NetRatings: Google Spike, Live.com Rise In February 2007

Earlier I wrote of the latest search popularity stats out from Hitwise and said those from other companies would be coming. Next up, Nielsen//NetRatings. The most recent figures out (PDF format) for February 2007 from NetRatings show a significant Google gain at Yahoo’s expense. Live.com also shows a notable gain. But the figures also show […]

Earlier I wrote

of the latest search popularity stats out from Hitwise and said those from other

companies would be coming. Next up,

Nielsen//NetRatings. The most recent figures

out (PDF format) for

February 2007 from NetRatings show a significant Google gain at Yahoo’s expense.

Live.com also shows a notable gain. But the figures also show the "search pie"

itself grew massively.

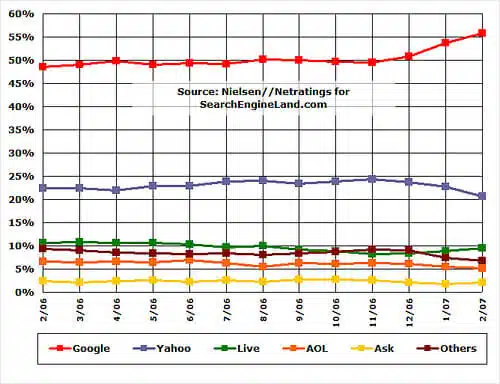

Here are the figures for February 2007, showing the estimated percentage of

all home and work searches done in the United States that were handled by each

search network:

- Google: 55.8%

- Yahoo: 20.7%

- Microsoft Live: 9.6%

- AOL: 5.1%

- Ask: 2.0%

- Others: 6.8%

Here’s a look over the past year:

The trend shows that Google, relatively steady over the past year, suddenly

gained about 5 percent of the overall "pie" of searches happening. It rose from

49.5 percent in November 2006 to 55.8 percent in February 2007.

Yahoo, also mostly steady over the past year, showed a drop at the same time.

It decreased from 24.3 percent in November to 20.7 percent in February 2007.

As for Microsoft, after nearly of year of steady declines, it posted three

months of consecutive growth, rising from 8.2 percent in November 2006 to 8.4

percent in December 2006, then 8.9 percent in January 2007 to 9.6 percent —

nearly a full percent gain — in February 2007.

I wrote before on

how Compete was also showing a Microsoft gain while Hitwise didn’t. Now we have

a second rating service finding a Microsoft rise. I’ll be looking at comScore

figures next.

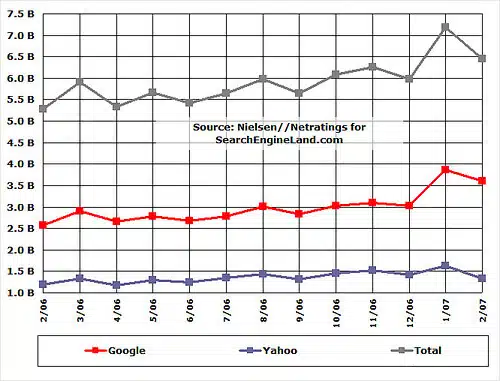

As for Yahoo, an important note. While it showed a drop in share — a

substantial drop — it’s important to note that the raw number of searches

remained pretty high. Consider this chart below:

In that chart, I’ve zoomed in on the number of searches conducted at Google

and Yahoo over time, as well as total searches. This is in contrast to the

percentage of total searches. The chart shows billions of

searches (and thanks to

this advice on how

to get billions to show in Excel without all those zeros):

See how in January 2007, total searches suddenly shot up from the 5.5 to 6.0 billion

range it had been at for several months to over 7 billion searches? See also how

that’s nearly the same amount of increase on Google? Somehow, Google gained about a billion new searches that hadn’t been part of the search pie

before. My guess is that this comes from YouTube traffic being counted as

"search" traffic for the first time and added

into Google figures [NOTE: NetRatings tells me no, more coming]. As a result, Google is seen as having a bigger share of the

existing pie even though Yahoo hasn’t lost that much search traffic.

I’m not taking away from the fact that Yahoo saw a decline. It did. It went

from 1.5 billion searches in November 2006 to 1.3 billion in February 2007. But

the percentage of overall share can be misleading if you suddenly have the

search pie expand. In January 2007, Yahoo had a 22.7 percent share of that pie

— a drop from the previous month, as the share trend chart shows. However, it

also had 1.6 billion searches, a rise over the previous month and more searches

than it had compared to any month on the previous year.

I’m checking with NetRatings about what caused the search pie to expand so

dramatically in January in Google’s favor and will postscript here when I hear

back.

Postscript: NetRatings sent me this:

As with every year, the release of our January data includes updates to our annual population and universe estimates. Also, as part of our ongoing commitment to accurate representation of the market, we occasionally make adjustments to our panel weighting targets. These targets are important to monitor and update as appropriate because they help ensure that the activity of our panelists reflects the real activity of the universe(s) we measure. With the January dataset, we made minor adjustments to our behavioral weighting targets. The actual impact on the data is nominal, and the month-over-month & year-over-year changes in activity are based on real and verifiable consumer activity. This change ensures stability and accuracy in each of our MegaView reports.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories