75% Of Small & Medium-Sized Businesses (SMBs) Say Internet Marketing Is Effective

Columnist Myles Anderson shares key stats from BrightLocal's most recent annual SMB Internet Marketing Survey.

In October-November 2014, we (BrightLocal) conducted our annual SMB Internet Marketing Survey.

This is an online survey of businesses with 1-50 employees in which we ask them about their attitudes and use of internet marketing, mobile marketing and marketing services. We ran the survey in conjunction with ChamberofCommerce.com, and we received 736 complete survey responses.

Ninety-five (95%) of respondents are located in North America (92% U.S.; 3% Canada), primarily because this is where our marketing of the survey was focused.

The following charts represent some of the key findings of the survey. The full survey results and charts can be viewed on BrightLocal.

Q: How Much Money Do You Allocate To Marketing Your Business Each Month?

Key Findings:

- 70% are spending less than $500 on marketing per month (vs. 73% in 2013)

- 83% are spending less than $1,000 on marketing per month (vs. 85% in 2013)

- Just 16% are spending more than $1,000 on marketing per month (vs. 21% in 2013)

There has been little change in the distribution of marketing spend since 2013. The majority of SMBs continue to spend less than $500/month on all their marketing activities, with only a fraction of this allocated to “internet and mobile” (more on this later).

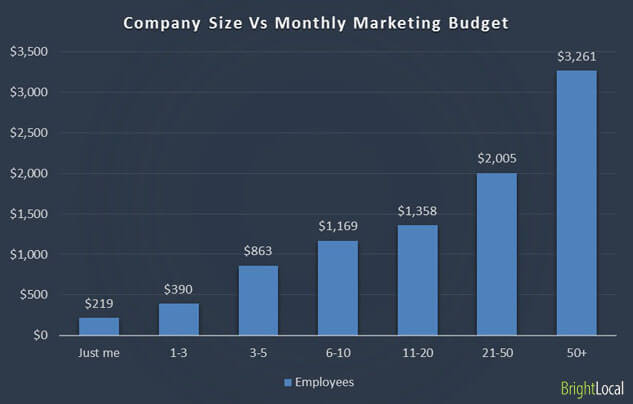

The levels spent vary between industries and also business sizes. We will release some further data/charts comparing industries, but we have analyzed Company Size vs. Marketing Budget, and there is a clear, if unsurprising, correlation here:

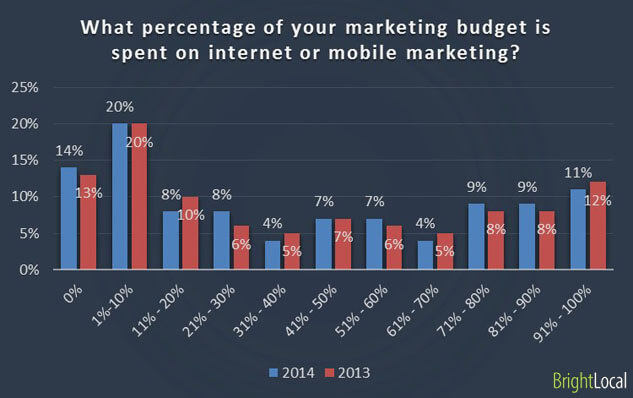

Q: What % Of Your Marketing Budget Is Spent On Internet Or Mobile Marketing?

Key Findings:

- 34% allocate less than 10% of their marketing budget to online channels (vs. 33% in 2013)

- 50% allocate less than 30% of their marketing budget to online channels (vs. 49% in 2013)

- 29% allocate more than 70% of their marketing budget to online channels (vs. 28% in 2013)

It’s clear that some SMBs don’t (or barely) engage in online marketing — one third allot less than 10% of their marketing budget to internet or mobile. Others have thoroughly embraced it as their preferred means for growing their business.

It’s likely that different industries and business sizes invest more in online than others, and we’ll be following up with this analysis shortly. (We haven’t crunched the numbers yet.)

For search agencies/consultants, this demonstrates the importance of targeting and pre-qualifying potential customers before you go after them. By understanding their budget levels and commitment to digital marketing, you can ensure you focus on the highest value leads and niches.

Q: In Next 12 Months, Do You Plan To Increase The Money You Spend On Internet Marketing?

Key Findings:

- 37% plan to increase their internet marketing spend over the next 12 months (vs. 21% in 2014)

- 47% are unsure (vs. 47% in 2013)

- 16% have no plans to increase their internet marketing spend in the next 12 months (vs. 32% in 2013)

Great news for the industry! Confidence is up, and SMBs are looking to increase their spend. Nearly 40% of SMBs are looking to spend more on Internet marketing in 2015 than they did in 2014, and many more are still undecided, so this number will rise.

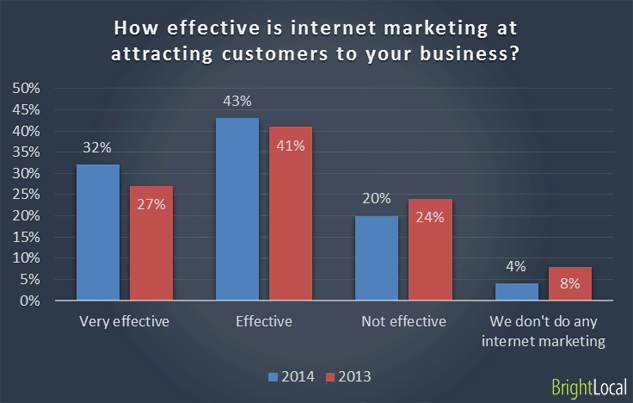

Q: How Effective Is Internet Marketing At Attracting Customers To Your Business?

Key Findings:

- 32% find internet marketing to be “very effective” at attracting new customers (vs. 27% in 2013)

- 75% believe that internet marketing is ‘effective’ or ‘very effective’ at attracting new customers (vs. 68% in 2013)

- 4% don’t do any internet marketing (vs. 8% in 2013)

More good news for the search industry: SMBs increasingly believe that Internet marketing delivers good returns for them.

This lines up with the findings in the previous chart: great confidence = greater spend

Q: Which Of These Success Metrics (KPIs) Are You Most Concerned With?*

Key Findings:

- Phone Calls are the most valued success metric — 31%

- Website Traffic came in second — 20%

- Search Rankings came in third — 20%

For those who work with SMBs, it’s not surprising to hear that phone calls are such a valuable success metric — the phone ringing means business!

It’s surprising to see that “Walk-in Customers” and “Website Enquiries” are lower down the priority list than Site Traffic and Search Rankings. Some of those surveyed won’t deal in walk-in customers, so this may skew the data point, but I would have expected enough businesses to have this type of customer to put it above phone calls.

We should also consider that this survey is about Internet Marketing, and tracking walk-in customers back to online marketing activities is tricky, so some SMBs may downplay or dismiss the role that online has in driving physical business.

It’s interesting to see that Search Rankings continue to be regarded so highly (they’re almost becoming a taboo subject in the search world these days). But SMBs still regard them as having significant value and equate high rankings to more sales. So, it appears that Search Ranking reports will be with us for a little while yet!

*Note: We didn’t ask this question in 2013, so we don’t have Y-on-Y comparison data.

Comparing Business Size & Type

As we delve further into the data, we will publish insights comparing Company Size and Company Type. These will be published in due course so please look for the follow up post.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories