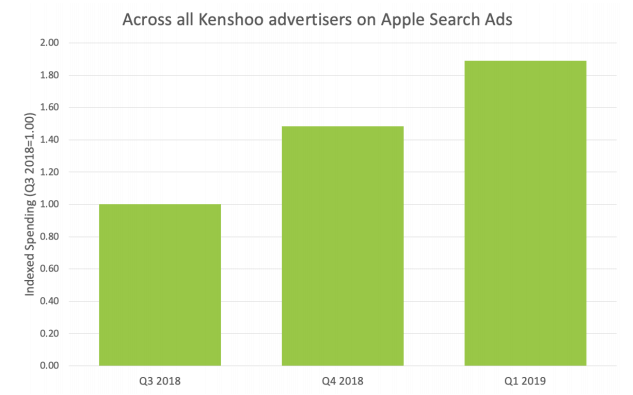

App-marketer spending on Apple Search Ads Grew by 90% in less than a year

The data come from Kenshoo's Q1 2019 Quarterly Trends Report, capturing trends from more than $6 billion in ad spend.

Kenshoo has released its Q1 2019 Quarterly Trends Report. The report originally and erroneously reported that app marketers on the Kenshoo platform “spent roughly the same amount on Apple Search Ads as Google and Facebook combined.” Despite this error, the search and social marketing platform says client spending on Apple Search Ads has been very strong.

Growth in a very short time frame. Kenshoo reported that, since Q3 2018, spending on Apple Search Ads has grown by nearly 90 percent. As the chart below indicates, Kenshoo platform advertisers over-index for Apple Search Ads.

The data in the Kenshoo report is drawn from campaigns generating 500 billion impressions, 14 billion clicks, representing a total of $6 billion in ad spend. Apple Search Ads are billed on a CPI basis.

Source: Quarterly Trends Report (Q1, 2019)

The magic of paid-search. Kenshoo makes a relatively straightforward observation to explain Apple Search Ads’ growth: they’re shown in response to queries in the App Store and therefore are more strongly aligned with user intent than many competing channels. Earlier this year, AppsFlyer found that Apple was generally the third leading site/network for mobile app installs after Facebook and Google.

Source: Apple Search Ad for Expedia

Apple Search Ads originally launched in GA in October, 2016. They come in two flavors: basic and advanced. The former is a simplified product, which has no keywords or bidding. It’s intended for marketers with budgets under $10,000 per month (per app).

Why we should care. Apple doesn’t specifically disclose revenue associated with Search Ads. However, third parties have estimated that they will generate roughly $2 billion in revenue for the company by next year. By comparison, Amazon made nearly $10 billion in ad revenue last year. The latter is slated to become the number three ad platform after Google and Facebook.

Editors note: This story has been changed to reflect a Kenshoo update correcting a misstatement concerning the comparative ad spend on Apple Search Ads vs. Google and Facebook in the Q1 2019 Quarterly Trends Report.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land