Did International Markets Cause Google’s Loss Of Love On Wall Street?

Wall Street wasn’t terribly impressed with Google’s figures for the last quarter of 2011 announced after the bell last thursday. To a normal person, you would think that generating $2.71 billion profit and significantly beating your own previous quarters would be a cause for celebration. But these aren’t normal people and this isn’t a normal […]

Wall Street wasn’t terribly impressed with Google’s figures for the last quarter of 2011 announced after the bell last thursday. To a normal person, you would think that generating $2.71 billion profit and significantly beating your own previous quarters would be a cause for celebration. But these aren’t normal people and this isn’t a normal market and share values immediately dropped by 10%.

Nor is Google without blame. I started digging into Google’s figures expecting to find that Google had actually seen a fantastic success at the end of 2011 – but had miscommunicated this with the city.

There is some truth in this but it is, by no means, the whole story. Google didn’t and doesn’t communicate fantastically with city slickers – but there are also some surprises in the figures when you look beyond the headlines.

A Wall Street Communications Issue Or The Figures?

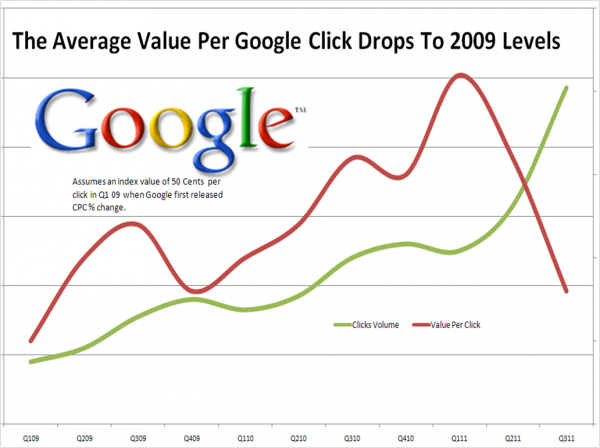

On its webcast, where Google explained its figures, there was some puzzlement over an 8% drop in the value of clicks combined with a 34% increase in the number of clicks.

This definitely worried some analysts – it’s a complicated piece to explain and Google didn’t say, “The value of our inventory dropped, but we sold much more inventory” which actually might have been a better presentation of the truth.

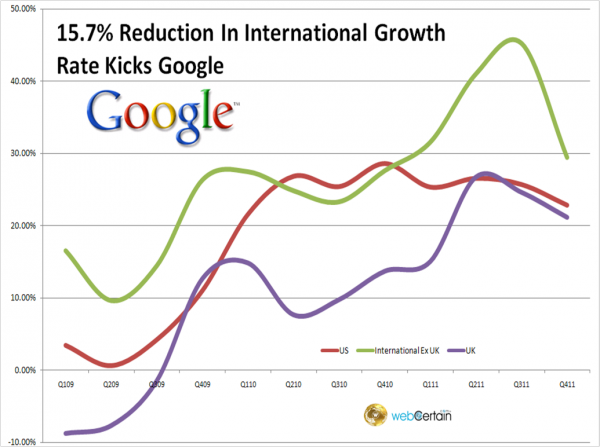

However, looking at the figures in more depth what was interesting was that Google seems to have performed relatively better in the US during the last quarter growing by 12.7% over the previous quarter. The UK grew by just 1.6% quarter on quarter and the rest of world managed just 6.8%.

However, last year at the same time, Google was reporting 15% growth in the US, 4.5% in the UK and 19.85 in the rest of the world – so there does appear to be some softening of growth.

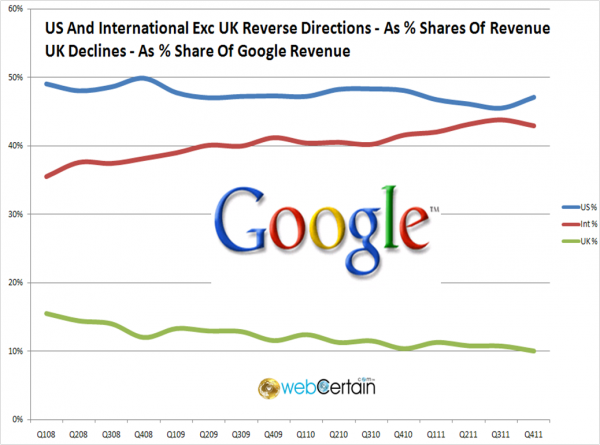

Share Of Google Revenue By Region Q411

When you look at the growth rates over time on the chart below, it all becomes a little clearer. Growth is “drooping” in the US and the UK, but has fallen back very sharply by some 15.7 percentage points in the rest of the world. Now, not many folks would sniff at an almost 30% (29.5%) rate of growth internationally, but this is the city we’re talking about.

In its announcement, Google talked about launching new ad formats which had reduced the revenue per click – analyst hearts could be heard beating faster.

