Live Blogging The Google Wallet Launch Press Conference

Google’s Commerce VP Stephanie Tilenius took the stage this morning in New York to announce what everyone was expecting: Google Wallet. She said that Google wants to create “tomorrow’s best shopping experience” and “bring online and offline together” through an open payments platform. Google aspires to bring offers, payments and loyalty together at the point […]

Google’s Commerce VP Stephanie Tilenius took the stage this morning in New York to announce what everyone was expecting: Google Wallet. She said that Google wants to create “tomorrow’s best shopping experience” and “bring online and offline together” through an open payments platform.

Google’s Commerce VP Stephanie Tilenius took the stage this morning in New York to announce what everyone was expecting: Google Wallet. She said that Google wants to create “tomorrow’s best shopping experience” and “bring online and offline together” through an open payments platform.

Google aspires to bring offers, payments and loyalty together at the point of sale to create a next-generation shopping experience. The capabilities are impressive; how quickly the public will adopt them is the question.

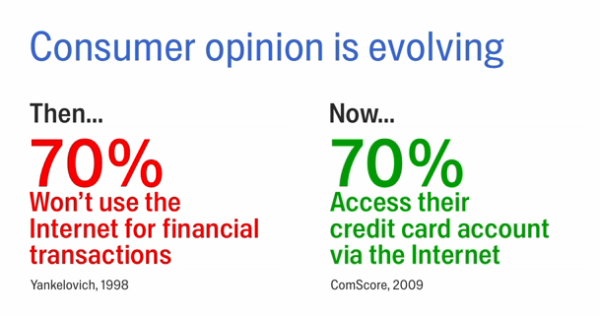

Tilenius cautioned that this was the beginning of a long journey. She began by reviewing the history and development of e-commerce, saying that consumers have become increasingly comfortable with shopping online.

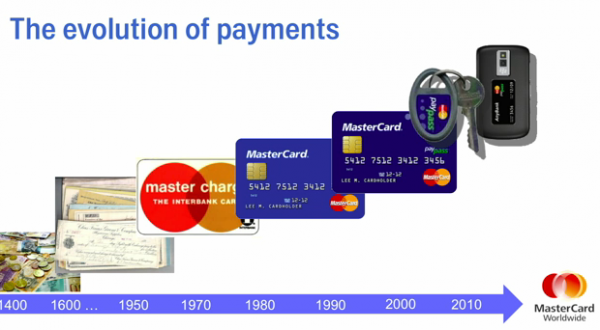

MasterCard then spoke and discussed the evolution of payments and NFC payments in particular.

Stephanie Tilenius returned and rattled off a list of initial partners: Citi, MasterCard, First Data and Sprint. She said they will help “usher in new era of Molo — mobile-local commerce.” Tilenius then went through some “blue sky” scenarios that might develop over time.

Now: Google Wallet

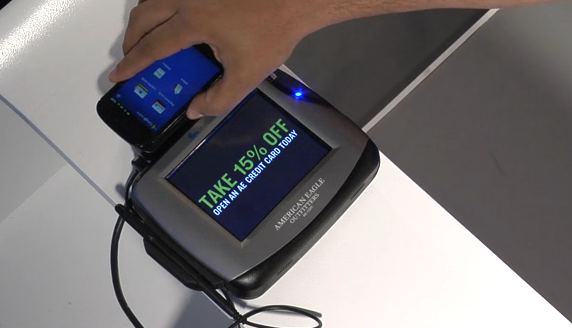

Tilenius said that Wallet is officially being released this summer. “You tap, pay and save” with NFC-enabled devices, which will number about 150 million later this year according to Tilenius.

Google Wallet will support multiple credit card accounts. Citi MasterCard (via MasterCard’s paypass network) and a Google pre-paid card will be supported initially. Later more cards will be available. You can lock Google Wallet for greater security.

Inaugural retailers include: Macy’s, Subway, American Eagle, Noahs Bagels, Container Store, Walgreens and many more.

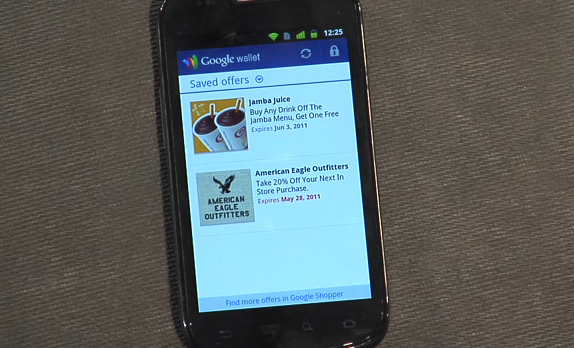

Google Wallet can also store offers, loyalty cards and gift cards.

Google Offers Formally Announced

Offers will be delivered as “deals of the day” via email. But there will also be other flavors and ways to access offers. Google Offers is integrated with Google Wallet; you can save with a click (including online, over the air).

To redeem users will be able to tap or show at the point of sale. Offers will be live in Portland, SF and New York this summer. In addition to deals of the day, there will be check-in offers, offer ads and Places Offers for local merchants.

Offers is intimately linked to Google Wallet. The idea is to bring the “pieces together”: offers, payments and loyalty in one place. Google also envisions customization of offers based on purchase history.

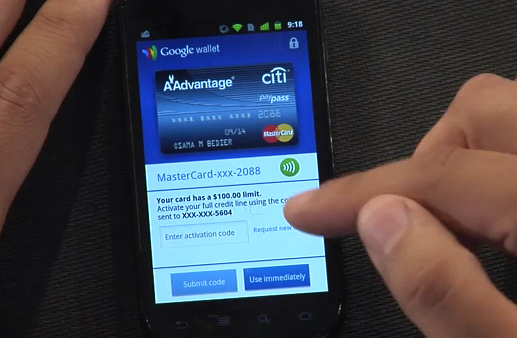

Live Demo of Wallet Set-up

Google offered a live demo of the Google Wallet initial set up and the security features of the system.

A Google prepaid card comes with Google Wallet. However you can add funds from any credit card to the Google prepaid card. Later more payment cards can be added. Eventually users will be able to have multiple payment cards in Wallet and choose the one they want to use for each transaction.

We’re now getting a much deeper dive on Google Wallet security. Google is trying to take security away as a source of criticism or skepticism about Wallet.

Online-Offline Integration

Google impressively showed an online search that then yielded an offer from American Eagle Outfitters. The offer was saved with a single tap and then appeared in the Wallet (exactly how an Android app can be downloaded over the air from the Android marketplace). This was also demonstrated with a check-in offer on mobile and a rewards card.

Now we’re hearing about Google’s “single tap” technology that enables the sending of multiple objects to the point of sale simultaneously: gift cards, offers, payment cards, reward cards.

In the fall Google Wallet will enable digital receipts and push merchant suggestions to consumers and (maybe) game dynamics.

Tap and Pay

We saw a demonstration showing an outdoor ad with a “tap for coupon” element (like a QR code). This obviously could be extended to all kinds of signage and traditional media ads.

This marketing possibilities here are pretty obvious and impressive.

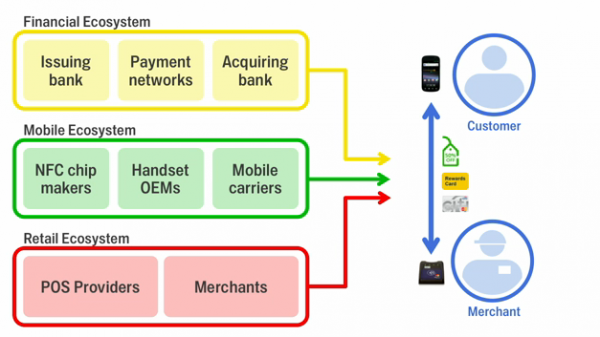

Open, Android-Like Ecosystem

Now we’re getting the pitch for third-party participation in the “open payments ecosystem.” Indeed this is the effective equivalent of “Android for payments.”

The Wallet is free to partners. And Google sees this as a tool for large and small entities.

The various partners appeared to make supportive statements and remarks: Citi, MasterCard, FirstData, Sprint.

Everyone agrees this is a significant, “watershed moment” for digital money/electronic payments. MasterCard said that there are 100,000 merchants that have the infrastructure to take advantage of Google Wallet already. (However I’ve seen the number 300,000 elsewhere.)

Powerful but How Many Will Have Access?

Apparently Wallet will only be accessible — for now — on the Nexus S (from Sprint). Earlier Google’s Tilenius said that up to 150 million devices later this year would be able to use the system. I assume this extends beyond Android to any device with an NFC chip.

The finale is a video with partner/retailer testimonials about how Google Wallet will make shopping easier, faster, more fun and incrementally more lucrative for retailers.

The combination of payments, offers and loyalty (together with consumer purchase history data) is extremely powerful for retailers, advertisers and merchants generally. However are two significant questions: one is around consumer privacy and the other is around adoption: how long this will take to “mainstream.”

My guess is that privacy will be less of an issue for people than simply having the hardware to access the capabilities. It remains to be seen how others in this increasingly competitive segment — Apple, Amazon, carriers, Visa, PayPal, etc. — will respond.

Postscript: TechCrunch points out that an NFC sticker can be applied to phones to broaden the number of handsets that can participate in the program. This is pretty critical.

Postscript 2: See PayPal Sues Google, Sees Powerful Threat To Its Future In Google Wallet

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land