Google Still World’s Most Popular Search Engine By Far, But Share Of Unique Searchers Dips Slightly

No question. Google remains the most used search engine in the world, far outdistancing competitors. But, over the past three months, its share of unique searchers had dipped below 80%, suggesting it has lost some regular searchers. Still, the huge percentage remaining at Google are searching more than ever. Meanwhile, has Yandex really taken the […]

No question. Google remains the most used search engine in the world, far outdistancing competitors. But, over the past three months, its share of unique searchers had dipped below 80%, suggesting it has lost some regular searchers. Still, the huge percentage remaining at Google are searching more than ever. Meanwhile, has Yandex really taken the number four spot from Bing?

comScore’s Worldwide Search Figures

The figures come from comScore. They weren’t released publicly, but after they emerged on GigaOm, comScore has been providing them to other publications upon request. Most attention has been focused on Yandex passing Microsoft to take over the fourth place spot as the world’s most popular search engine, based on searches conducted.

That’s true, though when you look at unique searchers — the number of people who use the search engine, rather than the number of searches conducted — Microsoft still has a big lead over Yandex. But perhaps more interesting, Google has seen a marked dropped in unique searchers over the past few months.

Google Leads In Number Of Searches

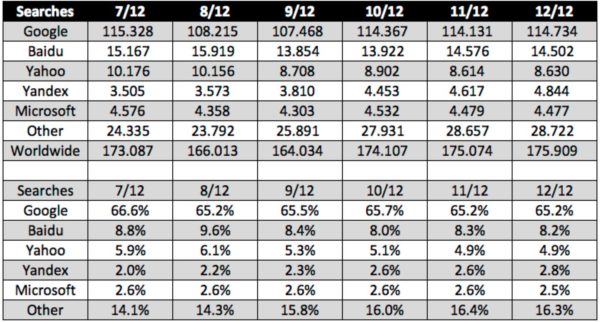

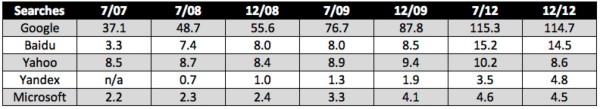

Let’s do the numbers:

The table above shows the number of searches — in billions — that have happened over the past several months for each search engine, on a worldwide basis. The “other” figure are searches that happened on search engines that aren’t one of the big five. Below that, you can see the percentage share each search engine has for the worldwide total.

For December 2012, the search landscape was like this:

- Google: 114.7 billion searches, 65.2% share

- Baidu: 14.5 billion searches, 8.2% share

- Yahoo: 8.6 billion searches, 4.9% share

- Yandex: 4.8 billion searches, 2.8% share

- Microsoft: 4.5 billion searches, 2.5% share

- Others: 28.7 billion searches, 16.3% share

If you’re wondering why I’m not saying “Bing” rather than “Micrsosoft,” that’s because these are searches that happen on Microsoft (or Google, Yandex, etc) websites. They include not just searches to find things across the Web (such as on Bing), but also searches to find things within a site (such as at Microsoft.com)

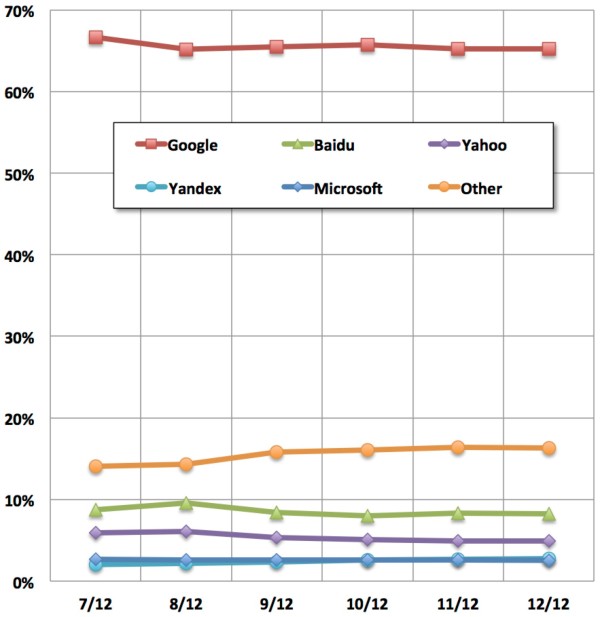

Now, let’s have some charts:

It’s easy to see just how far above all the other search engines Google is, in terms of share of searches.