Then like me, they popped the new growth rates they’d just heard into tracking spreadsheets and spotted the droop. Whoops. 2 + 2 = 15. Or rather, new ad formats + decline in revenue per click = seriously worrying downward trend.

International Growth Rates Q411

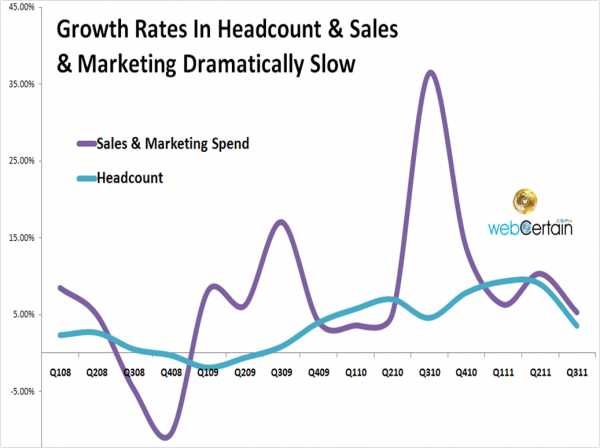

You will recall that Larry Page worried the city on his first set of figures by revealing huge growth in sales and marketing costs and in the headcount of people employed by Google?

The promise was all to do with what he now terms “velocity”. He wanted to get Google’s core products to a wider audience faster, before the doors closed and the first mover advantage was gone.

So are we seeing an appropriate return from the that investment? The uptick in investment started at the beginning of 2010, as you can see below. Would you expect a return by the end of 2011 and roughly 8 quarters?

The Investment In Marketing & People Must Show Results

People I’ve spoken to about changes in search technology tell me it can be as long as two years before you see the fruits of your labor.

So we should really have seen it by the end of 2011 and mid-2012 will definitely have to show some serious uplift if Larry Page’s dream is not to begin to be heavily questioned by analysts and shareholders. The stopwatch is running, the finish line is in site and at the moment Google isn’t going to hit the tape as it should.

Google Headcount And Sales Marketing Q411

But it also seems that Larry Page and Patrick Pichette, CFO have already spotted the danger as you can see above. The rate of growth in headcount and in sales and marketing costs softened already in the last quarter of 2011. Don’t forget though, these figures are percentages – the spend is still growing, but now by less than the company is growing.

Turning to the topic of inventory and the value of a click, Google has been providing up and down percentages for sometime, so below you’ll see a model based on all clicks having a value of 50 cents at the beginning of 2009.

In fact, the shape of the graph doesn’t vary regardless of the value – but it doesn’t affect the average value axis which is not shown here because it is simply a guess.

Average Google Value Per Click Q411

What you can see from the chart above is that in fact there has been a two quarter drop in the value of clicks which has the result that a click today has roughly the same value it did back in the depths of the 2009 recession. The clicks volume has naturally increased to compensate.

This is potentially good news for smaller businesses and for adaptible search marketers since if there are many more clicks to fight for at lower value – there will be opportunities for some to capture leads or business and to really make a mark.

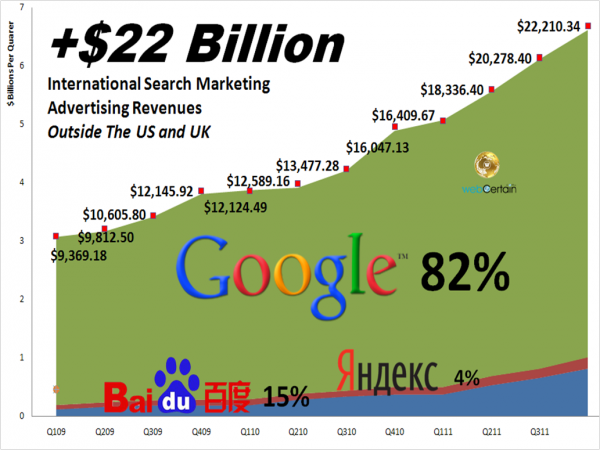

Google's Rough Market Share Outside US And UK Q411

The above chart warrants some explanation and some words of caution. We are only looking at Google, Baidu and Yandex figures to create the shares above and are ignoring Seznam, Naver and Yahoo-bing.

However, even when those figures are added back in, it is unlikely this picture would be that much different. Google is the clear leader in the rest of the world (excluding US and UK) but it’s share does appear to eroding very slightly at the edges.

Is Google Affected By Fear Of Losing Leadership?

Google will have much more data and analysis than this – but it might well explain the behavior of the company in terms of its sales and marketing and recruitment efforts.

One of the latest Googleplexes to open was in Paris for the purpose of targeting the Middle East and Africa, for instance.

Rough Search Market Size Rest Of World Q411

$22 Billion – Now That Is Good News!

There is also definitely good news for international search marketers in Google’s figures and in the chart above. The global search market (yes with a little display inter-mingled) is at least $22 billion!

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories