Your Mobile Site May Be A Lot Less Mobile Than You Think

Any smartphone shopper who’s tried to take advantage of the mobile Web will nod incredulously with Google’s recent survey that found 79% of marketers still do not offer mobile-ready content. For consumers, that’s a real letdown. But marketer antipathy towards mobile shoppers isn’t the only reason the mobile Web sucks. The fact is, most of […]

Any smartphone shopper who’s tried to take advantage of the mobile Web will nod incredulously with Google’s recent survey that found 79% of marketers still do not offer mobile-ready content.

For consumers, that’s a real letdown. But marketer antipathy towards mobile shoppers isn’t the only reason the mobile Web sucks. The fact is, most of the mobile site content offered by the other 21% also lacks the “smarts” to auto-connect with smartphone shoppers. How prevalent is this problem? Worse than you might think.

Calculating “Mobile IQ”

I think the old maxim rings true of mobile – you can’t (or won’t) manage what you can’t (or won’t) measure. So to spur on new thinking and solutions to this mobile experience problem, I recently embarked on an analysis of the top Internet retail sites. I set out to quantify what I refer to as the “Mobile Intelligence Quotient.”

I selected brands like Amazon, Best Buy, Staples, Office Depot, and others because big B2C and B2B brands like these have been early adopters of mobile site technology. (They are the 21% Google referred to.) Accordingly, each offers a “mobile-friendly” site to mobile shoppers who request their home page.

But what happens when iPhone, Android, and Blackberry shoppers request other “hub pages” (category, subcategory, best selling product pages) from these sites? How likely are shoppers to receive at least a mobile-friendly greeting, or better, the mobile equivalent page when the request doesn’t come through the home page? This is, after all, how most organic search, paid search, and social media users arrive at websites.

So we studied up to 100 hub page links found on each of these brands’ home pages. We then recorded a “Mobile IQ” score by smartphone device for each brand depending on whether the content served was at least mobile-friendly. What we found was fairly surprising.

Here is a sample of the results:

Amazon: 95% of pages requested fail to connect iPhone and Android shoppers with mobile content. Surprisingly, just 22% of pages fail to connect Blackberry shoppers to mobile content – good for Blackberry shoppers. (See audit detail here.)

Best Buy: 90% of pages requested fail to connect iPhone, Android, and Blackberry shoppers with mobile content. (See audit detail here.)

Staples: 98% of pages requested fail to connect iPhone, Android, and Blackberry shoppers with mobile content. (See audit detail here.)

Office Depot: 99% of pages requested fail to connect iPhone, Android, and Blackberry shoppers with mobile content. Surprisingly, nearly all of these actually produce “Apache tomcat” server errors. (See audit detail here.)

Having performed this same analysis on many other brands, these results are not atypical. For smartphone shoppers, the mobile Web seems even smaller than it really is.

Does Mobile IQ Matter?

Analytic types argue that the brand home page is all that counts, since smartphone traffic is not distributed evenly across pages, as my analysis tends to imply; indeed, smartphone traffic tends to cluster at the home page. But accepting your natural condition cannot be called marketing, can it?

As we learned in SEO over the years, the objective for large-scale sites ought to be the intentional redistribution of the brand so as to attract the long-tail (in this case, of smartphone shoppers across search queries, social media, and other deep entry points) in volumes that exceed the home page. Surely, that’s mobile marketing at its finest.

We are also learning that mobile users are search-dominant. In their study, “Understanding the Mobile Movement” released last week, Google said mobile search is engaged by 77% of smartphone users. These searches are done to meet fairly immediate needs: with nearly 90% of mobile searches leading to action within a day, and 50% leading to purchase. (Hence an argument I’ve made previous that mobile searchers are “worth” more than desktop searchers.)

We also know the mobile pie is growing fast. Back in February, Google said mobile search made up 15% of queries. If current comScore smartphone subscriber growth rates hold, the US smartphone user base will have grown nearly 50% annually by year-end (from 70 million to 100 million). Mobile search therefore could reasonably be expected to exceed 22% of total queries by year end.

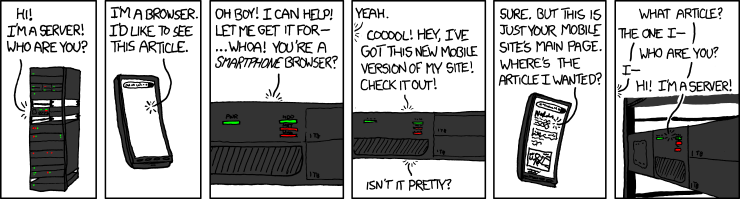

In 6 months (Christmas holiday season), your mobile search traffic will be 50% greater than it is today. Are your servers ready to greet smartphone shoppers and searchers accordingly? Or is this more like you:

Audit Your Mobile IQ

Start planning now to properly connect these page requests with your mobile content. Conduct an audit of your website’s hub pages to see what your iPhone, Android, and Blackberry shoppers see.

You may not have ready access to all three major smartphone device-types, or the time to manually inspect hundreds of pages on each. Fortunately, there are tools to help. My firm recently released into beta a tool called Mobile Site Analyzer, which makes the auditing process fast, easy, and free.(Disclosure: Mobile Site Analyzer is the tool we built to conduct the audits cited above.)

With this free version, users just type in a URL, like a home page, site map, category page, competitor site, etc. In a matter of minutes, they learn their mobile optimization score, which pages are impacting mobile conversion and ROI, and page-by-page analysis against mobile best practices. (I encourage all my Search Engine Land readers to try it out, and let me know your feedback.)

Most importantly, use your mobile audit to take action:

- Establish internal mobility benchmarks, and competitive benchmarks for ongoing monitoring

- As mobile-optimization changes are made, re-run the analysis on a regular basis

- Identify trouble pages that may be producing bad experiences (like Office Depot above)

- Analyze various categories, subcategories, or product pages

- Overlay conversion metrics to help prioritize optimization resourcing

Differentiate Through Mobile

Competitors with low mobile IQ scores are more susceptible to high bounce rates in their organic, paid, or social listings (not to mention poor customer satisfaction). You don’t want to be that cat. Why not go on the offensive? Once you know your site’s mobility, and are taking steps to optimize, analyze your competition and set traps for them, particularly in categories where you know their mobility is weak.

For instance, Barnes & Noble could leverage the fact that their Children’s Book category has twice the Mobile IQ of Amazon’s equivalent category. Anticipating the bounce, BN should promote their mobile-readiness in related PPC ads and Organic listings.

The bottom line is this: the mobile Web experience is so bad, that brands with high “Mobile IQ” are simply more attractive to smartphone shoppers. Get smart and take action today.

Comic from XKCD, used with permission.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land