Paid search trends to watch for the 2018 holiday shopping season

Shopping, local searches and audience optimizations are three of the biggest considerations to keep in mind.

And here. We. Go…

With turkey carving set to commence on the morrow, the busy holiday shopping season is officially upon us (I’m a 40L for curious souls, love classic fabrics, timeless styles and cheese). As such, paid search marketers are gearing up for the next few weeks of data crunching, promotional scheduling and optimizations to make sure there’s more than coal awaiting them on Christmas Day.

By now you’ve hopefully got a solid strategy set and are ready to take advantage of the surge in online shoppers searching for gifts and gadgets aplenty. Still, here are a few key paid search trends to think about before the bird is out of the oven.

In retail, Google Shopping is king

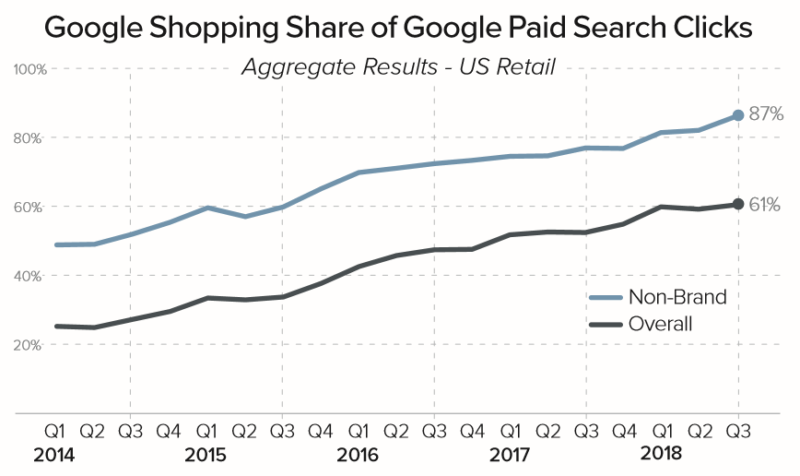

I’ve written at length several times (here and here) throughout the years on the growing importance of Google Shopping for retail advertisers, but it just keeps getting bigger! In Q3, data from Merkle (my employer) showed Shopping accounting for 87 percent of all non-brand Google paid search clicks.

As such, retail advertisers must now focus a significant portion of their attention on these campaigns to get ready for the holiday season. Keeping close track of which products are driving traffic and orders and mining query reports for potential negatives and/or query-mapping optimizations is now an absolute must.

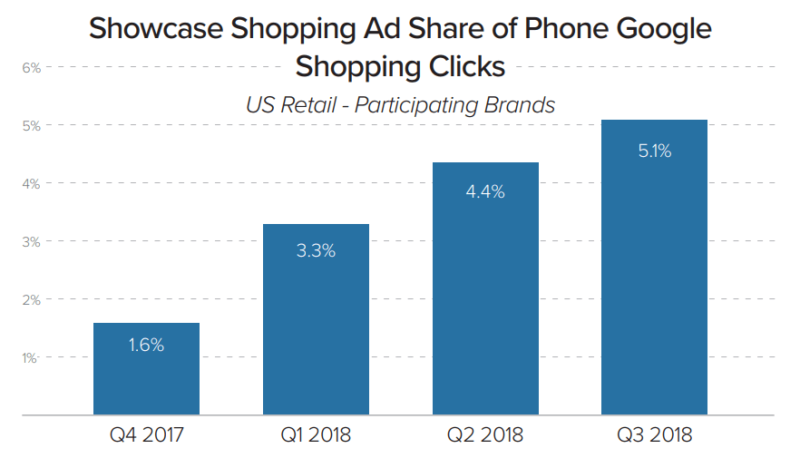

Advertisers should also be mindful of newer Shopping variations that are becoming increasingly prevalent in search results. For example, Showcase Shopping Ads have grown significantly over the last year, and went from accounting for just 1.6 percent of phone Shopping clicks for participating brands last Q4 to 5.1 percent in Q3 2018.

With Google increasingly choosing to show these units for more general searches, including in some layouts which show both Showcase ads and traditional Shopping units, having Showcase campaigns active and ready is more important than ever.

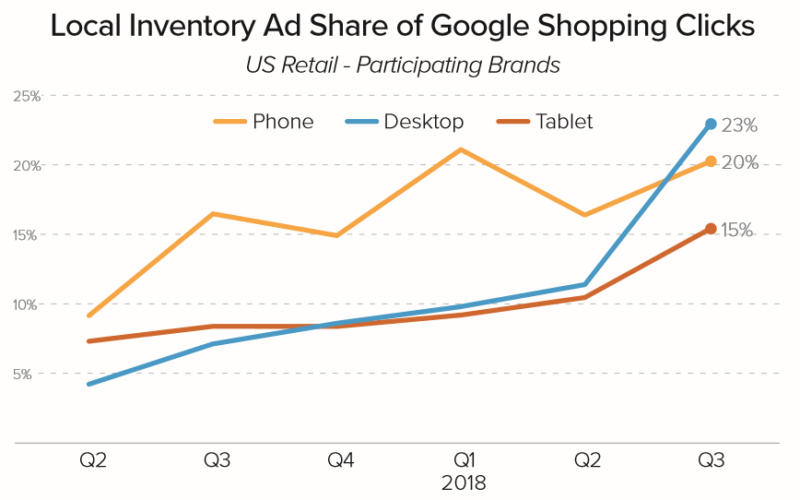

Another important variation of Google Shopping ads which stand to play a crucial role this holiday season are Local Inventory Ads (LIA), which give users information on when a product is available for pickup at a nearby store location. These units have also grown meaningfully in the share of Shopping traffic they account for over the past year for participating brands.

LIA trends can depend heavily on advertiser strategy during the holidays. Some retailers become significantly more aggressive with LIAs in order to push users in-store, while others maintain roughly the same strategy as pre-holiday. Still, many brands see LIA click share grow around Black Friday, as well as in the leadup to Christmas Day when users can no longer feel confident that items ordered online will arrive in time.

For advertisers that have LIAs active, being mindful of shipping cutoff days and shifting strategy to prioritize LIAs over traditional Shopping units can help provide a boost during key offline days.

However, LIAs aren’t the only local ads that brick-and-mortar brands should be mindful of during the holidays this year.

Users turn to navigational apps in the final days of holiday shopping

For the last several years, the U.S. Bureau of the Census has reported a jump in e-commerce share of total U.S. retail sales from Q3 to Q4, as shoppers seem to become more likely to order online during the busy holiday season. Even so, e-commerce sales still accounted for just over 10 percent of Q4 sales last year, as brick-and-mortar conversions continued to account for the vast majority of sales.

As many surveys and offline attribution techniques show, however, many brick-and-mortar sales are preceded by online research.

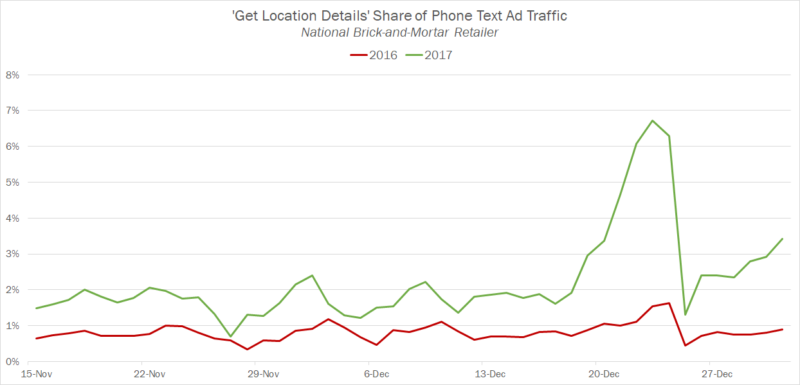

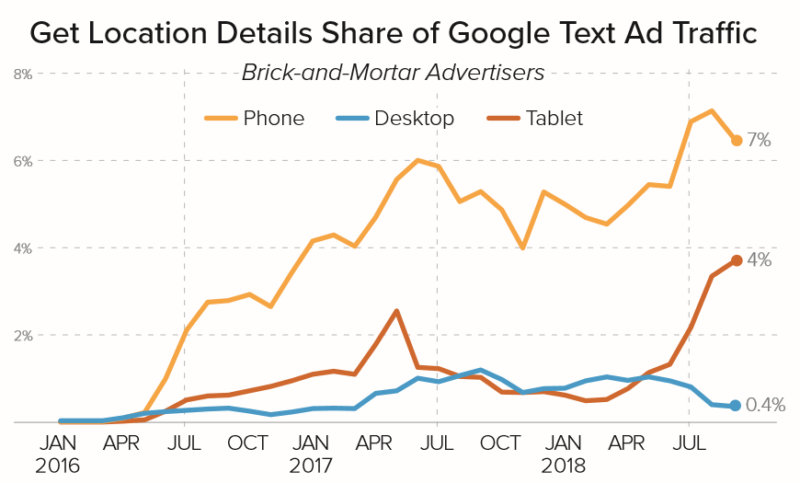

Users don’t just turn to traditional search engines in researching offline purchases – they also go straight to navigational apps, including Google Maps. While Google has yet to provide reporting to cleanly segment Maps ad traffic, click type reports provide some insight as the “Get location details” click type primarily comes from Maps.

Over the past couple of years, I’ve identified a trend that spans essentially all brick-and-mortar retailers studied that shows an increase in the share of text ad traffic attributed to “Get location details” in the days leading up to Dec. 25. This is what that looks like for one apparel retailer studied.

As you can see, Dec. 23 and 24 were by far the biggest days for Maps clicks. This trend indicates that shoppers modify their search behavior and go straight to navigational apps once they know shipping will be pricier or too slow to arrive in time. A similar uptick in searches probably occurs on other navigational apps as well.

Another trend to point out is that the share of traffic coming from these ads increased significantly from 2016 to 2017, something observed across our brick-and-mortar advertisers over the last couple of years. In Q3 2018, Merkle saw a meaningful lift relative to the quarters prior, so brick-and-mortar brands might be seeing even more traffic coming from these ads this year.

While Google announced Local Campaigns in July, at this point most retailers are still deriving Maps ad traffic from location extensions added to active keyword campaigns.

There’s not much control with this setup as there are no bidding or other targeting levers available specifically for Maps via location extensions, but one thing to certainly keep an eye on is offline attribution. Since Maps searchers are naturally more likely to head in-store than convert online, online conversion rate may start to slip as traffic from Maps grows. Being mindful of this throughout the holiday season will help ensure ads are being bid based on the full value they drive, both online and offline.

After Shopping and local searches, I’ve got one more big trend to keep an eye on this holiday season to help make your paid search campaigns glisten.

Audiences, audiences, audiences

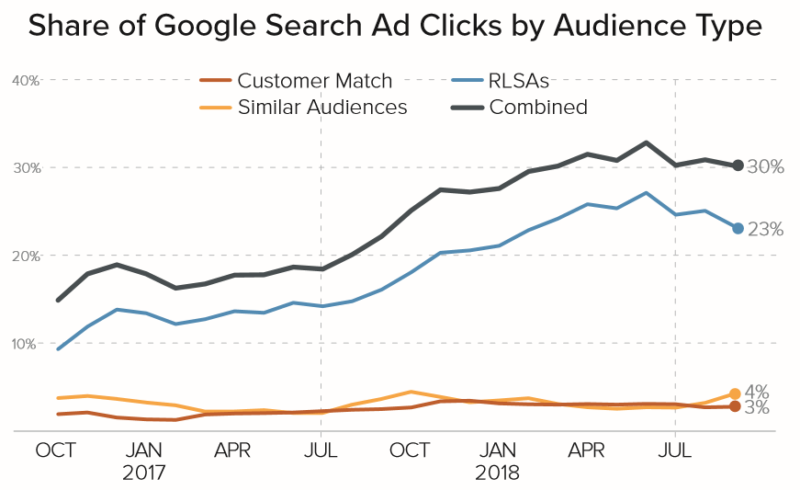

It’s probably no surprise to you that audience segmentation has grown tremendously in importance over the past couple of years. Merkle advertisers that use audience targeting find 30 percent of all Google paid search traffic is now attributed to Remarketing Lists for Search Ads (RLSA), Customer Match or Similar Audiences.

One trend that might pop out from the chart above is the dip in RLSA click share in September. The decline started in mid-September around the time of the rollout of Apple’s Intelligent Tracking Prevention (ITP) 2.0 initiative, but share bounced back and returned to previous levels by the end of the quarter, where it’s remained ever since.

Talking with sources in the know, it does sound like ITP 2.0 could eventually prevent RLSA tracking and targeting for iOS and Safari 12 users, but that the erosion of RLSA for those users would happen slowly over time. As such, we shouldn’t expect too much of a dip over the course of the holiday season, but it wouldn’t be totally out of the realm of possibility.

In terms of strategy, advertisers should be trying to use these audiences to maximize the value of these shoppers who are already familiar with the brand. While that can at times mean bidding more aggressively to stay in front of these searchers when they’re researching, it’s important to keep in mind that last click attribution often inflates the true value of ad clicks from these audiences, since some audience members would end up converting anyway.

In addition to bidding adjustments, modifications to ad copy and landing pages can help place the most effective offers and experiences in front of users based on interests displayed during past interactions with the brand. With RLSA audiences now allowed to include website visitors from as far back as 540 days, forward-thinking advertisers that created holiday shopping-specific audiences from last year’s Q4 shoppers can call on those audiences this season for optimizations.

I do think it’s important to note that there’s a lot of misinformation floating around on the use of audiences, with some in the industry going as far as to say advertisers should only target remarketing audiences in paid search since those users have higher CTR and conversion rate. While a small share of advertisers might want to pursue such a strategy, most brands would be ill-served by turning off ads to anyone other than those searchers that are already existing customers. In terms of incremental value, often ad clicks tied to non-audience members can have the biggest positive effect for an advertiser’s business.

There’s no silver bullet for all advertisers to use to effectively target audiences in paid search during the holiday season, as every brand is different. That said, brands should be aware of how these audiences have performed in the past and keep an eye on how things are shaking out this year to identify potential pain points or successful strategies that can be built upon throughout the season.

Conclusion

There are plenty of other paid search bits and pieces to focus on throughout the next few weeks, but Shopping, local searches and audience optimizations are three of the biggest considerations to keep in mind. Getting them right can go a long way towards making the next few weeks as successful as possible.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land