues or secondly that it’s needed in order to invest in growing future market share.

Headcount hasn’t followed the same dizzy trajectory of 69% growth — but for a technology-led business the actual 28% annual growth rate in people remains significant, particularly since people add to fixed overheads and cannot be trimmed quite so easily should the market shift against you.

This is particularly difficult in highly regulated employment markets such as those in Europe where it is considerably more difficult to “let go” staff than it generally is in the US.

Google Marketing Spend Leaps 69%. Source:WebCertain

Since Google releases data on the respective shares on international markets versus the US, we can attempt to see if that increase in headcount and marketing spend correlates with what’s happening in the world.

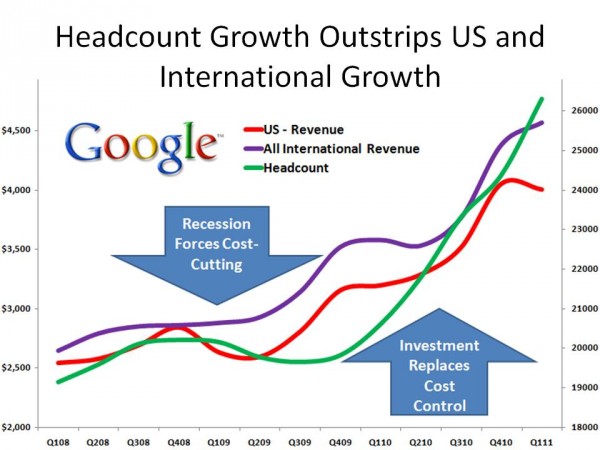

As the graphic below shows, US revenues have continued to grow steadily with a slight Q1 dip – a dip which may be partly due to a currency hedging correction but which nonetheless appears to suggest that Google’s US revenues very slightly declined in the first quarter of 2011.

International Revenues Are Star Performers

What the analysis in the graphic suggests is that revenues outside the US have been continuing to grow with the possibility that this growth is actually accelerating and masking this slight decline in US performance.

Does this growth in international markets justify the increase it headcount?

In my opinion, although as a general rule you would expect a business to gain efficiencies as it grows, this is not alway true for global businesses with many markets to serve which are still in development – so I believe this increase is probably justified. Even though the headcount increase is arguably ahead of the international growth curve, if your plan is to develop where you’ve previously not done especially well because they’ve not been “cared” for then this may well make sense.

Google Headcount Growth Outstrips US and International Growth. Source: WebCertain

Turning now to the growth in marketing spend which is analysed in the graphic below, the picture is a little less clear than in the case of headcount.

Firstly, the difference in marketing spend between last year and this is huge — a 69% increase in spend is a large check to write for any organisation representing an increased daily burn rate from roughly $6 million to over $11 million per day.

Google Marketing Spend Outstrips US and International Growth. Source:WebCertain

Let’s go back to the key question. If you’re already present in the vast majority of the world’s markets — with only a very small number of nations no longer having their own “local” version of your technology — and if only a few markets have resisted embracing you as the nation’s number one preferred search engine, why would you need to increase your marketing spend by roughly two thirds?

You might stab a guess at this spend going into new technologies such as Android, mobile advertising, YouTube advertising or other technologies. But no, in each case that doesn’t stack up. With Android, you’re marketing only to partners — the mobile phone companies who adopt your technology. With mobile advertising or YouTube, you’d expect the costs to pretty much track the revenues.

Google vs Pepsi In Russia?

Recently, I learned from a highly credible source in Moscow that Google has been investing vast sums of money into advertising within the Russian market. I haven’t been able to verify the numbers, but my source believes that Google has been rivalling Pepsi as one of the leading advertisers in Russia. Even if that’s not precisely true, what is clear is that Russia has been in Google’s marketing sights.

So there are two possible hypotheses as to where this money is going. Firstly, it’s going into emerging and strategic markets such as Russia, Korea, and possibly Japan.

The second possibility is that it is being used to leverage against perceived threats to Google’s business such as Bing, Yandex or Yahoo (in Asia) and Seznam in the Czech Republic.

Despite their vast spend in Russia, Google does not appear to have moved the Russian market share needle against the leader in the market , namely Yandex which has actually been claiming share gains during the same period.

My conclusion? Google is working hard to push up the cost of competing with it so that key threats, which could attack markets where it is actually weak but has never had any real competition giving Google first place by default — don’t even think it’s worth trying. Could this be the difference between the Eric Scmidt strategy and that of Larry Page?

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories