How Google Can Help Enhanced Campaigns Reach Their Potential

It’s been over a year since Google publicly announced Enhanced Campaigns for AdWords, and just shy of a year since the mandatory transition date in late July of 2013. Early on, there was a great deal of consternation surrounding the changes brought by this new campaign model, but advertiser sentiment improved as some of their […]

It’s been over a year since Google publicly announced Enhanced Campaigns for AdWords, and just shy of a year since the mandatory transition date in late July of 2013. Early on, there was a great deal of consternation surrounding the changes brought by this new campaign model, but advertiser sentiment improved as some of their worst fears failed to materialize.

Case in point, the growing consensus seems to be that smartphone cost-per-click has not risen much, if at all, versus desktop CPCs since Enhanced Campaigns were introduced. This concern wasn’t well-grounded in the first place, if for no other reason than the fact that advertisers should be firmly in control of the CPCs they pay and only willing to push them higher if the value of the traffic they are producing increases.

Enhanced Campaigns did not directly affect the value of individual paid search clicks to advertisers, but rather provided a more efficient means to segment our bids for aspects of user context like device and geography. This has allowed for greater scalability of mobile keyword coverage with segmented bids and the broader employment of tactics like geo-targeting.

Under Enhanced Campaigns, advertisers have not only been able to capture more of the long-tail of mobile search traffic, they have been able to account for more of the long-tail of user context through Google’s bid modifier mechanism.

But while the move to the Enhanced Campaigns model has been a net positive, there is still plenty Google can do to help this new paradigm reach its potential, particularly for the large and sophisticated advertisers, agencies and platforms that are driving huge sums of paid search traffic and spending.

It’s easy to dream up a slew of fanciful new bid modifiers Google could add, but I’ve tried to keep the following list to more practical changes they could make in the near term that would allow advertisers to better optimize their AdWords programs and ultimately increase their investment:

Allow Tablet Segmentation & Smartphone-Only Ad Groups

From the beginning, the biggest gripe about Enhanced Campaigns has probably been the fact that advertisers cannot separate tablet and desktop traffic, or create ad groups targeted exclusively to smartphones. I think many of us assumed these capabilities would return soon enough; but here we are, over a year later, and no dice.

Under the previous AdWords model, advertisers could do both of these things and even target specific mobile operating systems. This was undoubtedly more complex, but it should not be much of a challenge for large advertisers to start setting bid modifiers for tablet traffic right away, were Google to introduce that option tomorrow.

Notably, with its take on the Enhanced Campaigns model, Bing Ads does allow advertisers to set modifiers for tablets and desktops, and Bing Ads still allows smartphone-only campaigns. I’m not sure if this makes Google more or less likely to do the same; but, it would likely help them if they did.

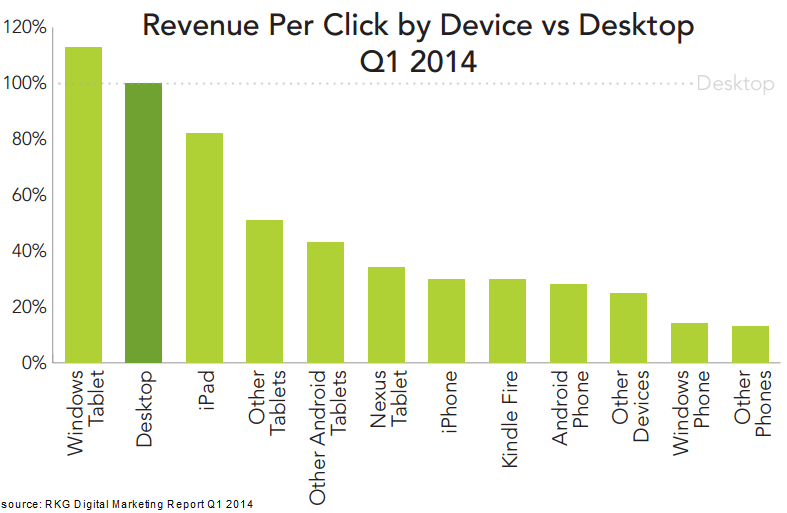

The reality is that tablets do not perform as well for advertisers as desktops on average and, as smaller and cheaper tablet models gain share, that gap is more likely to continue to widen than to close. This is leading to less-effective spending on AdWords’ combined tablet and desktop segment, which is causing ROI-driven advertisers to invest less than they would otherwise.

Add A Bid Modifier For Web Browser

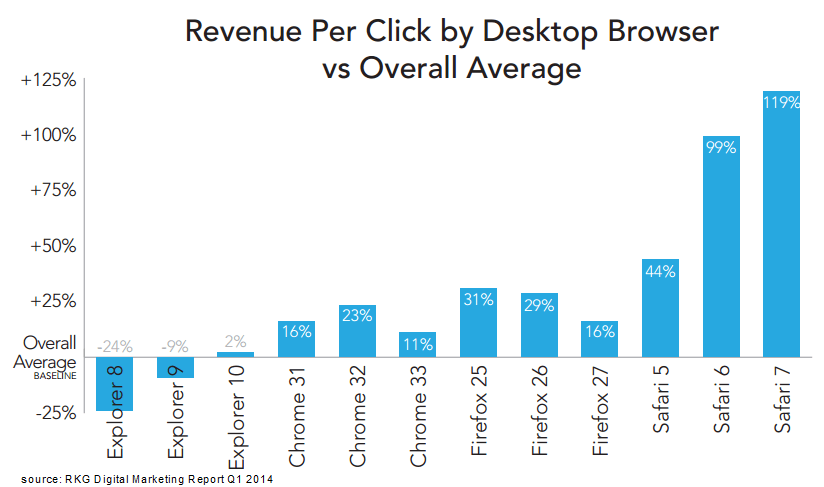

Along similar lines, we know that the web browser a searcher uses can be a strong predictor of the relative value of a paid search click. Safari users tend to generate much higher revenue-per-click than average while Internet Explorer users generate a slightly lower than average revenue-per-click.

Being able to modify bids on-the-fly based on browsers would be very helpful to advertisers’ efforts to capture more high-value traffic, and it would lead to reinvestment due to improved overall ROI.

Google surely knows the importance of the browser to predicting traffic value. When Google introduced Enhanced CPC (ECPC) nearly four years ago, browser was one of a handful of factors it listed as impacting the bid adjustments Google would make automatically for those advertisers using the feature.

It doesn’t seem to come up much anymore; but, ECPC is still around, as is Google’s related Conversion Optimizer, which cedes nearly total bidding control to Google.

If advertisers can use ECPC to adjust for browser and other factors like operating system, isn’t that sufficient? I would argue no, and the key reasons why are at the crux of the next set of opportunities for improving Enhanced Campaigns.

Pass Advertisers Zip Code, Household Income Tier & Audience List At The Click Level

Sophisticated advertisers need to steer their search programs based on their view of conversion performance, not Google’s, since these advertisers calculate the value of paid search by accounting for a number of factors that don’t make it into Google’s Conversion Tracking figures.

Among many possibilities, this includes multi-channel attribution considerations and simply accounting for frauds and returns. For most large advertisers, insights from Google’s view of conversions can be unique and very valuable (as with cross-device estimates), but are often directional at best.

As such, when Google has valuable insights on user context, but doesn’t provide advertisers with the means to connect the dots to our view of conversion performance, it prevents us from taking full advantage of what would otherwise be possible.

For example, advertisers can create geo-targets with an almost unlimited degree of granularity within AdWords; but, Google currently only passes the searcher’s location at the city level or broader for any single click via the Click Performance report over the AdWords API.

Now, we could try to determine the user’s location more precisely than city level ourselves, but when we go to adjust bids based on geography, what matters most is where Google thinks the user is. Chances are they can also determine this better than anyone else.

We shouldn’t expect Google to pass advertisers the exact longitude and latitude coordinates of each searcher that clicks one of our ads, but they ought to be able to pass the zip code or equivalent. This would allow for much more effective geo-targeting as the broader a geography gets, the more any performance distinctions among its constituent locations will blur.

A similar issue exists with Remarketing Lists for Search Ads (RLSAs). This feature has the potential to be very powerful, particularly under the Enhanced Campaigns model, but Google does not pass the audience list a user matched at the click level. So once again, the advertiser cannot take Google’s view of user context for a specific click and match it directly to their assessment of conversion performance for the same click.

The workaround in this case is to set up separate campaigns and keywords for any audience we want to target and track. This is the exact type of inefficient account structuring that Enhanced Campaigns was meant to resolve, however.

Lastly in this area, Google recently started providing performance data in the AdWords UI broken out by household income (HHI) tiers, and they gave advertisers the option to set bid modifiers based on these tiers in a similar manner to geographies.

Since a great deal of the performance differences advertisers see across geographies is tied to household income differences, this option seems like a more direct way to account for this factor, but advertisers cannot see the HHI tier for individual clicks.

So again, the advertisers most likely to use a new Google feature, those who tie into the API one way or another, are hampered by a lack of support.

Raise The Limit On The Number Of Geo-Targets Per Campaign

I assume Google will eventually pass searcher location at a more granular level, making it easier and more common for advertisers to accurately calculate and set bid modifiers for many thousands of geographies.

Currently though, advertisers are limited to setting 10,000 geographic modifiers per campaign. That sounds like a lot, but it’s only enough to cover about a fourth to a third of U.S. traffic at the zip code level.

For advertisers to be able to do all of the really cool things we want around geo-targeting, Google will need to raise this limit.

Allow Combinations Of Modifiers Beyond Simple Stacking

A few months back, RKG’s George Michie wrote a really great piece about the problem of modifier stacking. I encourage you to read it, and I’ll only touch on a few of the key issues here.

In short, Enhanced Campaigns bid modifiers stack together in just one way, and that limits how advertisers can respond to different combinations of user context within any single campaign.

For example, if I wanted to bid down smartphone traffic because it doesn’t convert well online overall, but I also wanted to bid it up for users near my store locations to encourage foot traffic, I would have to accomplish this by duplicating campaigns (again an issue Enhanced Campaigns were intended to alleviate).

As Google adds more bid modifiers, there will be more interdependencies between them (think the household income and geography example noted above). Without greater flexibility in how modifiers can be combined, the scalability potential of the Enhanced Campaigns model won’t be met.

A Fork In The Road?

Part of why the recent Step Inside AdWords event seemed a bit anticlimactic was that it was promoted many weeks in advance, but failed to deliver much for enterprise advertisers to sink their teeth into at a time when there is seemingly some low-hanging fruit Google could still go after for its advertisers.

Just providing full API support for some of the great things that they are already doing would go a long way toward improving the effectiveness of AdWords and encourage increased investment from the largest and most sophisticated advertisers.

While many experienced search marketers would like to see Google provide two versions of AdWords, an advanced option with all of the bells, whistles and knobs, and another for beginners; but, it’s understandable why Google wouldn’t want to ‘fork’ its big moneymaker.

I think Google can meet most if not all of the suggestions above without going too far down that road. In most cases, it seems to be a question of priority (for example, UI vs. API), rather than one of avoiding burdensome complexity for smaller advertisers.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land