Bing & Yahoo Search Share Up, But Google Has Little To Fear

Once again, Yahoo and Bing have gained share against Google, in the latest monthly search market share figures from comScore. However, questions remain on whether the growth from “slideshow” presentations should be counted as “real” searches. Meanwhile, on a volume basis, Google continued to grow, not drop, its market share. comScore’s latest figures — the […]

Once again, Yahoo and Bing have gained share against Google, in the latest monthly search market share figures from comScore. However, questions remain on whether the growth from “slideshow” presentations should be counted as “real” searches. Meanwhile, on a volume basis, Google continued to grow, not drop, its market share.

comScore’s latest figures — the number of searches conducted in the United States in June 2010 — were released to financial analysts yesterday. Those analysts quickly put out research notes finding that Yahoo and Bing’s growth continues to be heavily influenced by controversial slideshows and “contextual searches.” The data will also be released to the public shortly (note, it’s now up here).

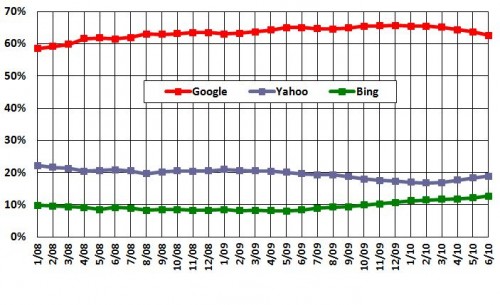

Google’s Share Keeps Dropping…

Here are the June figures:

- Google: 62.6% – down 1.1 points from 63.7% in May

- Yahoo: 18.9% – up 0.6 points from 18.3% in May

- Bing: 12.7% – up 0.6 points from 12.1% in May

- Ask: 3.6% – unchanged

- AOL: 2.2% – down 0.1 points from 2.3% in May

As you can see, Google’s lost share, as it has since March of this year:

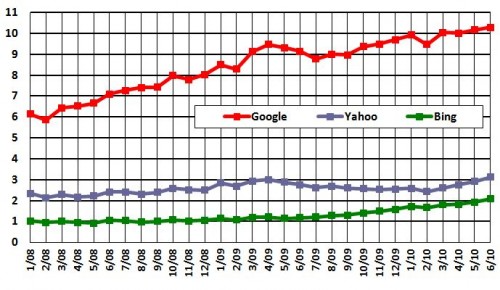

But Google’s Search Volume Rises

However, on a search volume basis — the actual number of searches each search engine handles rather than the share of all searches in the United States that they process — the Google picture is much different:

Again, June figures — but this time looking at number of searches handled for the three major search engines:

- Google: 10.292 billion – up 134 million from 10.158 billion in May, a 1.3% increase

- Yahoo: 3.114 billion – up 206 million from 2.908 billion in May, a 6.6% increase

- Bing: 2.082 billion – up 152 million from 1.930 billion in May, a 7.3% increase

All three players are up, unlike the share figures, where Google is down.

If you’re trying to better understand the important difference between search share and search volume, see our article from When Losers Are Winners: How Google Can “Lose” Search Share & Yet Still Stomp Yahoo.

Even Higher Volume Growth Doesn’t Help Much

Of course, Yahoo and Bing posted much larger growth in search volume than Google. If that growth were to continue in the long term, Google would need to be seriously concerned, right?

Not at the current growth rates. It would take a very long time for Yahoo and Bing to close on Google’s overall volume, despite their high single-percentage gains.

Consider these figures, the net gain for Yahoo and Bing — the number of actual searches they grew beyond what Google grew last month:

- Yahoo: 72 million

- Bing: 18 million

Those are tiny numbers. Google handles over 10 BILLION searches per month. Yahoo’s at 3 billion searches, a gap of 7 billion from Google. At the growth rate above, it would take about a year for Yahoo to close the gap to 6 billion.

Bing’s at 2 billion searches, an 8 billion searches gap from Google. At the rate above, it would take Bing 5 years at the rate above to close the gap to 7 billion.

Of course, Google might not keep growing. Of course, Bing and Yahoo could pose even higher gains in the future. But then again, there are already serious question about the gains they’ve posted so far.

Slideshows Are Search?

In particular, things like photo slideshows are used by both Yahoo and Bing to generate “searches” that might not reflect actual search behavior at all. Our article from last month, Time To End The Bull Search Engine Share Figures?, explains this in more depth.

When these types of slideshow searches are removed, the gains by Yahoo and Bing are more modest. For instance, according to Citi analyst Mark Mahaney research report, here’s how the June share and volume figures change when slideshows are removed:

- Google’s share rises from 62.6% to 66.2% – volume stays same at 10.3 billion searches

- Yahoo’s share drops from 18.9% to 16.7% – volume drops from 3.1 billion searches to 2.6 billion searches

- Bing’s share drops from 12.7% to 11.0% – volume drops from 2.1 billion searches to 1.7 billion searches

The Mobile Wildcard

Mahaney also makes an important point about mobile search volumes not being a part of these figures:

comScore doesn’t include Mobile Search results, which are likely growing very rapidly for GOOG — perhaps triple-digit Y/Y growth % and now accounting for almost 10% of total GOOG queries.

If Mahaney’s estimate is correct — 10% of Google’s total query volume is coming from mobile devices — then a considerable number of searches are not being counted.

AdWords Performance

The background to all this is, of course, money. More market share potentially means more money. But if the slideshows generate searches without a related increase in ad clicks, they help Yahoo and Bing little other than in public relations.

That leads to a related stat, this one put out by UBS fiancial analysts Brian Fitzgerald and Brian Pitz is about the performance of AdWords that show product images:

We recently ran searches on a basket of 65,000 commercial keywords on Google and found ~11% of all search result pages yielded a product image ad or what Google is calling ‘Product Listing Ads’ in the sponsored listings. In addition, our checks suggest these product ads have significantly higher (+40- 50%) better click-through rates than conventional text sponsored listings. The program is currently in Beta, with the program expanding to more merchants and users over time.

In short, instead of growing share through interface slideshow games, Google’s potentially growing revenue through interface and display changes.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. Search Engine Land is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.