Google’s ban on payday loans estimated to cost millions in lost ad revenue

Still, the estimated losses account for just .05 percent of Google's annual ad revenue last year.

Google’s ban on payday loan ads will cost the company millions. Paid search research firm, AdGooroo, estimates Google will lose $34.5 million in US ad revenue on desktop alone. While that’s a considerable sum, Google’s not likely to feel much of a pinch, considering it took in more than $64 billion in total ad revenue in 2015.

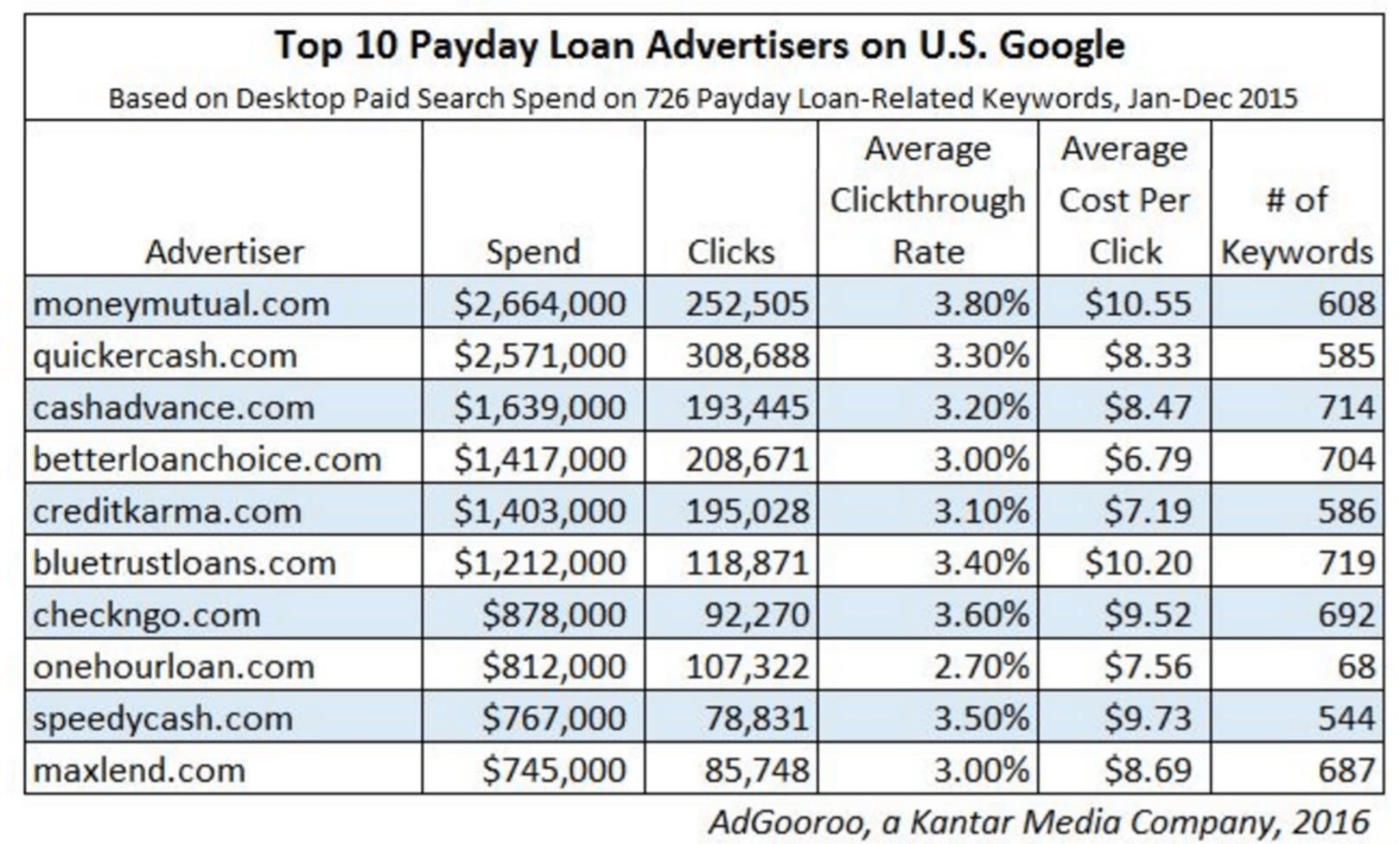

AdGooroo’s system observed 4,211 advertisers bidding on a set of 726 payday loan-related keywords in the US on Google desktop search in 2015. MoneyMutual.com and QuickerCash.com topped the list of advertisers, each spending more than $2.5 million last year on those keywords. The top four spenders in AdGooroo’s report are not lenders, but lead generation companies that sell consumer loan applications to lenders.

Google’s ban on ads for payday loans that require repayment within 60 days is global. In the US, ads promoting high-interest loans with an APR of 36 percent or higher will not be allowed to run in the US. The changes take effect on July 13, 2016.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land