Google Beats Estimates With Very Strong Q4: $6.67 Billion

Google posted a very strong Q4, given the recession, with $6.67 billion in revenues. This beats financial analyst general consensus estimates. Here are some top-level highlights from the earnings release: Revenues – Google reported revenues of $6.67 billion in the fourth quarter of 2009, representing a 17% increase over fourth quarter 2008 revenues of $5.70 […]

Google posted a very strong Q4, given the recession, with $6.67 billion in revenues. This beats financial analyst general consensus estimates. Here are some top-level highlights from the earnings release:

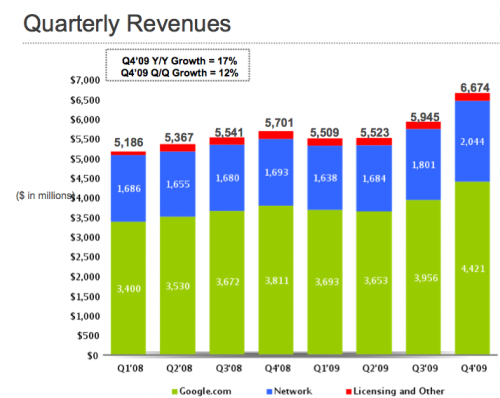

Revenues – Google reported revenues of $6.67 billion in the fourth quarter of 2009, representing a 17% increase over fourth quarter 2008 revenues of $5.70 billion.

Google Sites Revenues – Google-owned sites generated revenues of $4.42 billion, or 66% of total revenues, in the fourth quarter of 2009. This represents a 16% increase over fourth quarter 2008 revenues of $3.81 billion.

Google Network Revenues – Google’s partner sites generated revenues, through AdSense programs, of $2.04 billion, or 31% of total revenues, in the fourth quarter of 2009. This represents a 21% increase from fourth quarter 2008 network revenues of $1.69 billion.

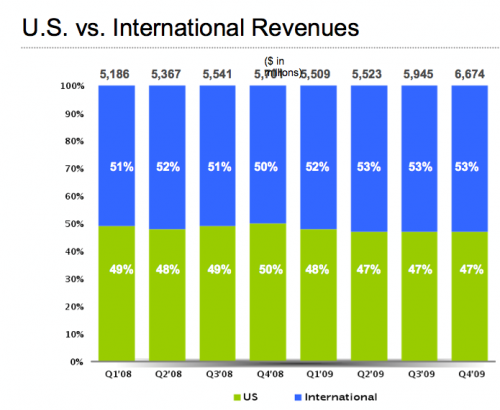

International Revenues – Revenues from outside of the United States totaled $3.52 billion, representing 53% of total revenues in the fourth quarter of 2009, compared to 53% in the third quarter of 2009 and 50% in the fourth quarter of 2008 . . .

- Revenues from the United Kingdom totaled $772 million, representing 12% of revenues in the fourth quarter of 2009, compared to 12% in the fourth quarter of 2008.

Paid Clicks – Aggregate paid clicks, which include clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 13% over the fourth quarter of 2008 and increased approximately 9% over the third quarter of 2009.

Here are some excerpts from the associated slides:

We’ll listen to the earnings call and amend this post with any interesting comments and information. There are apparently going to be two earnings calls: a standard overview of results and then an extended Q&A session at 3 pm Pacific. I’m not going to have the stamina to listen to both calls.

Here is a summary and paraphrase some of the earnings call remarks and Q&A session:

Google CEO Eric Schmidt: Touts search quality improvements and product improvements (e.g., Real Time search) and discusses future investments in personnel and technology in general. He says of acquisitions: “there will be at least one a month.”

CFO Patrick Pichette: Google saw some “impressive growth in YouTube revenues.” UK revenue up 13 percent, while US up 11 percent.

Product SVP Jonathan Rosenberg: Discusses “more wood behind fewer arrows approach.” This refers to shutting down non core products: Lively, Audio Ads and putting more emphasis on fewer core services and products. He says Android started 2009 with one device and now there are more than 20. He echoes Pichette: “YouTube is monetizing nicely.” We’re going to work hard on making ads richer, more diverse and more useful. We’re trying to make it easier for local businesses to manage their online presence and help them connect with people “around the corner.”

He alludes to Google’s efforts to bring local product inventory online. There’s potential to make the “mobile web better than the PC web.”

President Global Sales Operations Nikesh Arora: Discussed how larger businesses turned a larger part of their media spend to online. He also mentioned that retailers (both etailers and traditional offline merchants) were spending more online.

Arora also mentioned that “all parts of our display ad strategy” were performing well: DoubleClick ad exchange, YouTube, Google Content Network.

Schmidt: Asked about China, he offers a very general, high-level response. Wants to stay in China but “under somewhat different terms.” Says other positive things about China/Chinese.

Rosenberg: Re mobile . . . new formats (e.g., click to call) and targeting tools are making a “big difference.” We’re starting to see much improved monetization across mobile.

Pichette: YouTube . . . now running ads in 20 countries. Home page was nearly sold out in Q4.

Schmidt: A story that hasn’t been told is how successful Google is in display; you’ll hear a lot more about that in 2010. He also says that 2010 will be a very strong year for mobile revenue growth. Re Apple, he expresses respect, acknowledges that they compete but says their relationship is “stable.”

Also cites local as a growth area (not clear if he’s talking consumer behavior or small biz advertisers).

Rosenberg: Our CPCs not impacted by what our competitors do (re Bing question).

Pichette: Says that TV advertiser budgets will be shifting in some part to online display; this is a big area of focus for us this year because “it’s got a lot of runway.”

Schmidt: Re Apple (again) . . . not going to speculate on any deals or rumors of any kind (re implied Bing replacement of Google on iPhone).

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land