How the EU fine will ruin Google Shopping for the consumer

What will be the impact of the European Union's recent antitrust fine against Google? Columnist and shopping ads expert Andreas Reiffen weighs in.

As a paid search and shopping platform, Google is our most important partner. This doesn’t mean that I would refrain from highlighting critical aspects of things Google is doing. I’ve written about their low-price bias numerous times and the advertising digital duopoly created by Google and Facebook that puts retailers in a tough spot.

That being said, this new European Union (EU) fine makes absolutely no sense.

EU antitrust regulators recently slapped Google with a 2.4 billion-euro fine for favoring its own shopping search results over those of other price-comparison websites.

Now, the fine itself, while it may sound huge to you and me, is a drop in the bucket for an entity like Google. When your market value is 90 billion, fines like these aren’t necessarily that big a deal.

What concerns me (and, from the sounds of it, Google) are the regulatory changes that may force them to give equal treatment to smaller price-comparison services that compete with Google Shopping ads, which appear when people search for products.

Right now, Google Shopping is reserved for retailers alone. Price comparison sites like Idealo or Ladenzeile in Germany are not allowed to put ads through Google Shopping. Nor does Google show Shopping ads from its direct competitors, like Bing and Amazon.

Now, I’m not one of those uber-capitalists who think it’s life or death out there. More competition is good and indeed needed, especially when it comes to online advertising. But what the EU fails to understand is that forcing Google to show more price-comparison services creates a bad user experience for those of us who actually use Google.

Let me explain.

Why Google Shopping works

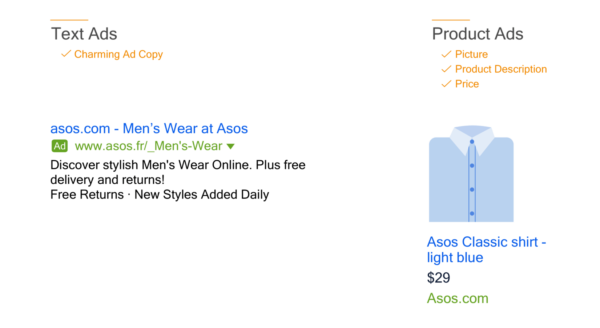

Google Shopping only works as an ad platform because it is pleasant to use from the perspective of the consumer. If you’re looking to buy a product, you can get a lot more of the relevant information up front from a Shopping ad than you can from the corresponding Text ad.

Google doesn’t specifically state how many users click on PLAs vs Text ads, but retail spending data would lead us to believe it’s significant.

Because Shopping reaches people lower in the funnel, they also convert better than Text ads. Our internal data shows that 80 percent of Shopping ads convert within the first five days (compared to 13 days for Text ads) and that Shopping ads bring in more than double the number of conversions. These are people who have done their research and are searching for product-specific terms because they are ready to buy.

Google has spent a lot of effort testing and perfecting these ads over time to make sure the user experience is as strong as possible for the consumer, and therefore the ad medium is highly enticing to retailers. To that end, there’s a reason they didn’t let price comparison sites into the party.

Ruining the user experience

Forcing Google to allow price comparison sites, or eventually even Bing/Amazon, into their Shopping auction adds another step for consumers to get to the products they want. It essentially forces them to go through a third party.

Right now, you search for a product on Google, spy the one you like in the Shopping ads section, and presto — you’re on the retail website with your first click. By adding the third step of going to a comparison price engine before you get to the retail website, you’ve complicated the process.

Users do not like complicated. The more clicks you put between someone and the end goal (buying a product) the less likely they are to cross the finish line. Having to go through a third party to reach the product you want is a terrible user experience.

And if the experience becomes too poor, consumers will ultimately stop using the service.

Does it really increase competition?

By letting price comparison sites advertise through Shopping, Google actually stands to make more money in the short term. More companies advertising in Google Shopping means more competition for traffic, and therefore, higher CPCs.

Most aggregation services have millions of products available, giving them an astronomical number of search terms for which they could run. They’re not shy about spending on digital advertising, either. I’d estimate that comparison price engines collectively spend more than 250 million euro/year on text ads in the EU.

If CPCs from all these new players get too high, it could push out a lot of the small to mid-size retailers, making it impossible for them to compete. This would ruin the user experience even further and ultimately reduce competition in Shopping. Google was definitely thinking long-term when they decided to exclude price comparison sites from Shopping.

Whether the court’s decision will have any impact at all is still a big question mark. Sites like Idealo have to play an arbitrage game, which means they have to pay less for a click on Google than what they receive from their partners for a click-out. Alternatively, they’d need to generate several clicks to partner sites from a single click coming from Google Shopping. Time will tell whether this will be viable, or to what extent.

What’s a poor Google to do?

Google only has 90 days to comply with the EU’s demands, and it will be interesting to see what they decide to do.

One potential option is for them to give slightly lower Quality Scores to ads created by price comparison companies. It’s very likely that this would already be enough to prevent them from doing this sort of arbitrage. That way, they would technically be able to comply with the EU’s rules without totally ruining the Shopping experience.

But, would the EU really be happy with that? If they decide to keep fighting, can they force Google to reveal their algorithm? Will Google have to open up text ads to more competition as well? Where does it all end?

What the EU is asking Google to do is to implement changes that will negatively impact users and retailers. And that doesn’t make any sense to me.

I think this was a bad decision made by a governing body that doesn’t really understand the way the internet economy works.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land