4 Revealing Facts About How Consumers Search And Buy Online

A recently released study by retail engagement firm Parago examined how consumers research and buy across several product categories. The research is chock full of insight about how people buy, with broad implications for digital marketers. I want to focus on one aspect of the research: insight into consumer behavior when the buyer is in […]

A recently released study by retail engagement firm Parago examined how consumers research and buy across several product categories. The research is chock full of insight about how people buy, with broad implications for digital marketers.

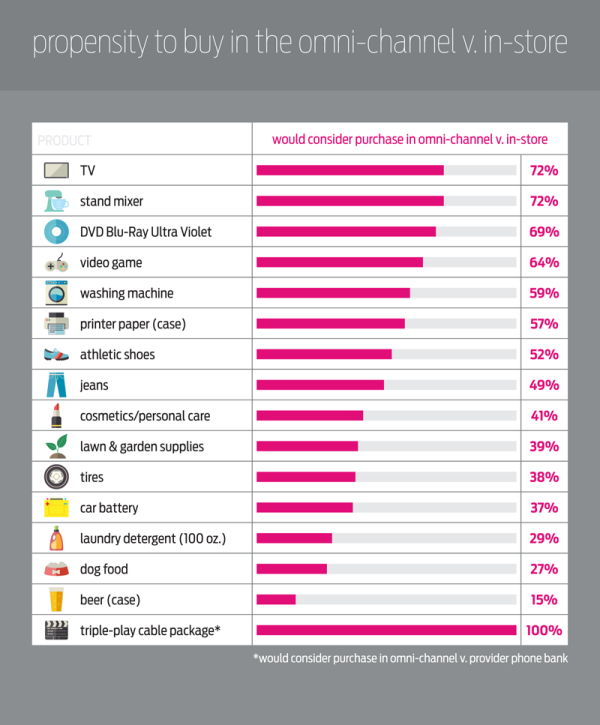

I want to focus on one aspect of the research: insight into consumer behavior when the buyer is in purchase mode. Analysis of the single graphic below, which shows the sources consumers turn to when researching a purchase, will produce several insights for digital marketers.

How Consumers Buy Online. Image copyright Parago.

1. Social Is Not A Purchase Research Channel

The finding that social is amongst the least leveraged channels in the purchase research process lines up with Conductor’s research that shows consumers turn to social only 15% of the time when they are researching a purchase compared to 97% of the time for search.

Conductor’s research was done in 2012, so it’s interesting to note that consumers do not appear to be turning to social with any more frequency as time goes on.

This is not to say that social does not have other substantial benefits such as brand building, customer listening and content distribution — our research showed that the second most popular use for social is content discovery — but consumers are just not turning to their social networks to research purchases.

2. Amazon Is Not As Dominant As We Think

There is a persistent perception in online retail that Amazon’s might is insurmountable, that the depth and breadth of their products and established brand are nearly too much for many retailers to overcome in the struggle for their share of the online retail pie.

Parago’s research shows that although Amazon has clearly established their brand and review-filled site as a key stop in the online research process, online retailers are very much in the game — provided they are visible in the natural search results.

Retailers may still require price parity to win the sale, but in every vertical in which Amazon was the second most utilized research channel, online search (Google) was #1.

3. Brand Loyalties Are A Real Influencer In Purchase Decisions

According to the research, retail websites are the third most commonly used resource in the buying process.

This suggests that brand loyalty influences the purchase process but not as significantly as online search. Interestingly, brand loyalty in the clothing industry is the most significant purchase influencer, which could stem from the fact that purchasing clothing is a personal process and requires more consumer trust.

4. The Need For In-Store Handling May Be Overblown

Another persistent truism that has stood the test of time is the argument that the need to handle products in store will constrain online commerce. A close look at buyer rankings for “in-store displays,” however, shows that for many product categories, consumers seem to have conditioned themselves to purchase online with limited hands-on interaction.

In fact, for product categories in which you might expect to see a need for hands-on interaction — such as electronics, furniture, housewares and sporting goods — in-store displays are only the third or fourth most turned to channel.

Those product categories where in-house displays remain the most turned to channel are those which remain primarily offline purchases, such as groceries and pet supplies, which are cumbersome to ship and needed with more immediacy.

The data show a move away from in-store purchasing; however, that should not be viewed in a vacuum. The move to the online commerce and the convenience of “point and click” purchasing leaves a void for buyers that is not reflected in the study — a connect-with-the-product-with-my-senses void, a let-me-pick-it-up-and-touch-it void and a see-it-compared-to-other-products void.

Where People Buy. Image copyright Parago.

This void can be at least partially filled by retailers who focus on helping buyers to make a purchase decision. This means providing buyers with rich information they might otherwise glean in an in-store visit.

And, it means providing rich media assets: large, detailed imagery, video and user reviews, all designed to appeal to the senses that would otherwise be stimulated in-store, with the goal of helping the user make an educated buying decision.

Working To Win Online Commerce

Recent research on how consumers buy online shows that across nearly all product categories, buyers turn to Google as their number one research source. The research suggests that these two truisms apply to online commerce:

- You’ve Got To Be In It To Win It. Buyers turn to search more often than any other resource when making a purchase; if you’re not visible in the search results, you’ve lost before the first whistle.

- You’ve Got To Bring Your “A” Game. As buyers move away from in-store displays as a resource in the buying process, online retailers have to step into the void and provide buyers with a replacement for the information and experiences lost from in-store experiences.

Those retailers who integrate these attitudes and take steps to execute on them will be well positioned to serve the growing shift to online commerce.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land