Yandex Overtakes Microsoft

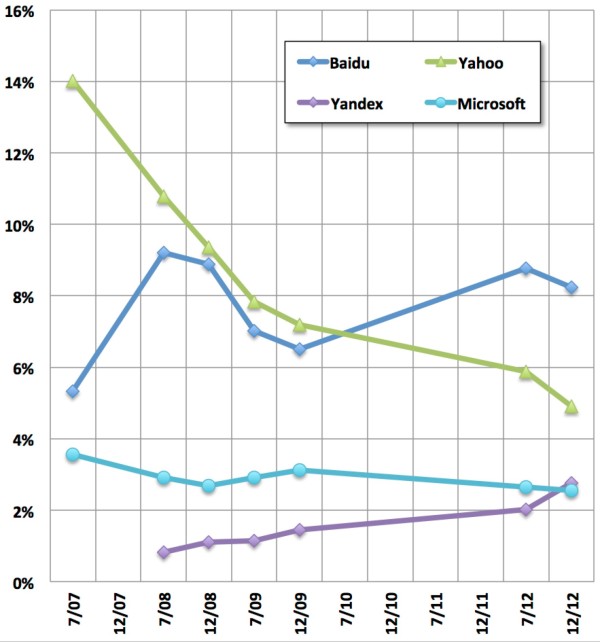

You have to eliminate the Google line (and the “Other” line) to better see what’s happening with the remaining Big Five:

Baidu and Yahoo have both seen recent drops, though the trend for Yahoo keeps going down, while Baidu is showing some recovery. The Yandex overtake of Microsoft can be easily spotted.

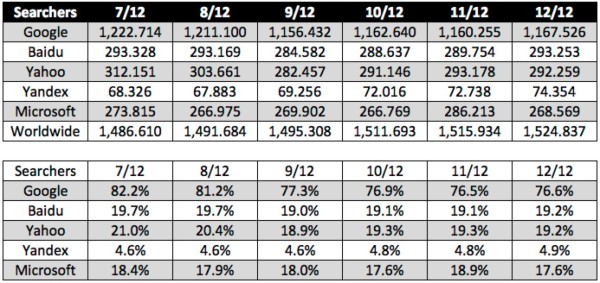

Unique Searchers Vs. Number Of Searches

Now, on to number of searchers. To contrast against the above figures, think of how often you go to a search engine (probably Google) in a given month and do a search. Each search you make is counted toward the overall number of searches at that search engine. But, you remain one individual, and the number of unique individuals using each search engine is what the “searcher” totals show.

The numbers, in millions:

Using the numbers above, for December 2012, the global landscape is like this:

- Google: 1.17 billion unique searchers, 76.6% share

- Baidu: 293 million unique searchers, 19.2% share

- Yahoo: 292 million unique searchers, 19.2% share

- Microsoft: 269 million unique searchers, 17.6% share

- Yandex: 74 million unique searchers, 4.9% share

Now, if you’re adding up all those share figures and wondering why you get to more than 100%, the answer is simple. A unique searcher can use more than one search engine. According to comScore, there are 1.5 billion unique searchers worldwide. Most of them use Google, but some of them use other search engines, as well.

Google Leads On Unique Searchers, But Sees Drop

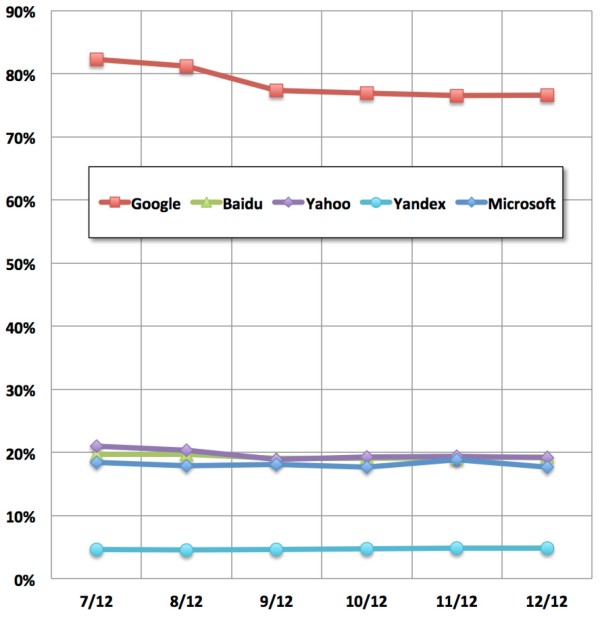

Time for some charts:

The first thing that leaps out is that Google’s share has dipped below the 80% mark for several months. How unusual is that? Hard to say, because comScore rarely releases these types of “searcher” figures. But comScore did say the last dip below 80% was back in August 2011 and that generally, Google’s at the 80% mark.

What would cause the dip? A small percentage of people abandoning Google. Who are those people? Why did they leave? Don’t know, sorry. However, given that the number of searches with Google hasn’t dropped, it probably has little to panic about.

Microsoft Takes Back The Number Four Spot

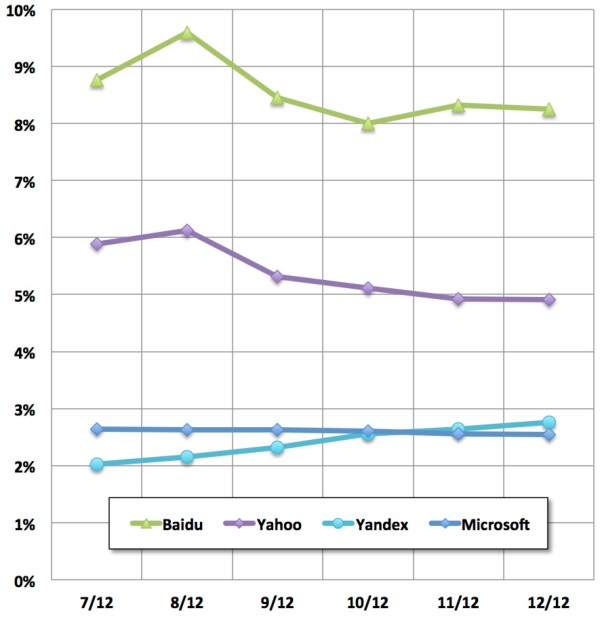

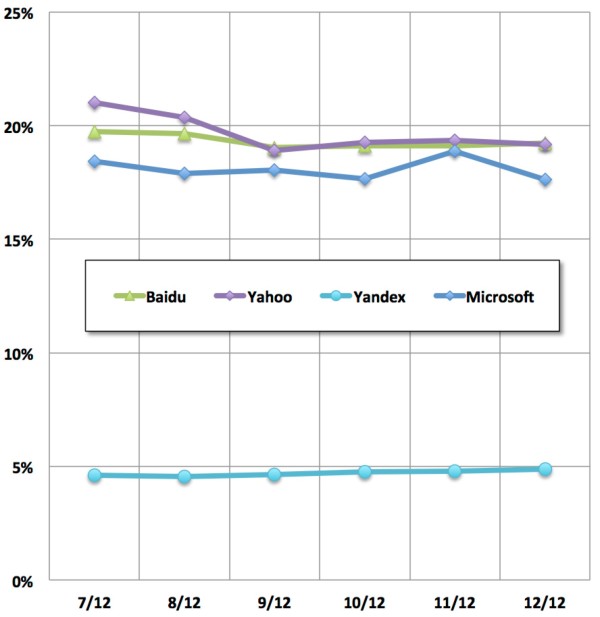

Eliminate Google from the chart, and you can better understand what’s going on with the rest:

Yahoo’s had a drop in searchers, but unlike with Google, it hasn’t seen an increase in number of searches.

