Yahoo Gemini Gaining Mobile Search Share, But Not At Google’s Expense, Yet

A criticism of the Yahoo Bing partnership is that the two have merely traded market share rather than cut into Google's lead. Gemini's growth in mobile search traffic share appears to be following that same pattern.

Yahoo launched its native and mobile search advertising platform, Gemini, last February, and since then there has been scant data released about its performance. When RKG noted in its fourth quarter digital marketing report that Yahoo Gemini had rapidly escalated mobile search ad serving in the second half of 2014, it caught my attention.

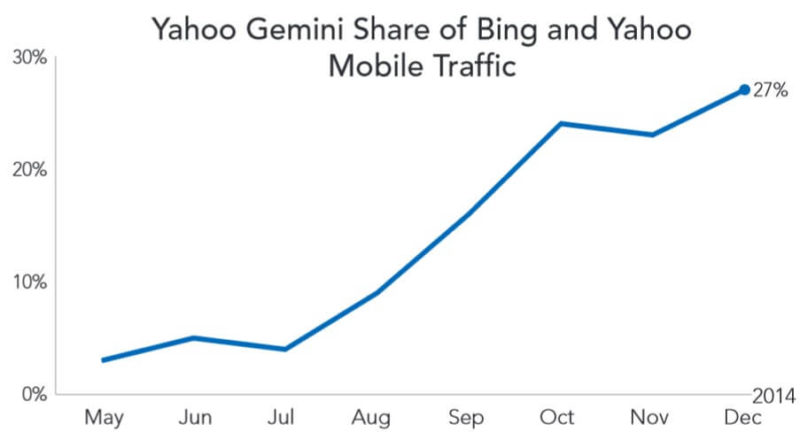

The digital marketing agency reported that, among its retail-centric clients that have opted in to the platform, Gemini ramped from serving roughly 4 percent of mobile search traffic on the Yahoo Bing Network at the beginning of Q3 to 27 percent by the end of Q4 2014.

Gemini serves search ads on Yahoo.com and its partner sites on tablets and smartphones. Before Gemini, all of Yahoo’s mobile search traffic was served by Bing Ads.

Yahoo’s Gain Is Bing’s Loss

I asked Mark Ballard, Director of Research at Merkle (which acquired RKG last year) and the author of the report, if any of the growth was the result of Yahoo gaining share from the overall pie — i.e. from Google — or if rather than transitioning traffic from Bing Ads to Yahoo ad serving. Ballard checked and responded:

“It does look like the spike in Gemini traffic is coming almost entirely at the expense of mobile ads served by Bing.”

Bing Ads’ decline mirrors Gemini’s growth in the follow-up chart Ballard provided below which shows Bing Ads and Gemini’s share of overall mobile search traffic among RKG’s client set.

RKG previously reported it first noticed traffic transitioning to Gemini on March 10th, 2014, when “Yahoo unexpectedly began migrating a small amount of mobile traffic from select Bing accounts to the new platform, with a second wave beginning April 1st.”

As for performance, at this point Ballard doesn’t see any clear differences between mobile search ads served by Bing and those served by Gemini. “Conversion rates and average sales-per-click are similar.” Though he adds, “That could change as Gemini traffic ramps up and advertisers have more data to work with to optimize their programs.”

Yahoo has said that eventually Gemini will serve all of its mobile search traffic instead of Bing. Ballard noted in the report that as Gemini assumes greater volume advertisers “may be approaching a point where holding out is no longer a good option.”

Going After “Non-Exclusive” Mobile Search

You may be wondering how Yahoo is able to push its own mobile search ad serving without violating its partnership with Microsoft (known as the search alliance) in which Microsoft powers Yahoo search and search ads. When Yahoo and Microsoft entered into the search alliance in 2010, mobile was left off the table.

Here’s how Microsoft now explains that decision on the Bing Ads FAQ page about Gemini:

Under the Search Alliance, mobile was deemed as so important to advertisers, that it was left as non-exclusive, so that both Yahoo and Microsoft could innovate rapidly on new mobile products and platforms for the benefit of advertisers.

I have trouble buying this argument since there was little movement on mobile search innovation by either company in the years immediately following the agreement. Regardless, the deal left mobile search open for Yahoo and, unlike her predecessors, Yahoo’s CEO, Marissa Mayer, is going after it.

(Re-)Building Search Ad Tech & Volume

Gemini is Yahoo’s first big effort to “innovate rapidly” in mobile search on its own and its first major investment in search ad tech generally since the alliance began.

Mayer has been working to build Yahoo’s search capabilities back up since taking the CEO role in 2012. “At Yahoo, we believe deeply in search – it’s an area of investment and opportunity for us,” Mayer wrote when announcing Yahoo’s deal with Firefox to replace Google as the browser’s default search engine in the U.S. last November.

Mayer has also been gunning to change — or get out of — the fraught partnership. In an interview with Marketing Land following the Firefox deal, Mayer said,

“I think that if you look at the overall search space, in Yahoo’s case, we’ve been trading share with our partner Microsoft for some time.”

That’s putting it kindly — Bing’s search share has grown at Yahoo’s expense since the two companies paired up. The partnership hasn’t taken share from Google, and the revenue per search hasn’t amounted to what Yahoo expected.

The Firefox deal, on the other hand, appears to be moving the needle. Yahoo’s U.S. search share increased from 8.6 percent in November to 10.4 percent in January, and at Google’s expense, according to StatCounter.

The volume coming through Gemini might be small potatoes now, but Yahoo’s investment in search ad tech, along with the Firefox deal, highlight Mayer’s ambitions for faster search growth. (Search has also been the bright spot in the company’s earnings as display revenues continue to decline.) Yahoo may feel it’s in a better position to back out of the alliance as it comes up on the five-year mark this month now that it has Gemini for ad serving that could eventually include desktop ads as well.

But, if RKG’s client set is any indication, Gemini’s growth to this point comes by simply siphoning traffic back from Bing, and not by attracting new investment that could affect Google’s mobile search share. Gemini’s feature and targeting capabilities aren’t on par with Bing Ads or AdWords yet, and its coupling of search ad serving with native ad serving in one platform won’t be a unique calling card when Bing Ads starts native ad serving on MSN. Is it too early to be expecting much more than a traffic shift from Bing to Yahoo? Maybe, but that second graph certainly shows it’s going to take a lot more investment and innovation for Gemini to go beyond “trading share” with Bing.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land