How The Food Network Suddenly Spiked In Popularity & Why comScore Isn’t Buying It

In May 2011, the mantle of the most-trafficked food site according to comScore passed to Food Network from AllRecipes, who had held the position for over two years. What was its secret recipe? Buying an audience through the AdOn network – a recipe that apparently didn’t ultimately taste right to comScore. They determined the surge […]

Why comScore Numbers Matter So Much

In today’s world of digital content powered by online advertising, advertisers and publishers alike keep a close eye on the numbers. Web measurement services such as comScore, Hitwise, Compete, and Nielson track the number of visitors to web sites.

In turn, these numbers are used in board presentations to demonstrate growth, by sales teams working to convince advertisers to make big campaign spends, and by advertisers deciding where to spend ad dollars. Venture capitalists make investment decisions based on traffic numbers related by these services. Google might choose to include particular sites to power its “OneBox” results based on this data.

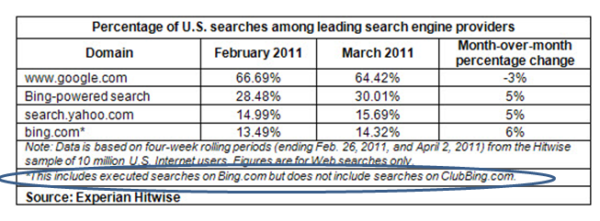

We use the numbers to monitor industries and consumer behavior. Is Bing starting to gain on Google in search engine market share? Are consumers increasingly interested in watching video? What social networks are losing ground?

The stats on these questions can change how and where businesses spend their advertising budgets and where they spend time engaging customers.

Are the numbers accurate? Well, no. They’re not accurate, but they generally are useful for looking at trends over time.

As these numbers gain value, it becomes more enticing to game them. And if the traffic numbers are being gamed for an unrelated reason (someone needs to hit particular numbers to get a good bonus, advertisers won’t buy unless the site gets more traffic, someone decides to boost ad revenue by injecting the site with more page views), the numbers reported by these measurements services can end up inflated as a potentially unintended side effect.

So should we trust the numbers? Mostly, yes. But it’s important to look at traffic sources, and not just traffic alone.

The Stats on Food

For over two years, allrecipes.com held a fairly comfortable lead in food-related web traffic according to comScore. As you might imagine, this gave them a powerful story to tell advertisers. It might have gone something like, “we’re the number one food destination on the web. Advertise with us for the best visibility to your target audience.”

“Target audience” is key. It’s the reason online advertising is so powerful. It’s why a company like Dole or Kraft would advertise on a food site rather than a car site or a general news site. Advertisers don’t want just any views of their ads; they want views by potential customers who are highly motivated to buy their products. And how much more targeted can you get if you sell food than to someone who’s making a grocery list of what to make for dinner?

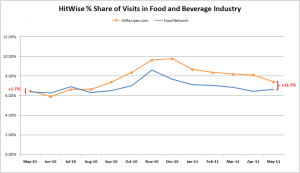

When the comScore numbers for May 2011 came out earlier this week, Food Network had gained 3.4 million unique visitors month over month (an increase of 26%) and had taken over the number one spot.

The other measurement services had All Recipes still at number one and didn’t show the traffic spike that comScore reported. So what happened?

Looking more closely at the data, nearly all 3.4 million new visitors to foodnetwork.com landed on a single page – a video page that autoplays continuous video and video ads.

Land on the page and the videos start playing. And keep playing. The intent behind this ad buy seems to be to increase views of their video ads, which have become big business.

Nearly all of the incremental traffic to this video page came from sites owned by a single network – sites that drove no traffic the previous month. In fact, comScore showed 92 sites driving traffic to foodnetwork.com in April and 196 sites driving traffic in May. (In contrast, All Recipes went from 93 sites to 91).

At least 77 of those new sites were affiliated with a single network: AdOn.

Buying Traffic: How the AdOn Network Works

The AdOn network works like many other ad networks do. They match ad inventory to publisher demand. AdOn (like many others) generally don’t work with publishers directly. Rather, they work with aggregators, who have publisher space available and are looking for ads. AdOn delivers the ads to the aggregators, who in turn display them on publisher sites.

The AdOn network has a click counter showing “clicks delivered today”. They’re dealing in high volumes of clicks.

They pitch their services as:

“We produce high traffic volume via a broad range of categories including cost per click (CPC) search, domain/toolbar, email, pop-under, TQ and conversion. Our advertisers get immediate access to our global partner network consisting of more than 1000 publisher sources, 1 billion search queries and millions of visitors. Our scale will help you satisfy your volume requirements.”

1 billion search queries? Wow. That’s nearly half of Bing’s search volume. Who are all these searchers and where are they searching from?

I talked to AdOn to find out. Robert McDaniel, VP of Product for AdOn, told me that they don’t own any of the sources of traffic. They work with aggregators who have pooled the “more than 1000 publisher sources” who are looking for ads (this would include parked domains, toolbars, popups, and popunders). When AdOn get a request for an ad, they call this a “query” (hence the 1 billion search query number mentioned on their site).

