When Losers Are Winners: How Google Can “Lose” Search Share & Yet Still Stomp Yahoo

comScore’s out with new search market share figures. Yahoo’s up, but did it “game” its growth with new navigational changes? Gaming figures is nothing new. But even if Yahoo effectively did, it’s the search volume — the number of searches — that people should care more about in deciding who’s “winning” and “losing” when it […]

comScore’s out with new search market share figures. Yahoo’s up, but did it “game” its growth with new navigational changes? Gaming figures is nothing new. But even if Yahoo effectively did, it’s the search volume — the number of searches — that people should care more about in deciding who’s “winning” and “losing” when it comes to search. Hint: Google dominates. Below, a look at the importance of search volume plus some background on gaming stats and the complexities of comparing figures.

Caveats To Live & Love

I’ve been covering search share figures for a long time. A very long time — from before Google existed. Before I dive into a post about search share, I’m going to revisit my long-standing advice that I offer anyone:

- Avoid drawing conclusions based on month-to-month comparisons. Lots of things can cause one month’s figures to be incomparable to another month. It’s better to see the trend across multiple months in a row.

- Avoid drawing conclusions based on one ratings service’s figures. Each service has a unique methodology used to create popularity estimates. This means that ratings will rarely be the same between services. However, a trend that you see reflected across two or more services may give you faith in trusting that trend.

- Consider Actual Number Of Searches: While share for a particular search engine might drop, the raw number of searches might still be going up (and thus they might be earning more money, despite a share drop). This is because the “pie” of searches keeps growing, so even a smaller slice of the pie might be more than a bigger slice in the past.

Do Two Months Of Gains = Trend?

As I’ve warned, a month-to-month jump is no big deal. A two month rise? I’m more interested. Keep that going over six months, now I’m feeling like a trend is happening.

There’s interest today in Yahoo because new figures from comScore show that in March and April of this year, Yahoo increased its search share. Prior to that, Yahoo had a full year of share decline.

April is particularly interesting, because Yahoo rose almost a full point, from a 16.9% share to a 17.7% share. And boom! In both March and April, Google saw a drop in share. Take that, big G!

What happened? comScore puts the growth down to navigational changes:

Both Yahoo! Sites and Microsoft Sites have experienced gains due in part to the introduction of new site navigation experiences that tie content and related search results together within several channels.

Search Share Over Time

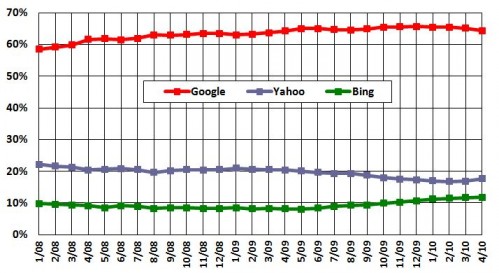

Do these changes go to the bottom line? Hold on to that thought. First, let’s look at the share trend over time:

That chart shows the percentage of searches handled each month by Google, Yahoo and Bing out of all searches that happen on five “core” search engines that comScore measures in the United States (Ask and AOL are the other two, not shown on the chart — both have less than 5% share).

Yahoo Slips From Its Share “Band”

That’s a pretty stark drop for Yahoo. In the past, I’ve written about search engines being within “bands” of share. Yahoo had been barely holding within the 20% to 30% “band,” then last September settled into the 10% to 20% range.

And Google? Sure, the last two months saw its share drop about 1% in total, a tiny bit compared to its overall share. But more important, Google has been in the 60% to 70% band for over two years. It’s way early to be thinking something’s significantly wrong. Google’s had consecutive drops before and kept on growing despite these. That’s not been the long-term story for Yahoo.

Is Bing Robbing Yahoo?

Meanwhile, look at Bing. Unlike Yahoo, it shows signs of leaving its traditional band of 0% to 10% behind and moving into the 10% to 20% range. Indeed, virtually all of Bing’s share increase appears to have come from Yahoo.

That’s not a surprise. Bing has been spending like mad on television advertising, positioning itself as a Google alternative. That seems to be working — except instead of pulling people from Google, Bing seems to be pulling the Google alternative audience that had been using Yahoo, as I expected.

Maybe. You’d really need to do a much deeper analysis of the figures, in particular, to get some crossover figures. What chunk of people used Google as their “primary” search engine and Yahoo as their “secondary” one before Bing’s launch in June 2009 compared to today, for example. That might give you a better sense if Bing really is pulling people away from Yahoo, as the figures suggest.

Getting those figures is hard work. It’s custom data that the big ratings services don’t typically release, nor that the financial analysts — if they’re ordering it up — typically put out in their financial advisory notes.

The Importance Of Search Volume

Still, there’s another number that’s easy to get that provides some great perspective — search volume. This is the number of searches that happen on a particular search engine in each month.

Why’s search volume so important? Well, the overall “pie” of searches keeps getting larger. A smaller percentage or slice of a big pie can equal more searches than a big slice of a small pie.

For instance, look at this recent share drop for Google:

- February 2010: 65.5% share

- March 2010: 65.1% share

- Drop: 0.4%

A drop, right? A sign that the big G is having problems. But now look at the volume:

- February 2010: 9.5 billion searches

- March 2010: 10 billion searches

- Gain: 0.5 billion searches

Google’s “Loss” Is Actually Huge Gain

Got that? Google gained 0.5 billion searches in the same time period that it was reported as having a marketshare drop. 500 million searches. That’s nearly as many searches as Ask handles in a given month. More than AOL handles. It’s 1/4 of ALL searches that Bing handles, or about 20% of ALL searches that Yahoo handles. Oh — and that’s even with me rounding down to keep everything in even multiples of 5. The actual volume change was 573 million searches.

How did this happen? Well, the overall searches on the five major core search engines reported by comScore totaled like this:

- February 2010: 14.5 billion searches

- March 2010: 15.5 billion searches

In one month, 1 billion “new” searches came out from nowhere. More than half of those new searches — about 600 million of them, came from Google. Yahoo only added about 200 million new searches to the pie; Bing, about 150 million, figures all rounded.

The pie grew overall, with Google by far the biggest contributor to that growth, but ironically its competitors are so much smaller that their growth made Google seem to have “lost” when talking about share figures.

Comparing Share To Volume

So what’s the volume trend like? First, a reminder of the share figures:

Now the volume figures:

Anyone want to get excited about Yahoo’s 1% “share” growth in a given month now? Sure, Yahoo’s also grown volume in the last two months — but on a volume basis, Yahoo’s even further behind Google than the share figures reflect.

Google Has Nearly Doubled Volume

Over the past two years, Google’s nearly doubled its search volume from around 6 billion searches per month to 10 billion searches — and that’s not counting searches at Google-owned YouTube. In the same period, Yahoo’s pretty much still at the 2.5 billion searches range — no long term growth. At least Bing has shown steady growth from the 1 billion to 2 billion range that seems likely to continue — assuming Bing keeps doing the marketing.

If Bing stops marketing, we’ll see. That’s the real thing to watch right now. What happens when the TV ads stop?

Gaming Search Figures?

As for the gaming aspect, let’s go back to what else comScore had to say on those navigational queries:

These features provide search results to users as they navigate through topical content and meet comScore’s established criteria for counting search queries.

That’s code for “we might be counting things we didn’t count before, and in case anyone complains [ahem, Google], these are legit searches.”

Of course, if new things are being counted, then all the past figures usually get tossed out — that’s what Nielsen did with its measurements in the fall of last year. I’ll be revisiting this in a future post.

We’ve been here before. In particular, there’s been a long-standing issue on whether the game-oriented searches that Bing offers (such as at Club Bing) should be counted as “real” searches (see SearchPerks – Microsoft’s New Prizes For Searches Program).

It’s actually part of something I’ve been working on recently, and here’s a quote I got from comScore last month on the issue as part of my research:

Yes. we include the Club Live searches in the core search totals. I think the effect is fairly minor these days….

It’s worth mentioning that even if this were the case, it would not affect our search figures since we measure search via a consumer panel which bots cannot join.

So did the Yahoo and Bing navigational changes really grow search that much and if so, do they go to the real bottom line, as there’s much commentary on today? I’ll follow up more on that later when I’ve had a chance to talk further with Yahoo and comScore. But as Kara Swisher at AllThingsD notes, we’ll really know (to some degree) with actual financial reports come out.

Also keep in mind that it’s not just changes at Yahoo and Bing that can inflate search figures. Every time Google runs a custom logo for some holiday, people click on it — and generate a search. In the past two years, Google’s greatly increased the number of logos it has run (see my Those Special Google Logos, Sliced & Diced, Over The Years post from this weekend for more). Are those generating volume increases?

Easy To Jump; Harder To Keep Flying

Here’s the thing. From what I’ve seen over the years, new navigation or other changes may grow share and/or volume to a new level but they don’t produce continued growth. In other words, you might jump up to a new height, but then you stop flying higher unless there’s actual honest-to-goodness search growth that’s also happening.

If Yahoo’s volume continues to rise according to multiple ratings services over the long term — and search-related revenues rise with it — then there’s a compelling story. So far, it still feels like the same old, same old to me — Yahoo losing people probably to Bing; Google standing well above them both with no signs of erosion.

Today’s news also highlight a long-standing issue that the industry has yet to address. Search share and search volume figures don’t tell the entire story. Both can be “inflated.” Or deflated, in a world where “blended” search might integrate information that previously required two searches to retrieve.

Revenue per search helps, but when Google doesn’t break out search revenue from display and contextual ad revenue, how much they make per search is an inaccurate guessing game that some third parties like to play. And even revenue per search might not indicate a long-term consumer trend. You can spike revenue per search by simply adding the number of ads to a page — but in turn, that might be a turnoff to searchers, leading to a long-term audience loss.

Ideally, we’d have some industry-agreed benchmarks. Don’t get your hopes up about that, however.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories