Search Market Share 2008: Google Grew, Yahoo & Microsoft Dropped & Stabilized

With 2008 behind us, I wanted to look back and plot how search engine market share changed over the year in the United States. No surprises here. Pick your numbers, Google grew and grew. Yahoo and Microsoft dropped by lately have leveled off. Before we do the pretty pictures, I’ll repeat my standing philosophy about […]

With 2008 behind us, I wanted to look back and plot how search engine market share changed over the year in the United States. No surprises here. Pick your numbers, Google grew and grew. Yahoo and Microsoft dropped by lately have leveled off.

Before we do the pretty pictures, I’ll repeat my standing philosophy about search market share figures:

- Avoid drawing conclusions based on month-to-month comparisons. Lots of things can cause one month’s figures to be incomparable to another month. It’s better to see the trend across multiple months in a row.

- Avoid drawing conclusions based on one ratings service’s figures. Each service has a unique methodology used to create popularity estimates. This means that ratings will rarely be the same between services. However, a trend that you see reflected across two or more services may give you faith in trusting that trend.

- Consider Actual Number Of Searches: While share for a particular search engine might drop, the raw number of searches might still be going up (and thus they might be earning more money, despite a share drop). This is because the “pie” of searches keeps growing, so even a smaller slice of the pie might be more than a bigger slice in the past.

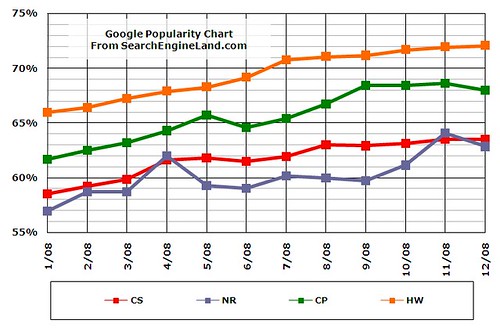

Google: Share Of Searches, 2008

Now for the charts. I’ll start with the share of all searches in the United States estimated to have been processed by Google in a given month. Why four lines? There are four major ratings services out there: comScore (CS), Nielsen (NR), Compete (CP) and Hitwise (HW). Each gathers data in different ways, and what each considers to be a “search” varies as well.

I plot them against each other in order to see how they agree on overall trends. For example, it matters less to me that comScore thought Google started 2008 with a roughly 58% share while Hitwise estimated a 66% share. What’s important is that both services agreed that Google’s share overall grew:

What’s most interesting are places where the trends diverge. If you see two lines cross or move widely apart from each other, then the services are radically disagreeing about what happened in a particular month.

Nielsen is the main exception here. Twice, in April 2008 and November 2008, it showed Google popping well above previous months. Why? I have no idea. I’ll try to look into it more in the future.

Bottom line? Google grew from a 57%-to-66% estimated share in January 2008 to a 63%-to-72% share by the end of the year. In short, a 6% gain.

Prediction? Expect continued incremental single-digit share growth.

Note that this prediction, as are the others below, isn’t based on a huge deal of analysis. I’m simply looking at the lines for 2008, plus reflecting on how I’ve seen search market share growth go over the past few years, and estimating that outward. Many factors potentially could radically change growth, such as further economic decline, the launch of new search products or the potential purchase of Yahoo by Microsoft. But my gut tells me that we won’t see any radical upheavals (we’ve typically not, over the years).

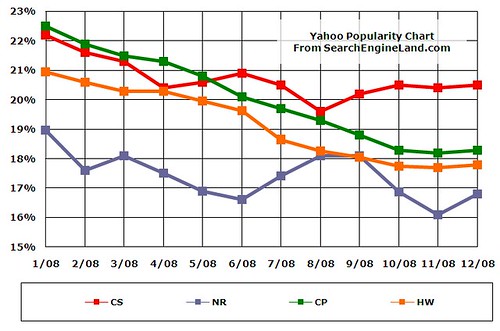

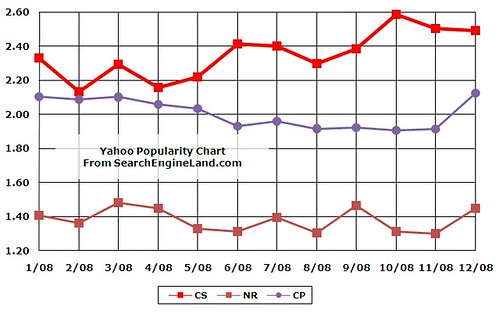

Yahoo: Share Of Searches, 2008

The first part of 2008 saw Yahoo losing share. I’d then argue that the situation leveled off toward the last quarter. That’s clearly reflected in the Hitwise and Compete figures from October onward. comScore shows an actual rise. Nielsen is mixed — it showed a Yahoo rise in the middle of the year when all the other ratings services were showing a decline.

Bottom line? Yahoo dropped from a 19%-to-23% estimated share in January 2008 to a 17%-to-21% share by the end of the year. In short, a 2% loss.

Prediction? Assuming no Microsoft purchase, I’d expect share to stay flat or perhaps show another 2-3% of decline by the end of 2009.

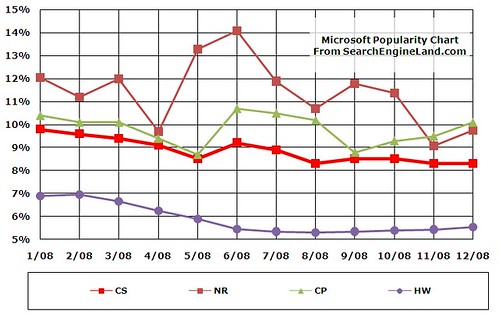

Microsoft: Share Of Searches, 2008

Similar to Yahoo, Microsoft saw a year of losing share early on and then stabilizing. Unlike Yahoo, some of that stability might be in question due the debate on whether to count Club Live searches. These are searches through giveaway, contest and other incentive programs Microsoft that runs. Microsoft hopes that over time, those searching for prizes and to solve puzzles will turn to it’s Live Search search engine to do “regular” searches.

Who counts Club Live searches? I know Nielsen does, and I believe comScore does (I’ll check and update). Hitwise does not. Compete splits the difference and reports share figure with and without Club Live.

Is it a big difference? You can compare at Compete how it looks with and without Club Live. Adding Club Live gives Microsoft about a 3% share bump.

In my charts, I’ve included the Club Live figures since both the long-standing services of Nielsen and comScore are already using them. Plus, even with the 3% bump this may give Microsoft, it’s still pretty far down in share.

Bottom line? Microsoft dropped from a 7%-to-12% share estimated share in January 2008 to a 6%-to-10% share by the end of the year. In short, a 1%-to-2% loss. Drop Club Live searches, and the loss would likely be greater.

Prediction? I’d expect share to stay flat or perhaps show another 1%-to-2% of decline by the end of 2009. There’s a slight chance in my view that distribution deals might bring single-digit growth.

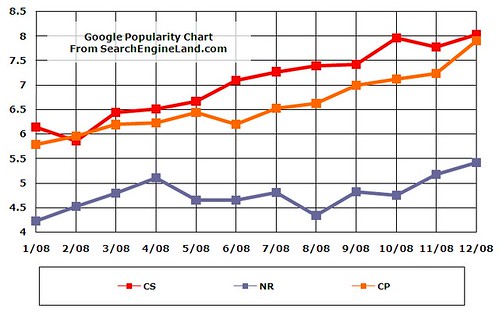

Google: Volume Of Searches, 2008

It’s easy to focus on share of searches and forget that search volume tells perhaps a more important story. That’s because, as I pointed out in my initial caveats, if the “pie” of searches gets larger, then even a smaller slice might indicate growth.

Below is the volume of searches Google handled each month in the United States, as measured in billions (Hitwise doesn’t report volume figures so isn’t shown):

Bottom line? Google went from an estimated 4.5-to-6 billion searches per month in January to a 5-to-8 billion searches in December.

Prediction? I’d expect Google to add 1 to 2 billion searches by the end of 2009, putting it in the 6-to-9 billion searches per month range.

Yahoo: Volume Of Searches, 2008

Remember how Yahoo’s share had declined and then leveled off? Consider instead its search volume:

Those are pretty static lines. Nielsen has it basically level. Compete shows a very slight decline, while comScore actually shows it gained searches.

Bottom line? Yahoo went from an estimated 1.4-to-2.4 billion searches per month in January to a 1.4-to-2.5 billion searches in December.

Prediction? I’d expect Yahoo to stay in the 1.4-to-2.5 billion searches range by the end of 2009.

Microsoft: Volume Of Searches, 2008

Similar to Yahoo, Microsoft’s search volume has stayed relatively static. It has to be noted, however, that 1/3 of that volume comes from the Club Live program. For example, in December 2008, Microsoft had 769 million “regular” searches and 408 searches on Club Live, for a total of 1.2 billion searches overall.

Bottom line? Microsoft went from an estimated 900 million-to-1 billion searches per month in January to 850 million-to-1.2 billion searches in December.

Prediction? I’d expect Microsoft to stay in the 1 billion searches range by the end of 2009.

Want more? For more about search market share, consider becoming a Search Engine Land member so that you have access to all the stories categorized in the Stats: Popularity area of our Members Library. Plus you get many other benefits and help support this site!

Also consider attending our upcoming SMX West search marketing conference in Santa Clara, California this Feb. 10-12. The Searchscape: Latest Stats About The Search Engines session on Feb. 11 features representatives from the major ratings services exploring issues like those in this story.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land