Basic Econometric Modeling: Measuring The Offline-Online Effect Of TV Advertising On Search Spend

Multi-channel advertisers often ask me how to measure the effect of their TV ads on their online marketing channels. The question is important because it is the first step in the answer to the media mix question: What is the right distribution of budget across TV and online channels to maximize return on investment. This […]

Multi-channel advertisers often ask me how to measure the effect of their TV ads on their online marketing channels. The question is important because it is the first step in the answer to the media mix question: What is the right distribution of budget across TV and online channels to maximize return on investment.

This is a tricky question to answer for the following reasons:

- TV campaigns are typically branding campaigns while search is typically DR focused.

- There is typically a halo effect in TV campaigns, e.g. when you run a TV campaign you typically see its effect last on search for a duration longer than the TV campaign.

- If the online and offline marketing teams are separate (they typically are) then the debate can be fractious.

While the econometric modeling is a vast subject, I want to present a simple method to help you answer the basic questions. We shall use the data of a direct-response advertiser that uses TV to drive people online and finish the sign up process there.

Simply put, econometric models aim to quantify the effect of several variables into a metric of interest. The basic assumption of econometric models are that the variance (fluctuations) seen in the output are due to changes in certain input variables.

In our case, we shall assume that the controlling variables for the number of brand impressions on search are a linear function of search spend and TV spend.

Since non-brand searches are influenced by many factors (not least the search engines matching algorithms), we shall only consider branded keyword metrics in this exposition.

Further, since SEM spend on brand terms is almost constant (all keywords here were bid to position 1 for the duration of the campaign),the baseline search impressions (search impressions without TV ads) can be expressed as a function of SEM spend:

Since SEM spend is constant, we can then define the impression jump as:

This simplifies to:

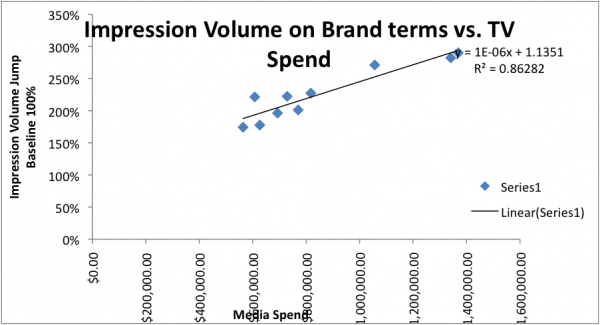

This is a simple one variable regression and can be plotted as shown:

The graph shows a strong connection between search impressions and TV spend. For instance: it shows that when TV spend is $600,000, then the impressions in search jump by 70%.

At $1.4 million in TV spend, the impression volume jumps by 200%. The R^2 of 0.86 indicates that 86% of the change in branded search impressions in this example are explained by changes in TV spend.

Limitations:

- This is a very simplified econometric model that does not account for time lag factors. If you are interested in more sophisticated time series models I would suggest looking into methods such as Holt-Winters, ARMA, ARIMA models.

- I have chosen only two factors: TV and Search spend to explain the fluctuation in search impressions. There might be many other factors that I have not accounted for to build my model. An econometric model for a large brand typically includes several macro-economic indicators as well as other marketing channels such as PR and print. Variable selection for these advertisers is an art and science in itself. As a result, while the fit of my model is reasonably good, my prediction accuracy over longer periods with the model might be poor if a yet unaccounted for factor becomes meaningful.

- You might wonder why I chose search impressions and not search conversions as my metric of interest. The reason is I typically find impressions regress much better than conversions when looking at the offline –online conversion. To connect conversions to offline spend, I would need to build a more robust model.

- This model has a basic problem in that it assumes that the properties of data fed into it have the same properties regardless of time. In other words, it assumes that the effect TV and search spend will have on search impressions is the same if the day is a prior month’s or a prior years. It also does not account for seasonal factors. While this assumption works when analyzing data from a stable period, it is clearly not true when markets change due to macro economic factors as well as due to seasonality. A sophisticated way to over come this is to use time series model , where time is a factor in the models.

I hope my exposition helps you get started in analyzing the offline-online effect or other places where detailed granular data is not available. While not the most accurate or the most comprehensive model, I have had success good success with this simple method in connecting the dots between the online and offline world when the dataset is from a stable time period. I hope you find this simple model useful, too.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories