US Paid Search Ad Spend Growth Slows To 12%, In Part Due To A Still-Nascent Yahoo Gemini

Seasonality and advertisers' reluctance to put budgets toward Gemini due to limited capabilities suppressed overall growth, report finds.

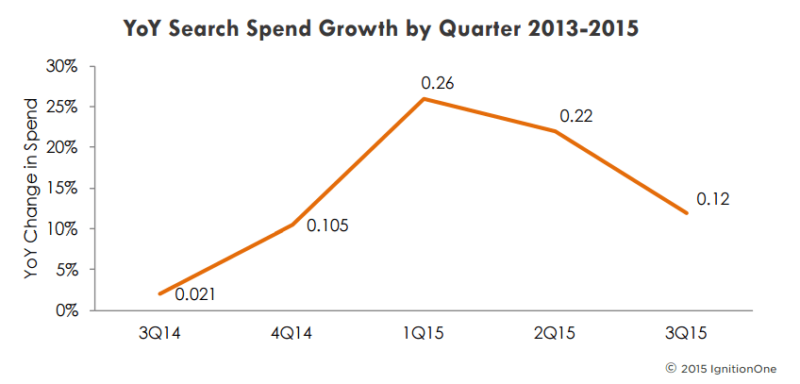

Search spend growth in the US slowed for the second consecutive quarter in the 3Q15, according to IgnitionOne’s latest digital marketing report. The firm points to expected seasonality, as well as to the fact that advertisers are holding back from Yahoo’s still-limited ad platform, Gemini.

Search spend growth in the US slowed for the second consecutive quarter in the 3Q15, according to IgnitionOne’s latest digital marketing report. The firm points to expected seasonality, as well as to the fact that advertisers are holding back from Yahoo’s still-limited ad platform, Gemini.

As a result of Yahoo’s and Bing’s transition after renegotiating their search deal, “a significant portion of traffic is out of reach of most advertisers due to Gemini limitations. This may cause “budgets to decrease because of traffic loss or to increased inefficiency,” the report finds. The firm believes advertisers will continue to underfund Gemini for some time but expects to see slow adoption, particularly for brand and core terms.

Because of the traffic shifts, IgnitionOne did not report on the individual performance of Bing and Yahoo but said Google ad spend was up 14 percent year over year among the client set measured.

Though growth slowed over two quarters, the report notes that the overall year-over-year growth of 12 percent is actually quite strong compared to Q3 2014, which saw just a 2 percent increase from the previous year.

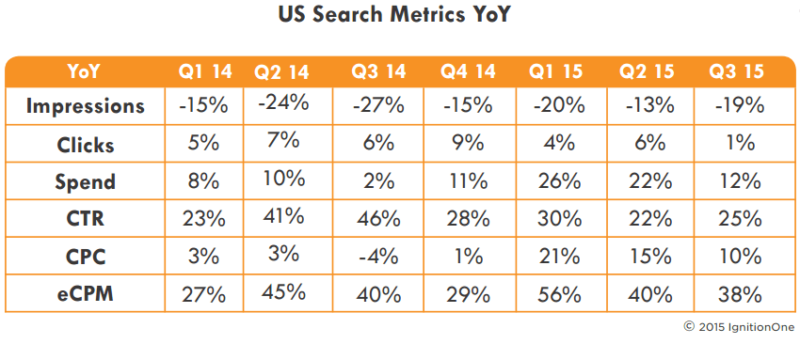

Impression Volume Continues To Decline

Impressions were off again last quarter, down 19 percent as a result of more ad spend shifting to mobile, where fewer ads show per query, advertisers moving away from search partner networks and higher CPCs matched by higher click-through rates (CTR), says IgnitionOne. CTR rose 10 percent year over year, while click volume ticked up just 1 percent.

Smartphone Spend Up Over 50 Percent

Paid search spend on smartphones rose 56 percent year over year and accounted for 64 percent of mobile search ad spend, compared to 36 percent spend share for tablets. Tablets saw a minimal increase of 2 percent growth.

Phone impressions dropped 21 percent, and tablets were off 28 percent. (It will be interesting to see the impact on impressions from Google’s move toward the end of August to show up to three ads in mobile search results.)

Clicks on phones, though, increased by 32 percent, and CTR jumped 67 percent year over year. Tablet clicks dropped by 13 percent, with CTR increasing by 20 percent.

CPCs on both smartphones and tablets rose 18 percent compared to Q3 2014.

You can download the complete digital marketing report here.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land