Meanwhile, Yandex — which looked so great from a number of searches perspective — is way below the rest. What’s up with that?

It could be a situation similar to Google, that Yandex is very good at getting its existing searchers to use it a lot. That’s potentially great, because extra searches may mean extra ad clicks. However, extra searches can also be generated in ways that don’t potentially translate into better monetization, such as things Yahoo has done in the past.

I can’t say what the situation is with Yandex either way, but as Tom Warren noted, Microsoft does have a good argument that on a unique searcher basis, it remains the number four search engine worldwide.

Worldwide Popularity, Over Time

Finally, one last set of numbers and graphs. I pulled some of comScore’s previous figures for worldwide search engine popularity, for 2007, 2008 and 2009. Sorry, comScore never released public figures for 2010 and 2011. But the past figures give a sense of growth for the major search engines.

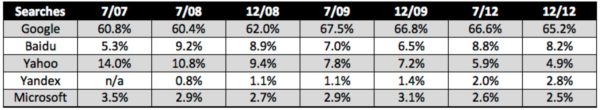

Below, the share of worldwide searches each search engine has handled over the past five years:

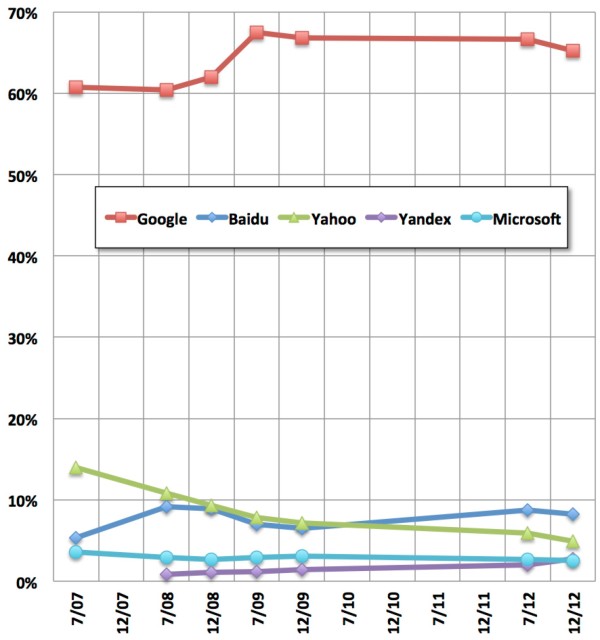

Here are the figures in a graph:

Over the period, Google has generally risen. Yahoo’s dropped from the 14% level to 5%. Baidu has bounced around. Yandex has come from less than 1% to nearly 3%, passing Microsoft which has dropped from 3.5% to 2.5%. A close-up on the non-Google search engines:

Why It’s So Hard To Catch Google

Perhaps the most fascinating part in looking over time are the number of searches. The table below shows number of searches each search engine has handled over the past five years, in billions of searches for each month shown:

Here are the figures in a graph:

I think that’s the most dramatic of all the charts. Over the past five years, Google has tripled the number of searches it handles, with each search potentially being a monetization opportunity.

Baidu has actually quadrupled the number of searches it handles. Yandex has done about the same. Microsoft has more than doubled its searches. So all of them — other than Yahoo — have growth stories, some growth on a percentage basis beating Google.

But in terms of pure volume, Google leaves the others in the dust. They’d need much higher percentage growth to really make a dent, or Google would have to make a sustained stumble over time, for them to approach Google’s volume.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land