The Cross-Border Series Part 4: Advertising In APAC

In the fourth and final installment of his series on search marketing across the globe, Microsoft's Gabriel Kwakyi discusses tips for doing business in the Asia Pacific region.

Asia Pacific, or APAC, includes countries along the Pacific Rim of Asia and Oceania, each of different sizes, cultures and developmental statuses. In aggregate, this region of about 20 countries counts near 4 billion people and $24 trillion in aggregate GDP (summed World Bank population and GDP figures, also used in the Excel charts below) and has exploded onto the digital scene.

In fact, according to a recent eMarketer study, APAC has already usurped North America for the title of global e-commerce heavyweight in 2014 and is still growing fast, with total sales estimated to exceed $1 trillion in 2017.

This final segment of the cross-border series dives deeper into the opportunity available in APAC, providing considerations and best practices useful for digital marketers looking to establish an effective strategy in the region.

How To Determine Which Countries Fit Your Strategy & Goals

One of the most important things to keep in mind when approaching APAC is that the region is highly diverse and segmented, spanning the mature countries of Australia, Japan and South Korea, the more developed countries of Taiwan, Singapore and Hong Kong and the titanic, yet still-developing China, India and southeast Asia and beyond.

Due to APAC’s broad market diversity, the first step is to determine what your primary goal and KPIs are, in order to determine which countries best fit your strategy. Is your strategy to gain mass distribution via razor-thin margins, which makes your primary KPI total or new sales volume? Or do you sell pricier differentiated products where the primary KPI is return on ad spend (ROAS)?

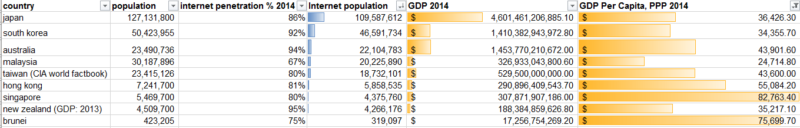

If your goal is sales volume: Offer a price point that is appealing for a wide range of customers. The countries best for this scenario are likely the most populous nations, such as China, India, Japan and Indonesia; but remember that only a certain subset of a country’s population is reachable via a digital marketing campaign, so be sure to consider the impact of internet penetration rates.

[click to enlarge]

If your goal is ROAS: determine what price point range is acceptable, and then use GDP per capita as a filter metric to determine which countries have more customers that fit your target market. In this scenario, the countries that may better fit your strategy include Japan, South Korea and Australia for lower price points, and Taiwan, Hong Kong and Singapore for higher price points.

Further refine for the right metrics: Although broad metrics like population, GDP and even aggregate e-commerce activity are directionally helpful, they can sometimes allow larger countries to overshadow smaller countries that may better fit your strategy, simply due to size or income disparities.

Analyzing average customer or average transaction e-commerce spending are two examples of more precise and unbiased metrics. For example, consider Australia and South Korea, which per an Emarketer study will both see much lower total e-commerce activity in 2015 compared to India and China. Yet according to annual average customer data, Australians and South Koreans far outspend their APAC counterparts. Remember to consider the impact of currency exchange rates, which can also factor into how countries rank in your strategic analysis.

If your goal is growth: It’s well known that China is the #1 growth market worldwide; in fact, per eMarketer data, the regional tiger recently passed Japan as the main engine of APAC’s e-commerce activity, and China’s e-commerce contribution to APAC is even projected to reach 70% by 2018.

What digital marketers may not be as familiar with is the fast-rising group of APAC countries referred to as the “South East Asian 6” (SEA 6), including Malaysia, Vietnam, Singapore, the Philippines, Thailand and Indonesia.

“Travel and hospitality are two of the top verticals for cross-border inbound marketing to Asian countries and especially Singapore,” comments Jonathan Wong, search advertising evangelist at Bing; a ZDnet article provides a concrete example, citing 25% of the average Singaporean’s $1,861 online spend per year as travel-related, with the country’s 2014 e-commerce spend totaling $3 billion, a 38% increase over 2013.

Furthermore, Singaporeans buy more than 50% of their online purchases from cross-border merchants, per a Borderfree report.

Nick Waters, CEO Dentsu Aegis Network Asia Pacific, adds, “Southeast Asia is seeing strong growth in ad spend, particularly in Indonesia and Vietnam, as disposable income of large population groups increases.”

Digital ad spend in Indonesia is even projected to surpass India in 2016, per an eMarketer study, as marketers target customers in this rapidly growing market where, according to e-commerce industry executives in a Financial Times article, sales will rise 300% YoY, from an estimated $1–$3 billion in 2014, to $10 billion by the end of 2015.

That said, opportunity does not arrive without challenges; the article also touches on some of the obstacles to Indonesia’s e-commerce opportunity, including the need for extra customer service hand-holding, difficult shipping delivery logistics, slow internet speeds and low adoption of online payment methods.

Don’t Forget To Factor In Business Limitations

In addition to determining which countries are most attractive to open up shop in, you’ll also want to understand how limitations factor into your strategy. Do you have the ability to translate into the local language and set up a native customer support infrastructure, such as a call center? Are you able to partner with a local company in order to navigate and adhere to local regulations? Do you have a mobile optimized website, app and conversion funnel?

Depending on your constraints, certain countries that may be less appealing from a goal/KPI standpoint may take precedence over others from a limitation standpoint. For instance, if you do not have support for local language translation, your best bet is to begin with the native English proficiency-level countries of Australia and New Zealand, with initial expansion to Malaysia and Singapore, followed by South Korea, the Philippines and India after that.

Tips On How To succeed When Marketing To APAC Customers

In addition to determining which countries make the most sense to include in your strategy, you’ll need to internalize considerations and best practices to succeed when marketing to APAC customers.

Translate to be understood. If your strategy aims to tap into the main opportunity that exists in APAC, then translation is a must-do. While some countries do share languages, it is important to consider the nuances between and within countries.

For instance, in an effort to increase nationwide literacy in the late 60’s, the Chinese government created simplified Chinese characters, which are used by mainland China and Singapore; yet Hong Kong, Taiwan and the region of Macau communicate via traditional Chinese characters.

Singapore has four official languages including simplified Chinese, Tamil and English, yet it also shares the Malay language with Malaysia, Indonesia and Brunei. In India, the majority of people speak Hindi and English, however some estimates peg Indians as speaking as many as 780 different languages. Do your due diligence and translate your keywords, ads and website or mobile app into the right language to provide an experience that customers can and will want to buy from.

Enable for mobile: As in Latin America (LATAM), mobile usage in APAC is wildly popular. A mobile commerce study of Thailand, done by commerce and mobile communications/payment app LINE found that while the ratio of mobile buyers to browsers was much smaller than desktop’s ratio, the majority of purchases in the study (56%) were still done via mobile devices.

In China, a report by the China Internet Network Information Center indicated that the percentage of Chinese accessing the internet via mobile phone (83.4%) exceeded that of those using computers (80.9%) in June 2014, and that the percentage of all Chinese who shopped on their mobile devices passed one-third, rising from 28.9% to 38.9% in just six short months.

Plan for alternative payments. Also in line with LATAM challenges, most customers in APAC have very limited access to credit or debit cards, preferring to use alternate methods, led by cash on delivery, but also including domestic platforms such as unionpay or alipay in China and the international favorite, PayPal. Korea is the region’s notable high-tech exception, with an average of more than four cards per customer, per an investigation by Reuters.

William Lai, search advertising evangelist for Microsoft Bing, offers an option for businesses looking to overcome some of these challenges while in the testing phase for new markets: “Initially, marketers should leverage e-commerce giants to get a foot into the market, which provide support such as online payment systems. Examples include Taobao, Tmall and JD.com in China, Yahoo in Taiwan and Hong Kong and Momo in Taiwan.”

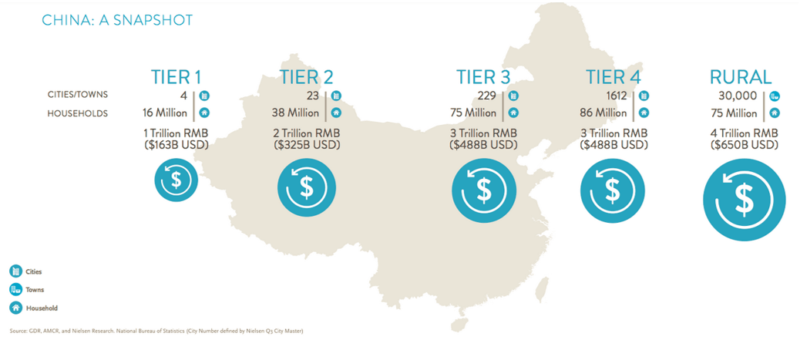

Geographic targeting by city tiers. Another concept that is important to consider when setting up a strategy in APAC countries such as India or China is the difference in customer types found in different tiers of cities, which can affect both purchase capability and intent. William Lai explains further: “Generally speaking, advertisers target the tier 1 & 2 cities due to their larger portion of affluent consumers with higher purchasing power and affinity for foreign brands. However some studies have found that the lack of physical store presences and higher internet penetration make consumers outside Tier 1 & 2 cities more dependent on e-commerce.”

Below is a breakout of consumer spending per a 2013 Nielsen report titled, “A New Era in Consumption,” and a list of China’s city tiers can be found here, per IMF rankings.

Optimize for APAC shopping preferences. An in-depth Fed Ex + Forrester cross-border study provides great takeaways on the e-commerce habits of APAC shoppers. Specifically relevant for SMBs, the study found that 57% of APAC shoppers found businesses of this size as the least preferred business entity to buy directly from, citing concerns over verifying reputation (46%) or moreover, a lack of a reputation (41%).

The study also revealed the top three concerns for APAC shoppers, including high shipping costs (52%), concerns of fake/inferior products (46%) and long delivery times (45%). Additional takeaways from the study include that online search is the most popular discovery method (used by 59% of surveyed customers) and that the top two reasons APAC customers choose to shop cross-border are to find items not available in their home country or available at a lower price (74% each).

This means that an excellent way to win over APAC customers is to market desirable niche products with limited availability in customers’ home countries. Per a similar PayPal study, both China and Australia shared an affinity for buying from the US when doing cross-border purchases (China 84%, Australia 69%), with top categories including clothes, shoes and accessories, health and beauty and personal electronics.

Also, be sure to offer fast, low-cost shipping, and regularly review competitive prices to divest products that you cannot provide compelling pricing for. Better yet, estimate the ratio of demand to competition for products in your portfolio by calculating an estimated ads per search metric, and pounce on gaps in demand coverage.

Lastly, to succeed in marketing to customers in APAC, it’s also important to clearly communicate a sterling reputation with credible evidence for both your brand and the quality of your products.

Localize your product, brand and business. While language translation and localizing terms such as currency are necessary activities, they are just a starting point; true localization involves understanding and adapting all relevant aspects of your brand to fit the local culture, including product, marketing/sales, customer services and other important customer touchpoints.

The topic of culture is a vast and ever-changing one, but here are some examples to help provide a starting point for learning about your new APAC customers: While green may be the color synonymous with “good” in the west, Chinese consider red to be the color of good fortune.

Most Westerners would not bat an eye at tearing apart thoughtfully wrapped presents at a birthday party, but most Japanese would feel insulted and taken aback, considering the care involved in the packaging and presenting of a gift nearly as important as the gift itself. Per a Fox News article, while most Western cultures symbolize marriage by wearing a single ring or wedding band, marriage in Indian society is often symbolized by wearing a variety of jewelry.

For the more visually inclined, check out this series of insightful illustrations, by a woman born in China and educated in Germany, which depicts differences between western and eastern societal concepts.

Most brands are built to fit the concepts and norms of one specific culture, and if marketed to other cultures without adaptation, they may not make sense to its new customers, hampering chances of success. Conduct user research to determine your local brand strategy, adjust your messaging and be ready to optimize based on how your brand does or doesn’t resonate with customers in APAC.

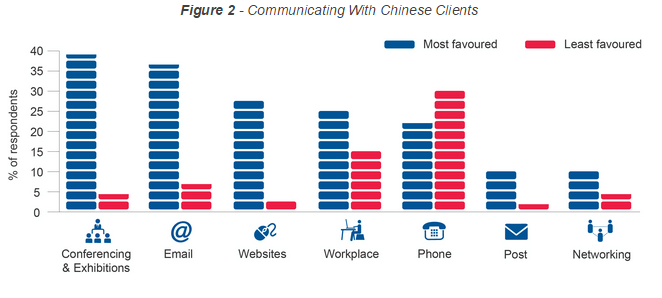

Not only does this idea apply to B2C e-commerce marketing, but it is also relevant for B2B marketing. Here are some takeaways from a B2B International report; recall that these Chinese B2B trends echo B2C trends, where one of the biggest turn-offs for e-commerce customers in APAC is a lack of reputation or concern over fake/low-quality products.

I want to conclude by giving a big thank-you to the following APAC marketing experts who contributed advice: William Lai, Yiping Cheng and Jonathan Wong.

Thanks for reading. Please feel free to share and comment if you have additional tips or lessons learned, and happy optimizing!

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land