As advertisers cut back, U.S. paid search spend estimate is slashed by billions

eMarketer argues paid-search is more vulnerable now than in past recessions.

As the pandemic has unfolded, initially bullish ad-spending forecasts have given way to more cautious or pessimistic projections. Such is the case with eMarketer’s newly revised search-spending numbers for the first half of this year.

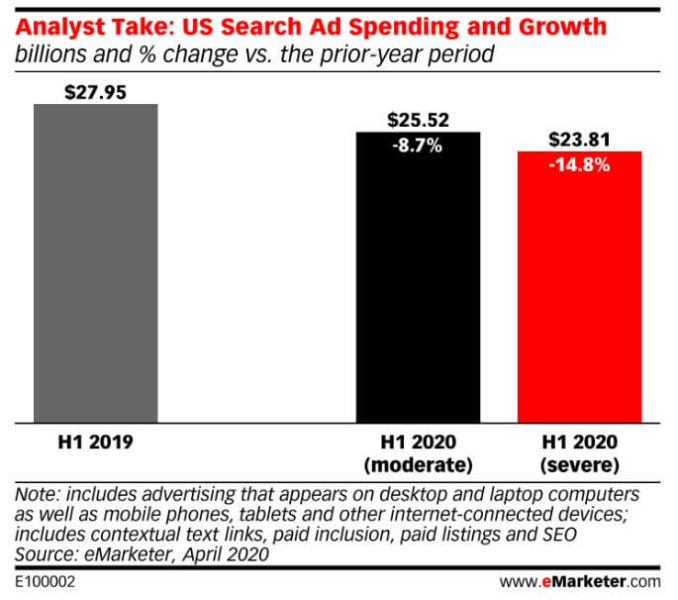

A drop of $6 to $8 billion. The firm revised its forecast for the first and second quarters of 2020 down, from nearly $28 billion to between $25.5 and $23.8 billion. That’s a decline of $6 billion to $8 billion compared with earlier projections.

Emarketer said that first-quarter search spending “came in somewhere between a year-over-year spending increase of 2.8% and a decline of 0.2%.” The firm assumes a pull-back starting in March and overall second-quarter year-over-year declines of 20% to 29% through the end of the quarter.

Search may not be “recession proof.” The online marketing environment is uncertain and volatile right now. Accordingly, eMarketer says it’s modeling a “range of possibilities for how advertisers in various industries will react to the new environment in terms of their search budgets.”

Many marketers assume that paid-search is “recession proof” and therefore will remain stable or even grow during a downturn. It’s a performance medium that offers easier to prove ROI than many other channels. However, eMarketer argues, “there are at least two major downward pressures on search ad spending during the current crisis.”

The logic behind the new forecast. The first is the mechanical fact that “Search budgets aren’t committed in advance and can be paused or pulled at any time.” In addition, eMarketer argues that “Search is a lower-funnel ad channel that’s typically geared toward driving conversions—including in-store—and many of those conversions can’t happen right now because of quarantines, inventory shortfalls and related problems.”

In support of this latter argument, it cites Amazon’s focus on essential products and Tinuiti’s report that Amazon has reduced its search spending on Google: “Amazon has reportedly pulled back significantly from spending on Google search ads, likely because it doesn’t want to drive additional demand when it’s already running close to capacity,” eMarketer observes.

Other downward revisions. Roughly two weeks ago eMarketer revised its global media ad spending forecast downward but still argued that ad spending will grow by 7% to $691.7 billion in 2020 compared with its previous estimate of 7.4% growth and $712 billion overall. In light of recent events and the prospect of an extended downturn, this may still be too bullish. For one, that revision factored in the Summer Olympics still happening.

Separately, Magna Global reduced its U.S. ad forecast this year, projecting a 2.8% decline where it had previously expected 6.6% growth. Both Magna and eMarketer assume ad spending will return to healthier levels in the second half.

Why we care. This crisis has shaken up every aspect of consumers’ lives, and that is reflected in shifts in demand and search behavior. With that, there have been winners and many more losers — businesses that have seen demand dry up or face existential supply chain challenges.

The disruption to search and digital ad budgets started in early March, and within a week, things had rapidly shifted with many more PPC advertisers pausing campaigns. For those still running ads, CPCs and CPMs had begun falling as auction competition dried up. Brad Geddes of paid search ad testing platform AdAlysis said on Live with Search Engine Land last week that he has seen 20% to 30% of B2B clients cut spend or pause campaigns. Historically, SEM has weathered recessions at least as well as other paid marketing channels. But we’re in an unprecedented climate. We certainly hope that the Magna and eMarketer expectations for an improved second half prove accurate.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. Search Engine Land is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.