Yahoo Q3 Revs Flat, 10 Percent Layoffs Confirmed

Yahoo announced (pdf) Q3 revenues this afternoon. Search revenues and performance-based display ads were up. However, “premium display” (CPM) was down. Revenues were $1.786 billion, a (tiny) one percent increase, vs. $1.768 billion in the same period last year. The company stressed that consumer page views and engagement were up. Yet Yahoo confirmed that it […]

Yahoo announced (pdf) Q3 revenues this afternoon. Search revenues and performance-based display ads were up. However, “premium display” (CPM) was down. Revenues were $1.786 billion, a (tiny) one percent increase, vs. $1.768 billion in the same period last year. The company stressed that consumer page views and engagement were up. Yet Yahoo confirmed that it would cut 10 percent of its headcount to gain more control over costs. The company also said that future hiring would emphasize developing countries where salaries are lower.

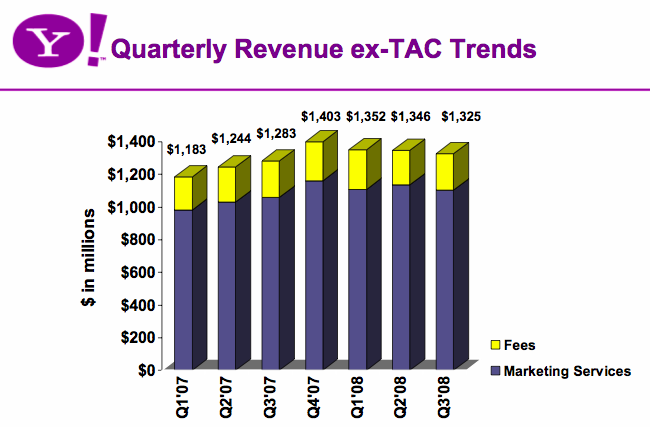

Here are the Q3 financial highlights:

United States revenues for Q3 were $1.2 billion, a seven percent increase compared to $1.195 billion vs. 2007. International revenues were $507 million, a 12 percent decrease compared to $573 million for the same period of 2007.

Jerry Yang, in prepared remarks, emphasized the global economic challenges and their impact on Yahoo display advertising. He also stressed several positive milestones, including strength in search and the launch of the APT display ad platform. He confirmed that the company would be cutting 10 percent of its staff. He said other cost-cutting measures would be examined. Yang also cited the Google-Yahoo paid search agreement as a positive and didn’t indicate there was any concern that it would be abandoned (but see below).

Yahoo President Sue Decker echoed and expanded upon some of the statements that Yang made. She pointed out that audience engagement is growing. Events such as the U.S. November elections, Summer Olympics, and global financial crisis are driving lots of page views, she said. Global page views are up 17 percent. U.S. and international search query growth has exceeded internal projections and comScore figures, she said.

Decker also explained that the Yahoo homepage will be transformed into a “personalized internet dashboard,” which can incorporate third-party content and email sources. She characterized the homepage changes and related changes in other areas of the site as a “transformation” from “one size fits all” to a personalized experience across Yahoo.

Revenue per search in the U.S. was up 11 percent year over year. Decker spent time touting the benefits of the APT platform, which has now rolled out with the San Francisco Chronicle and San Jose Mercury News sites. More sites and partners will roll out shortly.

Decker said that Yahoo was seeing some “consolidation of brand budgets” to the benefit of Yahoo in a number of cases, but overall brand budgets are declining. She added that “overall, the trend in display has been lower.” Decker said, by contrast, that “search held up very well.” (Google’s results last week certainly indicated that.)

Asked during the Q&A session about the outlook for the Google paid search agreement, Yang made bland statements about continuing to “work with the DOJ” but didn’t suggest the deal was in trouble in any way. However, TheDeal, SAI and CNET are suggesting that the agreement is all but dead:

A proposed joint venture between rival Internet companies Google Inc. and Yahoo! Inc. appears headed for the trash bin, just ahead of an expected U.S. Department of Justice challenge to the agreement, lawyers close to the deal said.

Assistant Attorney General Tom Barnett met on Oct. 17 with lawyers for the parties for the second time in two weeks. The bottom line of the meeting was grim, said one lawyer who asked not to be identified.

“Nothing good came from it,” he said.

The subject of “shareholder value” came up, given that Yahoo obviously didn’t accept the Microsoft buyout offer (for $31 per share) and now Yahoo shares are worth much less. Jerry Yang primarily cited cost cutting in his response.

There was also a vague question at the end about potential acquisitions and shareholder dilution, which could be seen as a veiled reference to a potential Yahoo-AOL combination. However, notwithstanding all the rumors, AOL didn’t come up by name in this context.

See related coverage at Techmeme.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories