The 5 Reasons Paid Search Will Be Second Behind Display Starting Next Year In The US

Spend on display ads is projected to surpass that of search ads in 2016. Columnist Josh Dreller explains why, and what this means for search engine marketers.

Well, my fellow SEM pros, the long-foreseen time has come.

In 2016, search engine marketing will fall behind online display as the dominant channel for US digital marketers in terms of dollars spent.

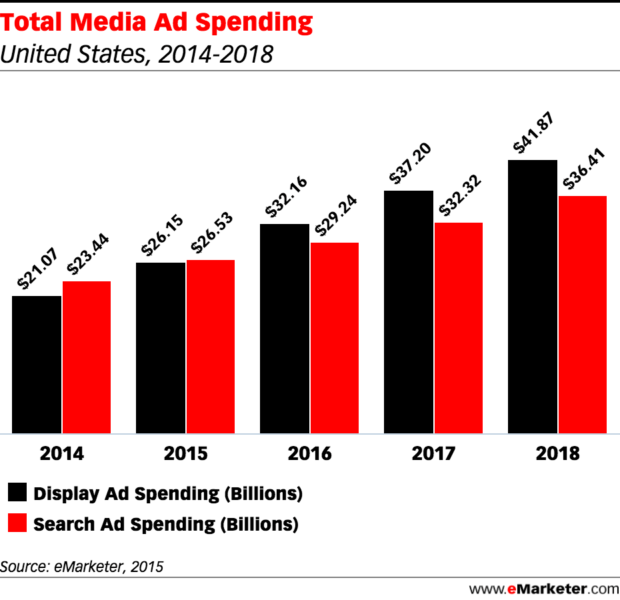

According to eMarketer (which aggregates marketing industry data from multiple sources), marketers will only spend $29.24 billion on search ads in 2016 versus $32.16 billion in display ads.

And the trend will likely continue. Display is expected to blow past SEM forever starting next year.

Is this a reason to freak out and worry about your job? No, not at all.

Did I do something wrong? you’re asking yourself. Ha, no. It wasn’t you. (Well, maybe…)

Then why did this happen? Let’s dive deeper…

5 Reasons Paid Search Spend Is Dropping Behind Display

1. Search engine query volume is stabilizing. Paid search is, by definition, a pull medium, meaning that it requires a consumer to do something to trigger an ad. Paid search spend isn’t necessarily directly correlated to query volume, but it’s obviously a huge factor in SEM spending.

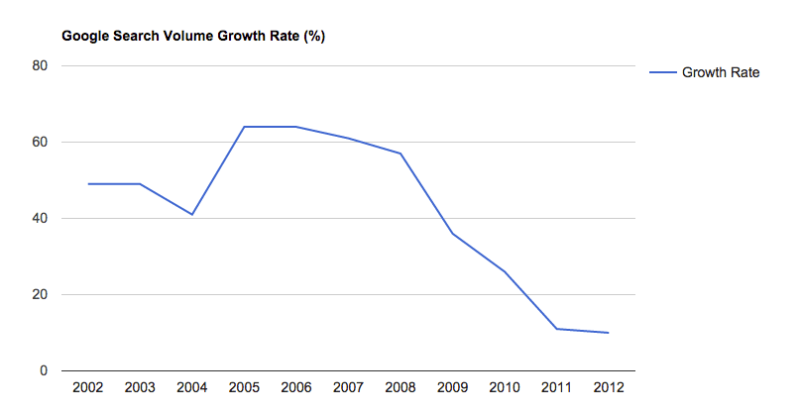

I know from being in this industry since 2002 that query volume growth has slowed down, but the actual data has been hard to get to (as detailed here on Search Engine Land earlier this year). Volume does grow every year, just not at the exponential rates we saw in the early days of search engines.

I found this from InternetLiveStats.com:

After expanding significantly in the first decade of the 21st century, Google’s search volume growth rate started to decline in 2009 and 2010, and is currently estimated to be at around 10% per year.

In the start-up phase growth was phenomenal, with a 17,000% year to year increase in search volume between 1998 and 1999, 1000% between 1999 and 2000, and 200% between 2000 and 2001. Google search continued to grow at rates of between 40% to 60% between 2001 and 2009, when it started to slow down stabilizing at a 10% to 15% rate in recent years.

If you look at the chart, Google query growth began to flatten and then dip around 2005, which is when broadband penetration growth also peaked in the US. The takeaway here is that once internet users had high-speed access, they pretty quickly reached a point where they starting searching as much as they needed in a day and have only been searching incrementally more since then.

I mean, how much searching can you really need to do in a day? You’re not going to double your number of searches every year, right?

Of course, the rise in mobile over the last 10 years has probably accounted for the growth of searches over the time when we all only had a desktop or laptop computer. So the trend remains: queries continue to grow year over year, but only at a stable rate.

As you can see in the five years covered in the eMarketer chart, search engine ad spend growth has similarly stabilized, to about 10 percent to 15 percent.

Coincidence? Probably not. It makes sense that search query volume affects ad spending with the channel.

2. Display ads are readily available. Search is a pull medium, but the opposite is true with display. It’s a push channel. Yes, it does require a consumer to reach a page where ads can be shown, but there are 47 billion web pages on the internet, and that number is growing every day. Plus, there can be (and usually are) multiple ads on every page where advertising exists.

That’s a LOT of ads!

So there’s plenty of inventory in display. In fact, the lack of scarcity is often cited as one of the problematic issues with display advertising. For publishers, it’s hard to put high price tags on even their best premium ad space, because there’s so much inventory available.

Unlike SEM, where there’s basically a trio of self-service partners where practitioners buy ads, display publishers are in constant competition for eyeballs and have a variety of tactics they use to sell their inventory.

Some have in-house teams that put deals together for large advertisers. Others offer self-service platforms. Publishers also work with ad networks and yield management partners to push their inventory into reselling channels — they don’t make as much as selling directly to advertisers, but that becomes a “make it up in volume” game. It’s better to get something for your unsold ad space than nothing at all.

So not only are there a lot of ads, but there are a lot of folks selling them. Display ad revenue is growing at around 20 percent per year and probably only accounts for a fraction of available impressions, so the ceiling is very high for display.

The fact that there are more and more ads every day with display is both a challenge and a boon. In the context of this piece — why display is outpacing SEM spend — more ads available definitely means there are more opportunities to purchase ads.

3. Marketers are scrutinizing dollars more and more. Ten years ago, in a relatively unsophisticated, last-click world where digital spend was 10 percent of total marketing budgets, the paid search teams were the darlings of the advertising world. “It works better than anything else!” you’d often hear quoted (and still do).

The Great Recession of 2007–2009 forced every business to get smarter and savvier, and it has forever left its imprint on marketing. Today, every dollar is scrutinized, and each channel must prove its worth or risk its budget being allocated elsewhere. Although this was very disruptive for our industry, it helped shake things up a bit in a positive direction; after all, dollars should be spent on the best advertising, right?

On one hand, paid search benefited from this pivot, because it is a highly measurable medium and can prove out the investment very easily. Even during the recession, marketers were spending heavily in SEM. However, over the last few years, even paid search budgets have been cannibalized a bit for social and other rising channels.

Marketers will probably never take money away from the low-hanging fruit of SEM, such as branded terms, but the rest of the budget is up for grabs. As I outlined in an article here on Search Engine Land in 2009, “Paid Search’s Law of Diminishing Returns,” no one looks at the entire ROI of their paid search campaigns any more.

They look at every “tier” because they know their branded terms get awesome ROI, their next best terms get great ROI, and so on and so on, until the lower tiers of their account, which don’t perform very well.

It’s that lower tier, maybe 10 percent to 15 percent of most paid search accounts, that savvy marketers sometimes pull away and put into better-performing vehicles or just test budgets for emerging channels. This could also be a factor in SEM’s stabilized growth.

4. Marketers have become more sophisticated and savvier with display. Display was getting a bad rap in the mid-2000s. Ad networks were getting a bit out of hand, making tremendous margins on the arbitrage of selling banner ads for basically giving marketers the privilege of buying from them. I remember one of my colleagues at an ad network referred to his jobs as “slinging banners,” which was a bit of a tongue-in-cheek reference to the commoditization of that inventory.

There were also few controls in place to watchdog the ad impressions. We still live under worry of bots and fraudulent clicks, but the industry also has viewability and verification systems that help marketers avoid the bad inventory.

More accurate market measurement — such as advanced attribution — has been able to paint display in a better light and prove out its efficacy. Under “last ad click” conversion measurement, display was often under-credited, and that has changed with advanced measurement. Marketers can now view their display ads’ contribution to the total pie, which has certainly helped its reputation as being an effective channel.

The big evolution for display has been the well-documented programmatic revolution that began to catch fire around 2009. The Great Recession shook up the display marketplace more than any other digital channel, so publishers and display marketers needed to evolve or risk the loss of billions.

At that time, a few cutting-edge folks saw the value in the fair, auction-based marketplace of paid search and the Google Content channel (later the GDN), so Demand Side Platforms (DSPs) were born to tap into banner ad inventory and sell it like paid search.

A virtual explosion of data vendors arrived on the scene to help drive advanced targeting, and now what once was a small fraction of programmatic buying and selling will soon be 72 percent of the display market.

Display is now “sexy” again, and every major agency now has an in-house trading desk practice specifically to buy display ad impressions at a high rate. Display has seen a resurgence and in many cases rivals the ROI that paid search can bring to a marketer’s portfolio.

5. Digital marketing budgets are going up, and SEM doesn’t dramatically scale. Ten years ago, digital marketing comprised 10 percent of the total marketing budget. Then it was 15 percent. Then it grew to 25 percent. By 2017, it will be 35 percent. As budgets grow, digital marketers are expected to dramatically scale up their efforts but keep the same efficiency.

And that’s where paid search falters. Most advertisers are already “maxed out” on paid search. And as all of us who have managed paid search accounts know, eventually, you hit the law of diminishing returns, and there just isn’t any more volume on your core keywords.

To keep spending, you end up filling your campaigns with keywords with fringe relevancy at best — and of course, they don’t convert as well as your primary terms.

So as time goes on, your paid search accounts will most likely only grow effectively on a parallel path to the growth of queries on your primary keyword set. That’s an organic growth trend in line with the 10 percent to 15 percent year-over-year growth that we’re seeing with search engine advertising revenue in the eMarketer chart.

SEM Is Still #1 In My Book… And Many Others

In summary, if we put it all together, the formula is:

Search query volume is growing, but stabilized

plus

Total digital marketing budgets are growing fast and with more intense scrutiny on value

plus

The fact that it’s quite hard to dramatically scale up paid search efficiently

plus

A virtual limitless supply of display ads

plus

Display’s data-driven, programmatic resurgence

EQUALS

Display spending is overtaking Paid Search spending in 2016 and beyond.

Hey, I still think SEM is #1. I could write pages and pages on the benefits and value, but certainly there seems to be a cap on effective budget growth, whereas display seems to be a limitless opportunity for ad buying.

So, my fellow SEM pros, don’t look at this change as a bad thing; search engine marketing helped usher in the digital marketing revolution and helped pave the road so that one out of three dollars spent in marketing will soon go to digital channels.

Search may now be second, but I bet if you asked any CMO which digital channels they would cut first when they’re forced to scale back, SEM would be the last on the list.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land