What The Closure Of UK Malls & Main Street Retailers Means For Online

The UK has seen the closure of three high-profile, traditional retail brands in the last fortnight, following on from a dismal 2012 and an increased downturn for the sector since 2009. The recent closures had legacy presence in bricks and mortar on the UK high street (AKA: the UK’s Main Street or Mall retail profile) […]

The UK has seen the closure of three high-profile, traditional retail brands in the last fortnight, following on from a dismal 2012 and an increased downturn for the sector since 2009.

The recent closures had legacy presence in bricks and mortar on the UK high street (AKA: the UK’s Main Street or Mall retail profile) in common: HMV, Blockbuster UK, and Jessops. All had been considered institutions in UK retailing.

Since 2008, the list of once-stalwart bastions of the high street entering administration has been relentless:

- Base, the fashion retailer

- Toyzone

- Sleep Depot

- MK One (twice!)

- Miss Sixty

- MFI (furniture and fitted kitchens)

- Woolworths, the department store institution

- The Pier

- Officers Club (both high street fashion)

- Zavvi (formerly Virgin Megastores, of course)

- USC

- Land of Leather

- Threshers & Wine Rack

- Comet, the electrical goods retailer which also incorporates Dixons

- JJB Sports

- Clinton Cards

- Game

- Blacks Leisure (outdoor equipment and clothing)

- Habitat

- Focus DIY

There are many, many more, including brands which are smaller businesses but no less important to the health of the high street in the UK.

As a result, currently one-fifth of all retail property in the UK is empty. This has had a predictably chilling effect on the sector, and highlights the opportunities currently being grasped by online retailers and traditional brands which have embraced the Internet and changing consumer habits, notably John Lewis and Asos & Next, as noted in the linked Financial Times article.

Mobile Shopping & Online Channels Propelling Growth

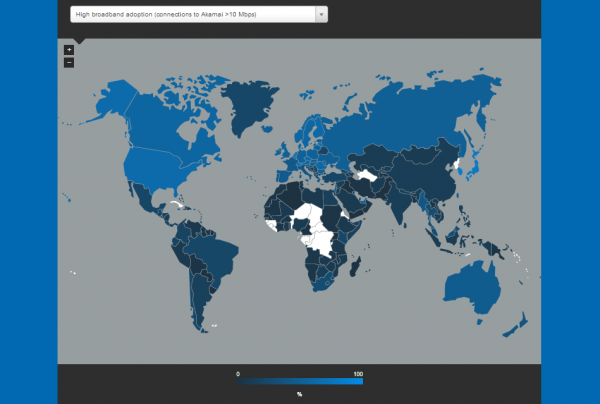

Given the UK population is the world’s most committed online shopper, and is also much more saturated in browsing and buying online via mobile and tablets, the UK’s high street woes are portents of similar brand shifts in other countries worldwide.

That is not to say, or course, that such seismic shifts are not already occurring (with their own winners and losers), but that much greater shifts should be expected in all territories where broadband and mobile saturation is increasing dramatically (as in South Korea, Hong Kong and Japan, for example).

High speed broadband connections precipitate increased mobile smartphone & tablet retail online.

Where we see traditional retail dissonance brought on from online purchasing behaviours, the savvy search marketer should see opportunity in new markets for their brands’ (or clients’) ability to distribute multinationally and project a strong brand presence online to reach new territories.

So, here’s to a strong 2013 for new, ambitious and forward-thinking multinational brands with tablet and smartphone conversion strategies.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land