Adobe: Paid Search Spend Growth Slowed In Q4, Mobile Continued To Eat Into Desktop

Retail advertising spend on mobile Shopping ads nearly doubled year-over-year in Q4.

Paid search continued to grow in the fourth quarter of 2015, but at a slower pace than in the previous year, according to the latest Adobe Digital Index report.

Spend among advertisers running campaigns on the Adobe Media Optimizer platform rose three percent year over year in Q4 2015, compared to the 12-percent increase seen in Q4 2014 globally.

Growth on Google slowed to five percent globally, down from eight percent the previous year. For Bing and Yahoo, growth rates declined sharply in Q4 to seven percent, down from 36 percent in Q4 2015.

Mobile Spend Share Rises, Clicks Remain Cheaper

Smartphone share of search spent grew to 23 percent of spend in Q4 2015, up from 15 percent the previous year. Desktop spend share dropped from 69 percent last year to 62 percent in Q4 2015. Tablet spend share fell from 16 percent a year ago to 14 percent in Q4.

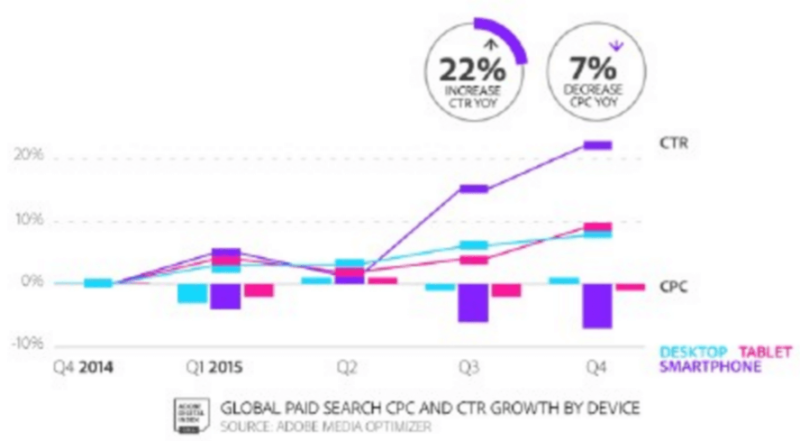

Yet, even as desktop spend share falls and mobile click-through rates keep rising, mobile CPCs actually fell seven percent year over year globally.

Smartphone CPCs cost 26 percent less on average than desktop, yet mobile CTRs made significant gains in the final two quarters of 2015. CTRs were 40 percent higher on smartphones than desktop in Q4, up from the 20 percent seen the previous year and through Q2 2015.

Mobile Shopping Ad Spend Nearly Doubled

On smartphones, product ad spend jumped 95 percent among brand and retail advertisers. Desktop accounted for just 11 percent of the 37-percent spend gain seen overall in Q4 year over year.

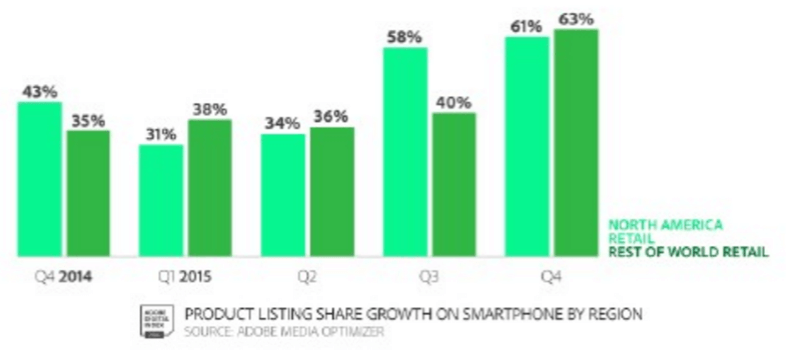

The engines continued showing product listing ads on more queries. In North America, Shopping ads accounted for 64 percent of retail advertiser impressions in Q4, up 42 percent from the previous year. That was similar in the rest of the world, where 63 percent of retail impressions came from PLAs, up 78 percent year over year. (Adobe uses the term Product Listing Ads to include Shopping ads on both Google and Bing.)

Gemini CPCs Rose Relative To Google

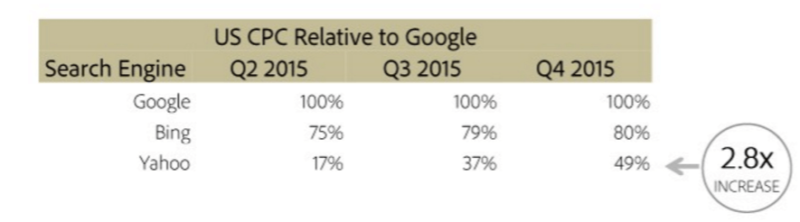

Looking at Yahoo’s upstart (or restart) effort into search, CPCs remain heavily discounted, but the gap compared to Google continues to shrink. CPCs on Gemini increased nearly threefold relative to the search leader, rising from just 17 percent of Google CPCs in Q2 2015 to 49 percent in Q4.

Bing CPCs also continued to rise relative to Google, increasing from 75 percent of Google CPCs in Q2 to 80 percent in Q4.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land