(Update: since this story was published, the AdOn website has been edited to say “over 1 billion queries for ads per day, and millions of visitors and ads served per day”. And AdOn provided us an additional comment to clarify that some of their traffic originates from search.)

Rather than send ad-generated clicks directly to the advertiser, McDaniel says AdOn redirects ad clicks through one of their owned search engine sites and then to the final advertiser destination. McDaniel told me that these owned sites have the look and feel of a search site, but are really just intended to process the traffic, not originate it. This implementation causes the traffic referrer to be one of these search sites, rather than the actual origination of the click (such as that parked domain).

In essence, it works like this:

- A person clicks on an ad (which typically might be on a parked domain or on a popup that was spawned from a toolbar).

- The click leads to one of the search engines in the AdOn network, which redirects to the advertiser site.

So while it looks to a measurement service like comScore that all of those clicks are coming from an AdOn search engine, they really aren’t. And those 1 billion search queries are really just non-search clicks redirected through one of AdOn’s search engine sites for processing.

Which makes more sense than actual searchers using these search engines, which have names like chillcow.com and happythat.com and all look suspiciously similar.

If you try to do an actual search on any of them, you’ll find that they return a very similar set of sponsored search results no matter what you search for.

Looking more closely at other Scripps-owned sites in Hitwise, it’s clear that HGTV, for instance, is also newly making use the AdOn network to generate additional traffic. The HGTV traffic also seems to be funneled to a single video page that autoplays videos and video ads.

Below you can see May 2011 Hitwise data for HGTV. The circled sites are AdOn search engine sites and the arrowed sites are parked domains; you can see they sent no traffic the previous month.

This traffic is boosting HGTV’s comScore numbers as well.

But Traffic is Traffic, Right?

Buying traffic is how advertising works. There’s nothing inherently nefarious in it. If you want a lot of new visitors to your site, you might buy ads to get those visitors. But the key again is “targeted” traffic. Traffic based on misleading people into clicking, from untargeted audiences who aren’t actually interested in what you’re providing, or that is automated doesn’t help anyone except someone looking solely for a graph to move up and to the right.

And buying untargeted traffic to view ads on your site (when the advertiser is paying for your targeted audience) might make you money, but the advertiser isn’t really getting what they paid for.

If Kraft is buying ads on the Food Network, they want to advertise to the Food Network audience, not to a random audience brought in from another source just to view those ads.

And if the ad network that the Food Network is buying traffic from is funneling the traffic through intermediate sites, such as these search engines, then the Food Network has no visibility into where that traffic is actually coming from and if the audience is really even interested in food.

(After this story was published, AdOn provided an additional statement that “we make the originating HTTP-Referer that we see as well as the keyword that generated the click available to our advertiser if they would like it.” They also stressed that they believe their traffic is targeted, telling us “We do geo and keyword based targeting like most other CPC/Text Ad networks. Some of our advertisers buy ‘run of network’… [but], even with the run of network ads, there is some level of user intent when they chose to click on an ad.”)

The Impact on the Online Publishing Industry

When you get right down to it, we have access to so much free content online because online advertising works. Publisher sites can afford to stay in business because of the money that advertising brings in. And advertisers keep spending ad dollars on online advertising because it’s effective. Randall Rothenberg, President and CEO of the Interactive Advertising Bureau recently noted:

“As Americans spend more time online for information and entertainment purposes, digital advertising and marketing has emerged as one of the most effective tools businesses have to attract and retain customers.”

If online advertisers don’t see a return on investment for ad dollars spent on visitors viewing or clicking on their ads, they may stop advertising online, which would hurt all online publishers. The IAB’s has published Networks and Exchanges Quality and Assurance Guidelines that Yahoo’s VP of Marketplace, Ramsey McGrory noted are important for sellers to adhere to because otherwise “the buyers… aren’t going to have a level of comfort about that … ad network’s inventory.”

Their Audience Reach Measurement Guidelines note that “filtration procedures are necessary to ensure that non-human activities (for example, known or suspected robot/spider originating transactions) are excluded from measurement counts.”

These guidelines are intended to ensure that the traffic is both real and targeted.

The Quality of Traffic From Ad Networks

The AdOn network web site notes that their solutions provide “high-quality traffic”, so I asked AdOn’s McDaniel about the quality of the traffic generated by their network. He told me that while quality is a subjective measure, they do work with their advertisers to ensure the traffic performs. He acknowledged that the traffic “isn’t Google traffic. That’s why [advertisers] aren’t paying Google prices”, but said that “performance is a great measure of quality” and that they “want to deliver a quality product that is successful for advertisers.” (And he was adamant that all of their traffic was real, not automated.) He noted that they use Adometry to score the quality of the clicks on their network and “maintain a very low amount of clicks with scores of less than 100“.

These goals sound a lot like the goals of any ad network. But it’s important for advertisers to really dig into the details of what an ad network means by quality traffic.

Specific Media gathers data about audiences to deliver “relevant messages to specific audiences” to generate “maximum brand impact”.

“We’ve developed a sophisticated data mining system that allows us to use the billions of data points we gather across our network to enable advertisers to address the specific consumers they want to reach with relevant advertising based on demographics, interests, contextual relevance and geography.”

Google’s own Double Click also talks about using targeting to developing a relevant message:

“The targeting options in DFA help you deliver a more relevant message when advertising online. Choose from a variety of targeting options, including audience segment, geo, daypart, browser type, OS, keywords, and user lists for remarketing.”

The bottom line is that this issue isn’t about the AdOn network. It’s about publishers potentially buying unqualified traffic to deliver ad views to their advertisers when those advertisers are specifically buying access to that publisher’s audience.

AllRecipes.com president Lisa Sharples told me:

“Allrecipes has been the #1 food site according to comScore for the past 26 months so of course we were surprised to see that our position had changed. As brands shift more of their marketing dollars from traditional to digital formats such as video, mobile and rich media, it’s essential decision makers have access to accurate, credible audience analytics. Allrecipes is committed to developing impactful advertising formats that provide strong results for top brands. Advertisers can trust that when they buy ads from us, they are connecting with Allrecipes’ vibrant, active and engaged community. We are head down focused on integrating online video as part of a positive user experience within our existing community of home cooks, delivering a sound product to them and our advertisers. We applaud Nielsen, Hitwise, comScore and the IAB for their vigilance in ensuring questionable tactics are not tolerated.”

comScore Revises Their Food Network Numbers

comScore initially looked into the Food Network spike and found that since the traffic was mostly coming from searches, Food Network may have invested in search marketing that drove the numbers up. But as you saw above, those searches weren’t actually searches at all.

The original May 2011 comScore numbers show Food Network at 16,828,000 million unique visitors (and foodnetwork.com specifically at 16,760,000 unique visitors). Revised numbers out today include the note: “Food Network and Foodnetwork.com May 2011 Unique Visitors and Page Views were overstated due to inclusion of invalid traffic. Revised data for Food Network is 14,352,000 Total Unique Visitors… Revised data for Foodnetwork.com is 14,294,000 total unique visitors.”

I asked comScore for more information about why they determined this was invalid traffic, but they haven’t yet provided public details.

Hitwise they told me that they discounted most of this traffic during data analysis. They said they look at clickstream data to make sure the traffic is valid and for instance, discount traffic from pop ups, from bots, or is otherwise automated.

Ultimately then, both comScore and Hitwise have deemed the AdOn traffic invalid. AdOn says their traffic is valid. Where’s Food Network in all of this?

Did Food Network knowingly direct a bunch of invalid traffic to a page that plays video ads in order to get more video ad dollars or to appear to advertisers to have a larger audience? Or were they simply using an ad network as many publishers do in order to gain audience?

I was hoping to get more insight on this from Food Network themselves, but I haven’t yet gotten a reply to my emails and voice mails. Without their side of the story, it’s impossible to say for sure. (But I’ll update the story if I hear from them.)

How Often Are Stats Adjusted?

We’ve seen adjustments like this before. In 2007, Microsoft gained 3.1% share by way of its Club.Live.com game that had people searching as part of the game. Compete, which had initially reported the numbers later revised them to exclude Club.Live.com after an investigation. Hitwise explicitly exclude that traffic when calculating search share numbers.

In 2010, comScore devised a new metric called “explicit core search” when looking at search engine market share specifically in order to separate actual searches from “contextual search” (slideshows and other activities that trigger searches that the visitor didn’t explicitly perform).

How Adjustments Are Reported

Looking at the restated comScore report, you may notice that the original numbers are still listed and the new numbers are only included as a note. This is the standard way comScore reports adjustments, as Yahoo found out last year.

When comScore underreported Yahoo page views by more than a billion in June 2010, Yahoo posted the correction themselves, noting “Due to the size of the error, Yahoo! is making the announcement today as comScore does not generally issue restatements of its published reports.”

comScore said that they’ve had the same correction policy for ten years: they include the correction as a note in its client notification center.

“When a client data error is discovered after the data for the month is officially published, we investigate the root cause, recalculate the affected metrics and report our findings to the client for review. Once we are satisfied that the revised metrics are correct, we post them in the Client Notification Center, an equivalent of software ‘release notes’ that compile any known issues for the month. Clients can use the postings to report the corrected metrics in internal and external communications.”

The Bottom Line?

The measurement services all want to report accurate numbers as they have to remain credible sources for this data as advertisers rely on it more and more. Understanding traffic sources is important because online advertising only provides return on investment if the ads are being viewed by real people who are legitimately interested in the types of products and services provided by the advertisers. We all need to get past the narrow focus on page views (and even total visitors). We all have been saying for years and years (and years) that page views is a terrible metric, but we don’t really believe it.

Those organizations that make money from impression-based advertising understandably look at page views and number of unique visitors as a primary metric. More traffic = more ad revenue. But that can be short-sighted thinking. What’s important is increasing traffic of a qualified audience who is interested in what your site offers and what your advertisers offer, and who will return and will engage with both you and your advertisers. Without that, why would advertisers continue to invest ad dollars online?

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories